- Poland

- /

- Construction

- /

- WSE:ZUE

Market Participants Recognise ZUE S.A.'s (WSE:ZUE) Earnings Pushing Shares 28% Higher

Despite an already strong run, ZUE S.A. (WSE:ZUE) shares have been powering on, with a gain of 28% in the last thirty days. The annual gain comes to 133% following the latest surge, making investors sit up and take notice.

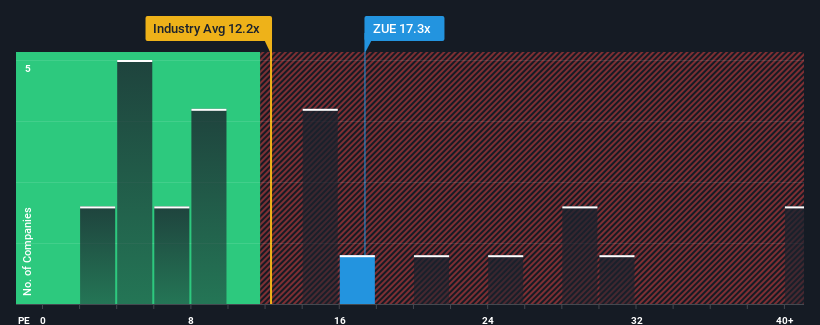

Following the firm bounce in price, ZUE may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 17.3x, since almost half of all companies in Poland have P/E ratios under 12x and even P/E's lower than 7x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

For example, consider that ZUE's financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for ZUE

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as ZUE's is when the company's growth is on track to outshine the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 16%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 486% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 10% shows it's noticeably more attractive on an annualised basis.

With this information, we can see why ZUE is trading at such a high P/E compared to the market. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Final Word

The large bounce in ZUE's shares has lifted the company's P/E to a fairly high level. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that ZUE maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

We don't want to rain on the parade too much, but we did also find 3 warning signs for ZUE (1 is concerning!) that you need to be mindful of.

If you're unsure about the strength of ZUE's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if ZUE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:ZUE

Adequate balance sheet low.

Market Insights

Community Narratives