- Poland

- /

- Construction

- /

- WSE:VTL

Market Might Still Lack Some Conviction On Vistal Gdynia S.A. (WSE:VTL) Even After 78% Share Price Boost

Despite an already strong run, Vistal Gdynia S.A. (WSE:VTL) shares have been powering on, with a gain of 78% in the last thirty days. The last 30 days bring the annual gain to a very sharp 92%.

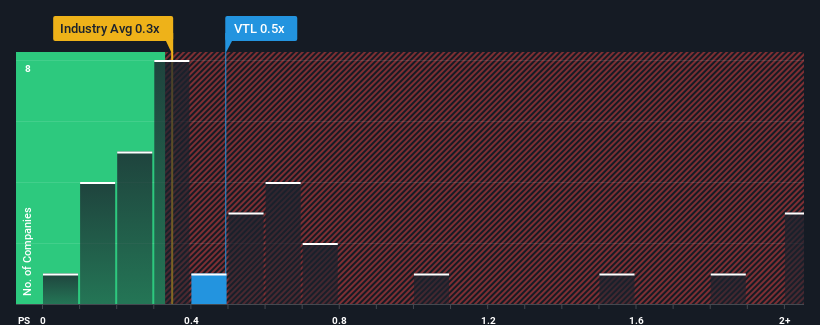

Although its price has surged higher, it's still not a stretch to say that Vistal Gdynia's price-to-sales (or "P/S") ratio of 0.5x right now seems quite "middle-of-the-road" compared to the Construction industry in Poland, where the median P/S ratio is around 0.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Vistal Gdynia

What Does Vistal Gdynia's P/S Mean For Shareholders?

The revenue growth achieved at Vistal Gdynia over the last year would be more than acceptable for most companies. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Vistal Gdynia's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Vistal Gdynia would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 15% last year. Revenue has also lifted 7.0% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 0.9% shows it's a great look while it lasts.

With this information, we find it odd that Vistal Gdynia is trading at a fairly similar P/S to the industry. It looks like most investors are not convinced the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

The Key Takeaway

Vistal Gdynia appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As mentioned previously, Vistal Gdynia currently trades on a P/S on par with the wider industry, but this is lower than expected considering its recent three-year revenue growth is beating forecasts for a struggling industry. When we see a history of positive growth in a struggling industry, but only an average P/S, we assume potential risks are what might be placing pressure on the P/S ratio. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader industry turmoil. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Vistal Gdynia you should know about.

If these risks are making you reconsider your opinion on Vistal Gdynia, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:VTL

Vistal Gdynia

Vistal Gdynia S.A. engages in the production and sale of steel structures for the construction, energy, shipbuilding, and offshore industries in Poland and internationally.

Slightly overvalued with weak fundamentals.