Undiscovered Gems in Europe with Promising Fundamentals April 2025

Reviewed by Simply Wall St

As European markets experience a resurgence, with the STOXX Europe 600 Index climbing 3.93% amid positive sentiment from delayed tariffs and ECB rate cuts, investors are increasingly looking towards smaller-cap stocks for potential opportunities. In such a dynamic environment, identifying companies with solid fundamentals becomes crucial for those seeking to capitalize on the market's evolving landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| ABG Sundal Collier Holding | 8.55% | -4.14% | -12.38% | ★★★★★☆ |

| Decora | 22.54% | 13.65% | 13.80% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| Moury Construct | 2.93% | 10.42% | 27.28% | ★★★★★☆ |

| Sparta | NA | -5.54% | -15.40% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Beijer Alma (OM:BEIA B)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Beijer Alma AB (publ) operates in component manufacturing and industrial trading across Sweden, the Nordic region, Europe, North America, Asia, and internationally with a market capitalization of approximately SEK10.59 billion.

Operations: Lesjöfors contributes SEK4.90 billion and Beijer Tech adds SEK2.31 billion to the revenue stream of Beijer Alma AB (publ).

Beijer Alma, a notable player in the machinery sector, has shown impressive earnings growth of 37.6% over the past year, significantly outpacing the industry average of 3.4%. Despite a high net debt to equity ratio of 50.6%, its interest payments are well covered with EBIT at 5.1 times interest repayments. The company reported a net income increase from SEK 519 million to SEK 714 million for the full year ending December 2024, bolstered by strategic acquisitions and operational efficiency improvements in segments such as Lesjöfors. However, challenges include rising debt levels and leadership transitions with Johnny Alvarsson stepping in as acting CEO from April 2025.

APG|SGA (SWX:APGN)

Simply Wall St Value Rating: ★★★★★★

Overview: APG|SGA SA is a company that specializes in providing advertising services mainly in Switzerland and Serbia, with a market capitalization of CHF686.32 million.

Operations: APG|SGA generates revenue of CHF328.94 million through the acquisition, sale, and management of advertising spaces.

APG|SGA, a nimble player in the media sector, showcases strong financial health with no debt over the past five years and earnings growth of 12.9%, surpassing the industry average of 9.9%. The company trades at a compelling 35.8% below its fair value estimate, indicating potential upside for investors. Recent results highlight net income growth to CHF 30.28 million from CHF 26.82 million last year, alongside basic earnings per share rising to CHF 10.1 from CHF 8.95 previously. A dividend increase to CHF 12 per share further underscores its robust performance and shareholder-friendly approach.

- Navigate through the intricacies of APG|SGA with our comprehensive health report here.

Examine APG|SGA's past performance report to understand how it has performed in the past.

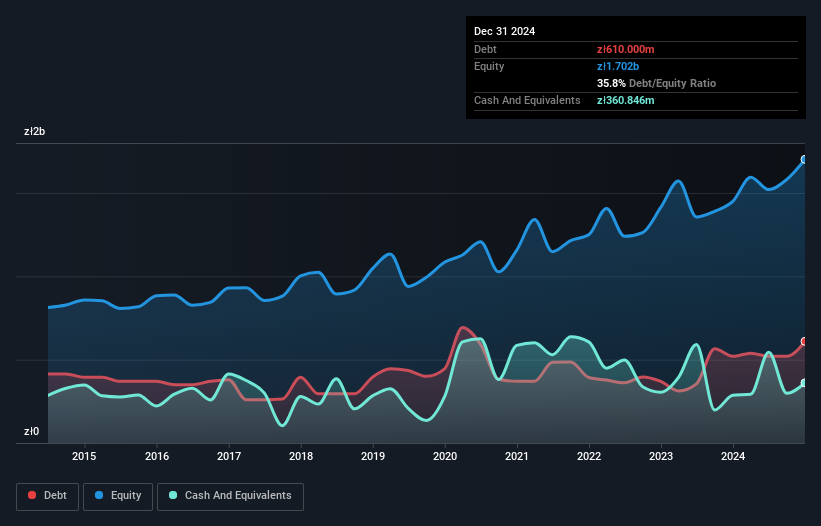

Dom Development (WSE:DOM)

Simply Wall St Value Rating: ★★★★★★

Overview: Dom Development S.A. is a Polish company involved in the development and sale of residential and commercial real estate properties, with a market capitalization of PLN5.61 billion.

Operations: Dom Development generates revenue primarily from the sale of residential and commercial real estate properties, which amounted to PLN3.17 billion. The company's financial performance is reflected in its net profit margin, which showcases a key aspect of its profitability.

Dom Development seems to be making strides in the European market with its debt to equity ratio improving from 41% to 35.8% over five years, suggesting a stronger financial footing. The company reported earnings growth of 23.6%, outpacing the Consumer Durables industry's modest 0.1%. Trading at a discount of 26.3% below estimated fair value, it presents potential for value seekers. With net income rising from PLN 460 million to PLN 569 million and basic earnings per share increasing from PLN 17.94 to PLN 22.07, Dom Development appears poised for steady growth amidst robust industry competition.

Next Steps

- Dive into all 357 of the European Undiscovered Gems With Strong Fundamentals we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Beijer Alma, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Beijer Alma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BEIA B

Beijer Alma

Engages in component manufacturing and industrial trading businesses in Sweden, rest of Nordic Region, rest of Europe, North America, Asia, and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives