- Japan

- /

- Semiconductors

- /

- TSE:6235

Discovering November 2024's Hidden Gems with Potential

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration's policies, key indices like the S&P 600 for small-cap stocks are experiencing fluctuations influenced by sector-specific developments and broader economic indicators. In this dynamic environment, identifying hidden gems involves focusing on companies with strong fundamentals and potential resilience to policy shifts, offering opportunities for growth amidst market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 9.17% | 14.32% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Can-One Berhad | 88.80% | 9.35% | 23.83% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Diplomat Holdings (TASE:DIPL)

Simply Wall St Value Rating: ★★★★★★

Overview: Diplomat Holdings Ltd. is a sales and distribution company in the fast-moving consumer goods sector with a market cap of ₪981.97 million.

Operations: Diplomat Holdings generates revenue primarily from its sales and distribution activities within the fast-moving consumer goods sector. The company's financial performance is characterized by a gross profit margin trend, which has shown variability over recent periods.

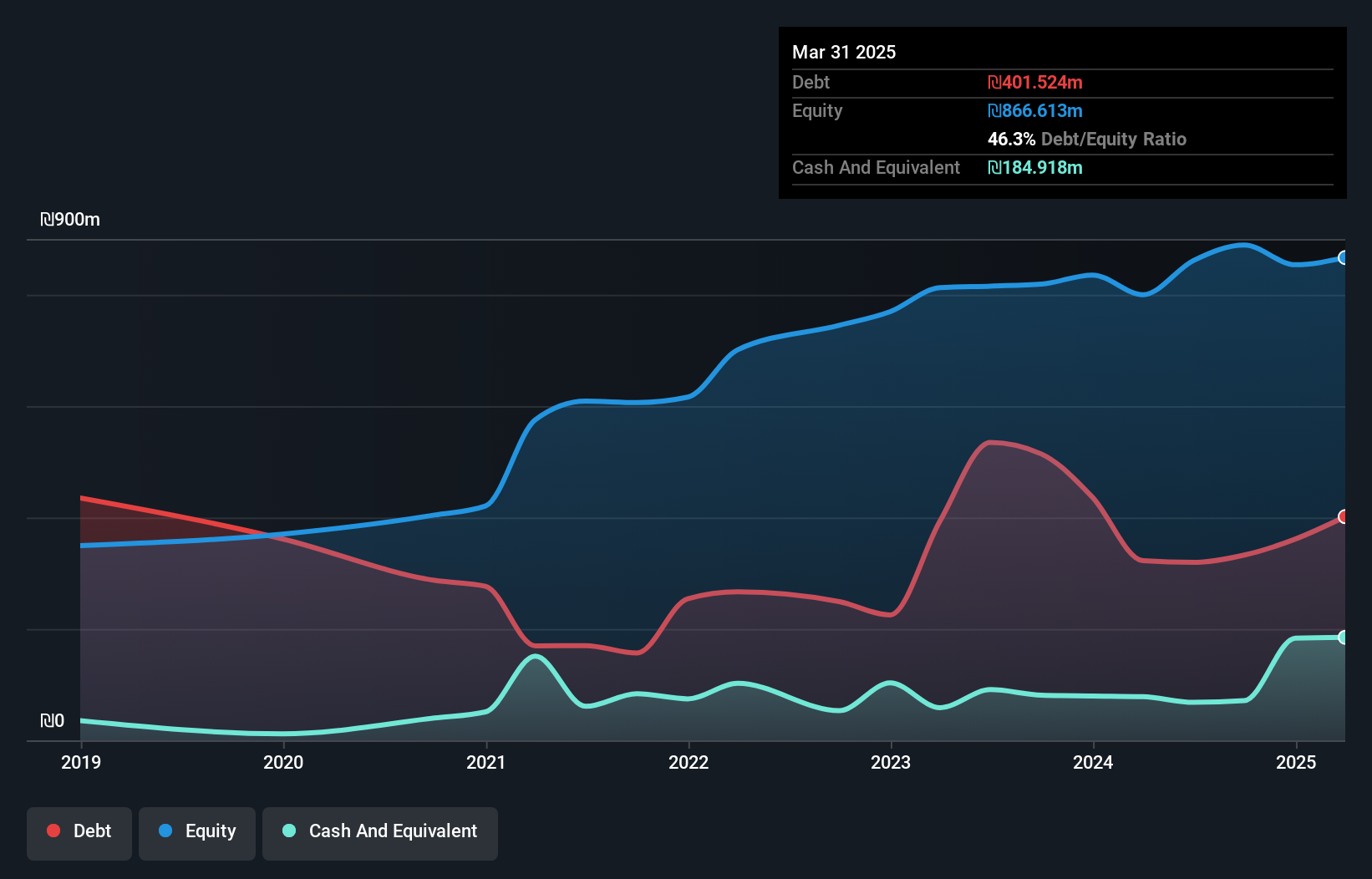

Diplomat Holdings, a nimble player in the market, has showcased impressive financial strides. Over the past year, earnings surged by 53.8%, outpacing the Consumer Retailing industry's 40.4% growth. The company reported net income of ILS 56 million for Q2 2024, up from ILS 15 million a year earlier, with basic EPS climbing to ILS 2.05 from ILS 0.56. Its debt-to-equity ratio improved significantly over five years from 120% to a satisfactory 37%. Trading at nearly full discount to its estimated fair value suggests potential upside if current trends continue favorably in this dynamic sector.

- Dive into the specifics of Diplomat Holdings here with our thorough health report.

-

Examine Diplomat Holdings' past performance report to understand how it has performed in the past.

OptorunLtd (TSE:6235)

Simply Wall St Value Rating: ★★★★★★

Overview: Optorun Co., Ltd. operates in Japan, focusing on the manufacture, distribution, and import/export of vacuum coating machines and related equipment, with a market cap of ¥84.91 billion.

Operations: Optorun generates revenue primarily from the manufacture and distribution of vacuum coating machines and peripheral equipment. The company's financial performance is highlighted by its market capitalization of ¥84.91 billion.

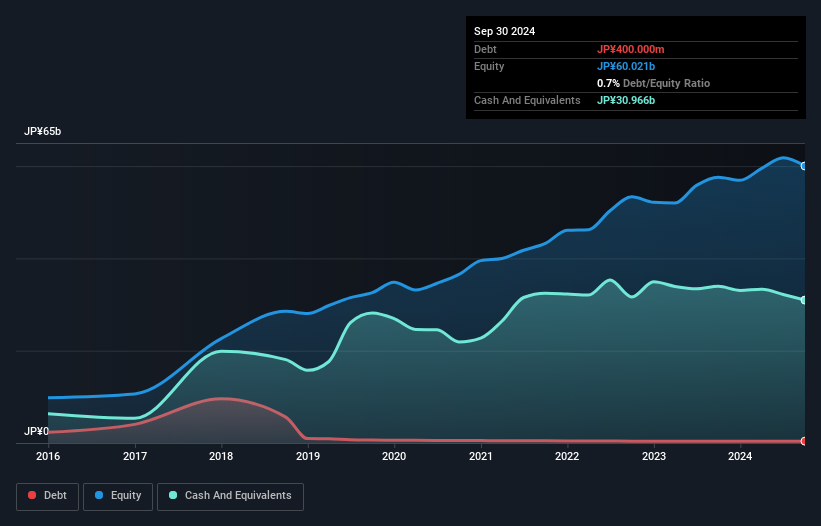

Optorun Ltd. stands out with its impressive earnings growth of 16.5% over the past year, surpassing the broader semiconductor industry's 3.3%. This growth is partly influenced by a significant one-off gain of ¥2.7 billion, which has impacted recent financial results up to September 2024. Over five years, Optorun has effectively managed its debt to equity ratio, reducing it from 2% to a mere 0.7%, while maintaining more cash than total debt, showcasing prudent financial management. Despite these positives, free cash flow remains negative; however, future earnings are projected to grow at an annual rate of 19.21%.

- Get an in-depth perspective on OptorunLtd's performance by reading our health report here.

-

Explore historical data to track OptorunLtd's performance over time in our Past section.

Atal (WSE:1AT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Atal S.A. is involved in the development and sale of residential buildings in Poland, with a market capitalization of PLN2.39 billion.

Operations: Atal generates revenue primarily from the sale of residential buildings in Poland. The company's market capitalization is PLN2.39 billion.

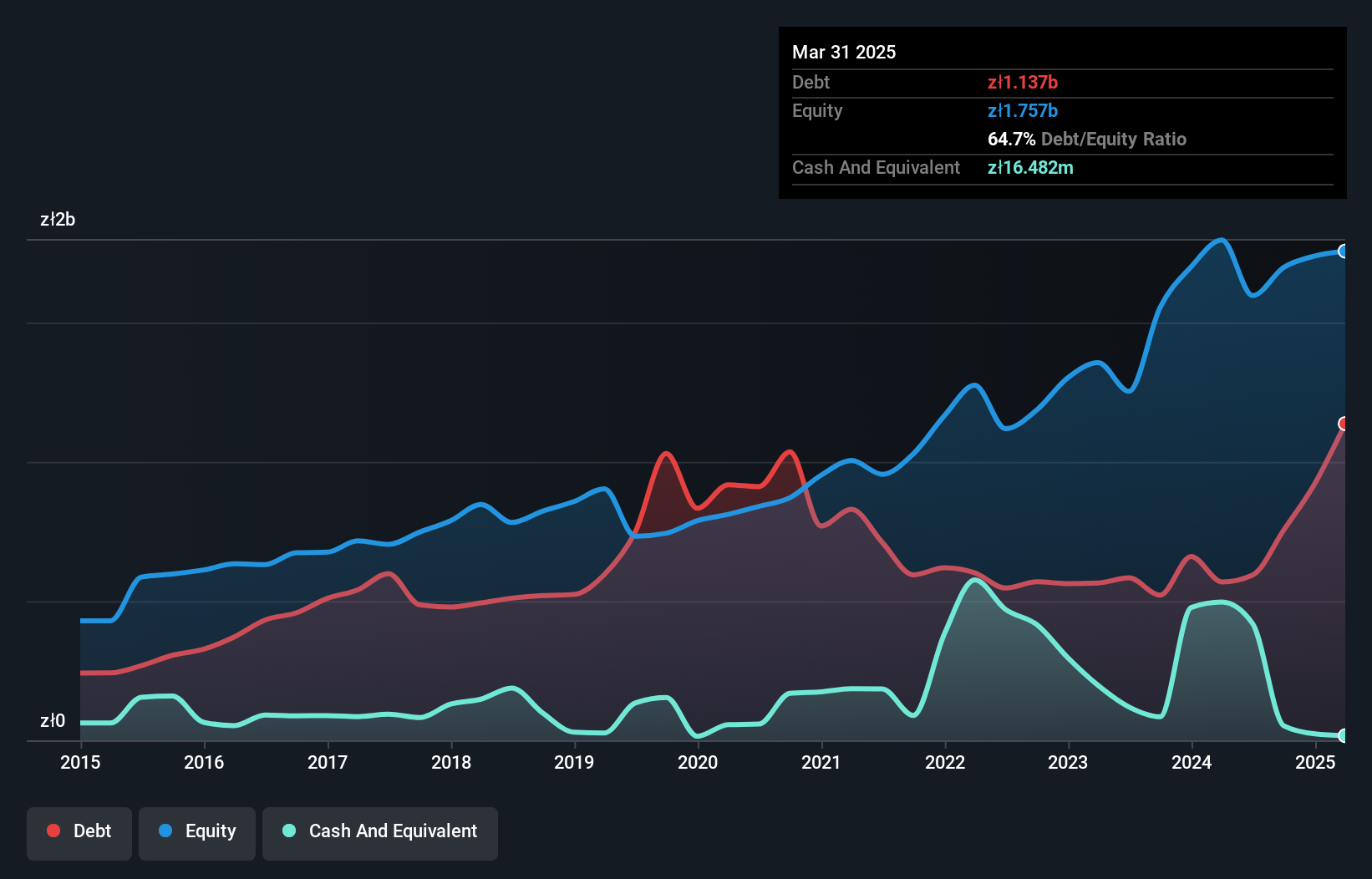

Atal, with its focus on residential projects, has shown a promising financial trajectory. The company's net income for the half year ending June 2024 rose to PLN 154.22 million from PLN 144.72 million the previous year, highlighting robust performance despite a slight dip in basic earnings per share to PLN 3.57 from PLN 3.74. Atal's debt management is commendable with a reduction in its debt-to-equity ratio from 138.5% to just 39% over five years, and it trades at an attractive value—54% below fair estimate—suggesting potential for investors seeking undervalued opportunities in real estate development.

- Delve into the full analysis health report here for a deeper understanding of Atal.

-

Gain insights into Atal's historical performance by reviewing our past performance report.

Where To Now?

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4642 more companies for you to explore.Click here to unveil our expertly curated list of 4645 Undiscovered Gems With Strong Fundamentals .

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio , where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management .

- Find companies with promising cash flow potential yet trading below their fair value .

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6235

OptorunLtd

Engages in the manufacture, distribution, and import/export of vacuum coating machines, peripheral equipment, and units using vacuum coating products in Japan.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives