- Poland

- /

- Professional Services

- /

- WSE:ETX

Investors Aren't Entirely Convinced By Euro-Tax.pl S.A.'s (WSE:ETX) Earnings

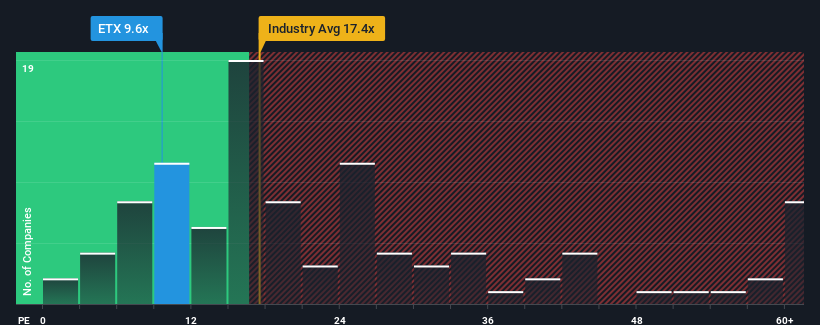

There wouldn't be many who think Euro-Tax.pl S.A.'s (WSE:ETX) price-to-earnings (or "P/E") ratio of 9.6x is worth a mention when the median P/E in Poland is similar at about 11x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

As an illustration, earnings have deteriorated at Euro-Tax.pl over the last year, which is not ideal at all. One possibility is that the P/E is moderate because investors think the company might still do enough to be in line with the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Euro-Tax.pl

Is There Some Growth For Euro-Tax.pl?

The only time you'd be comfortable seeing a P/E like Euro-Tax.pl's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered a frustrating 7.8% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 174% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

This is in contrast to the rest of the market, which is expected to grow by 14% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's curious that Euro-Tax.pl's P/E sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Euro-Tax.pl's P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Euro-Tax.pl revealed its three-year earnings trends aren't contributing to its P/E as much as we would have predicted, given they look better than current market expectations. There could be some unobserved threats to earnings preventing the P/E ratio from matching this positive performance. It appears some are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Having said that, be aware Euro-Tax.pl is showing 2 warning signs in our investment analysis, and 1 of those is potentially serious.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Euro-Tax.pl might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:ETX

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives