European Market Gems: 3 Companies Estimated Below Fair Value

Reviewed by Simply Wall St

As the European markets navigate a mixed landscape, with the pan-European STOXX Europe 600 Index showing modest gains amid dovish signals from the U.S. Federal Reserve and easing trade tensions, investors are keenly observing opportunities where stocks might be trading below their intrinsic values. In this context, identifying undervalued stocks can be particularly appealing, as they offer potential for growth when market conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SBO (WBAG:SBO) | €26.95 | €53.16 | 49.3% |

| Pandora (CPSE:PNDORA) | DKK867.40 | DKK1734.70 | 50% |

| Nordisk Bergteknik (OM:NORB B) | SEK12.00 | SEK23.59 | 49.1% |

| Noratis (XTRA:NUVA) | €0.78 | €1.56 | 49.9% |

| Mo-BRUK (WSE:MBR) | PLN296.00 | PLN581.73 | 49.1% |

| Kitron (OB:KIT) | NOK60.30 | NOK120.56 | 50% |

| High Quality Food (BIT:HQF) | €0.614 | €1.22 | 49.7% |

| DSV (CPSE:DSV) | DKK1345.50 | DKK2657.52 | 49.4% |

| doValue (BIT:DOV) | €2.80 | €5.53 | 49.4% |

| Atea (OB:ATEA) | NOK147.60 | NOK293.57 | 49.7% |

We'll examine a selection from our screener results.

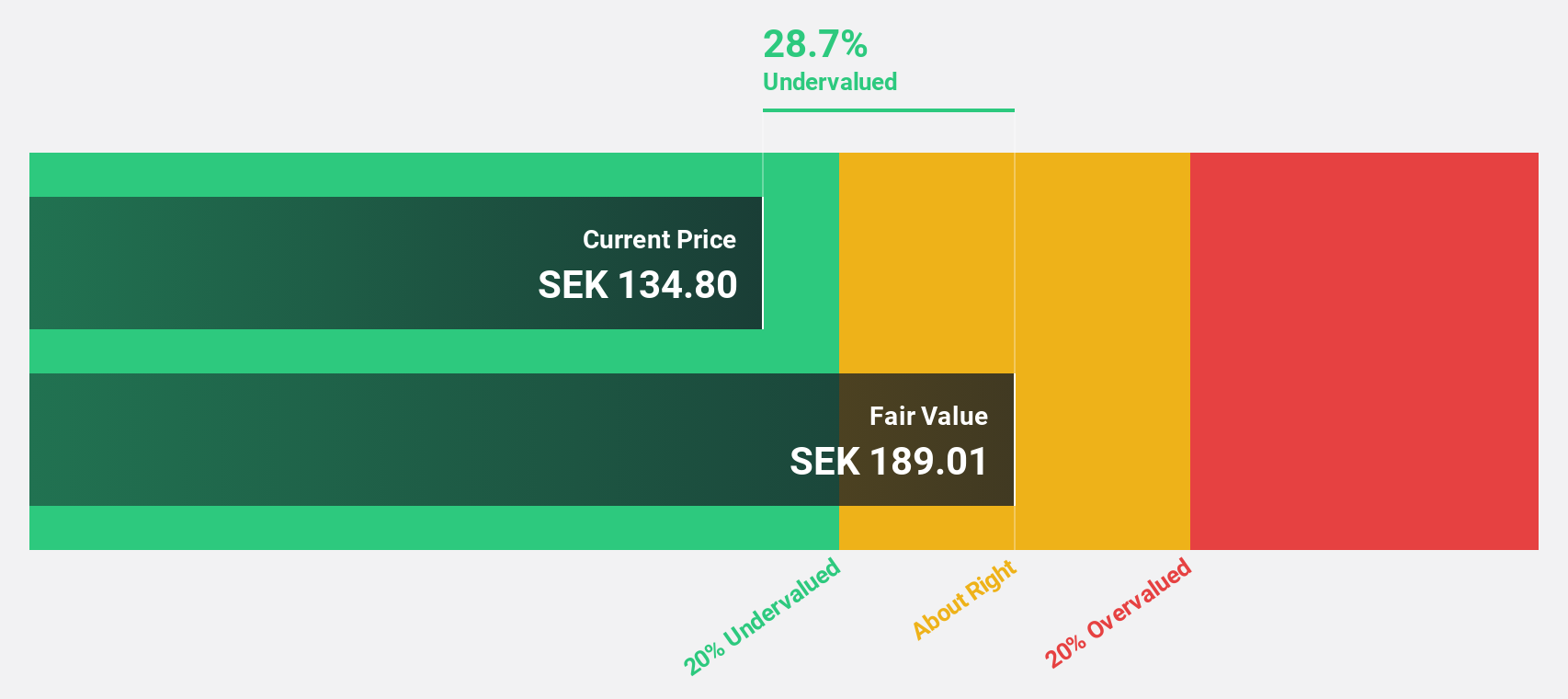

Asmodee Group (OM:ASMDEE B)

Overview: Asmodee Group AB (publ) focuses on publishing and distributing tabletop games, with a market cap of SEK27.46 billion.

Operations: The company generates revenue primarily from its Games & Toys segment, amounting to €1.45 billion.

Estimated Discount To Fair Value: 29.0%

Asmodee Group, trading at SEK119.38, is undervalued based on discounted cash flow analysis, with a fair value estimate of SEK168.06. Its earnings are forecast to grow significantly at 33.8% annually, outpacing the Swedish market's 12.4%. Recent strategic expansions include launching Moodbox Games in the US and managing Middle-earth Enterprises' tabletop games category, potentially enhancing its cash flow position despite slower revenue growth projections of 3.7% annually compared to market expectations.

- Our earnings growth report unveils the potential for significant increases in Asmodee Group's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Asmodee Group.

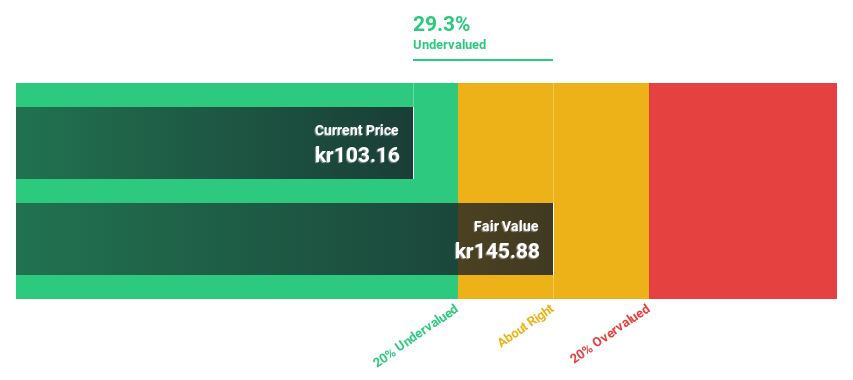

Troax Group (OM:TROAX)

Overview: Troax Group AB (publ) manufactures and distributes mesh panel solutions across the Nordic region, the United Kingdom, North America, Europe, and other international markets, with a market cap of SEK8.63 billion.

Operations: Troax Group generates revenue primarily from its mesh panels segment, amounting to €272.74 million.

Estimated Discount To Fair Value: 23.1%

Troax Group, trading at SEK147, is valued below its estimated fair value of SEK191.1 based on discounted cash flow analysis. Its earnings are projected to grow significantly at 29.6% annually, surpassing the Swedish market's growth rate. Revenue is expected to increase by 4.3% per year, higher than the market average of 3.3%. Although analysts agree on a potential price rise of 31.3%, Troax has an unstable dividend track record which may affect investor sentiment.

- Our growth report here indicates Troax Group may be poised for an improving outlook.

- Dive into the specifics of Troax Group here with our thorough financial health report.

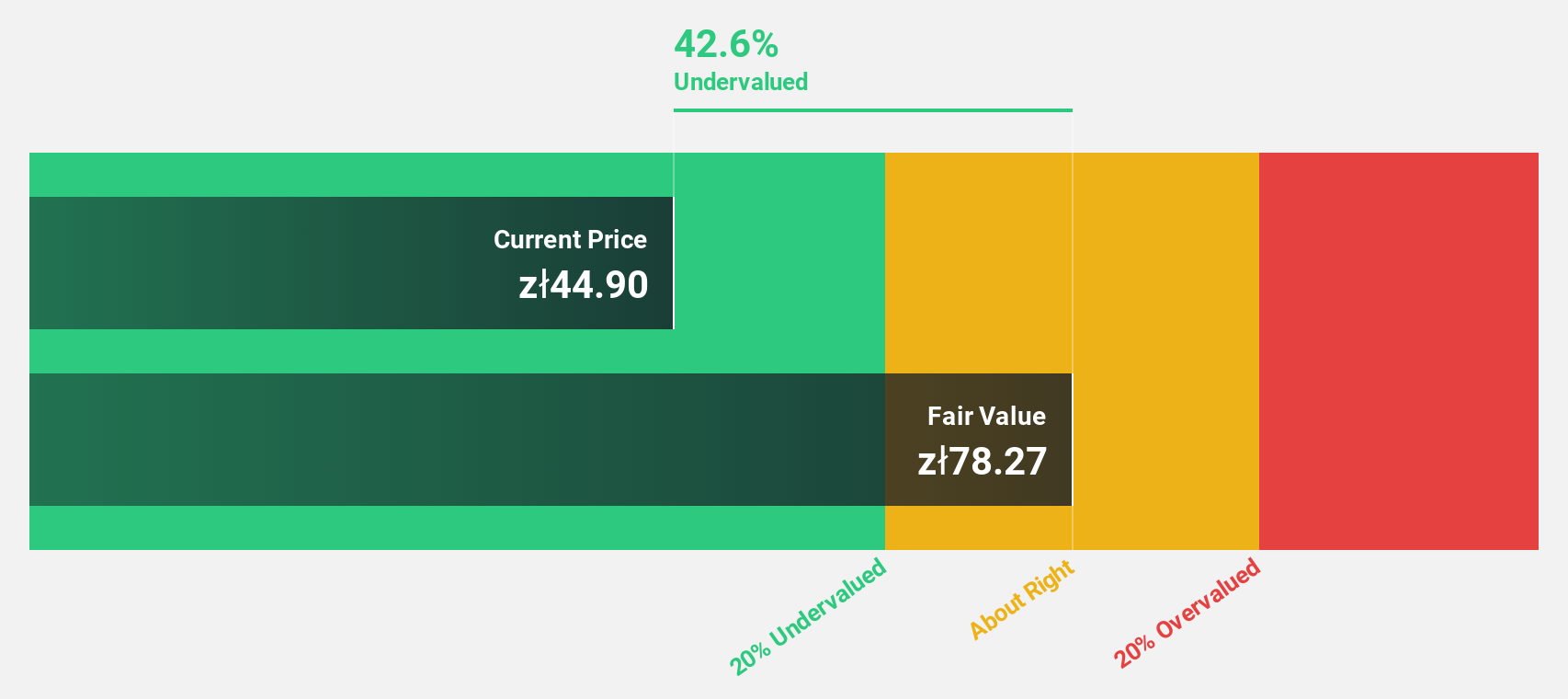

Archicom (WSE:ARH)

Overview: Archicom S.A. operates in the real estate sector in Poland, with a market capitalization of PLN2.63 billion.

Operations: The company's revenue segments include Housing Activities in Wroclaw (PLN431.08 million), Warszawa (PLN124.88 million), Cracow (PLN81.84 million), Lodz (PLN51.11 million), Poznan (PLN10.59 million), and Supporting Companies contributing PLN227.45 million to its operations in Poland's real estate market.

Estimated Discount To Fair Value: 36.5%

Archicom, trading at PLN46, is valued below its fair value estimate of PLN72.46, indicating significant undervaluation. Despite a recent net loss of PLN1.05 million for the half year ending June 2025, earnings are forecast to grow significantly over the next three years with an expected annual growth rate exceeding 20%. However, profit margins have decreased from 20.9% to 12%, and its high dividend yield of 7.33% is not well covered by earnings or free cash flows.

- According our earnings growth report, there's an indication that Archicom might be ready to expand.

- Unlock comprehensive insights into our analysis of Archicom stock in this financial health report.

Where To Now?

- Investigate our full lineup of 213 Undervalued European Stocks Based On Cash Flows right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Troax Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:TROAX

Troax Group

Through its subsidiaries, produces and sells mesh panels in the Nordic region, the United Kingdom, North America, Europe, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives