Here's Why Seco/Warwick (WSE:SWG) Can Manage Its Debt Responsibly

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Seco/Warwick S.A. (WSE:SWG) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Seco/Warwick

How Much Debt Does Seco/Warwick Carry?

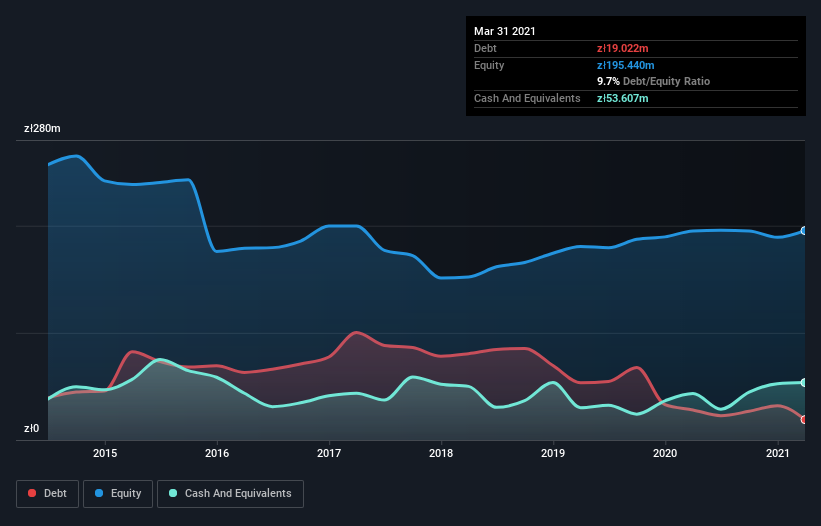

As you can see below, Seco/Warwick had zł19.0m of debt at March 2021, down from zł28.1m a year prior. However, it does have zł53.6m in cash offsetting this, leading to net cash of zł34.6m.

A Look At Seco/Warwick's Liabilities

Zooming in on the latest balance sheet data, we can see that Seco/Warwick had liabilities of zł210.2m due within 12 months and liabilities of zł46.7m due beyond that. Offsetting this, it had zł53.6m in cash and zł163.3m in receivables that were due within 12 months. So its liabilities total zł40.0m more than the combination of its cash and short-term receivables.

While this might seem like a lot, it is not so bad since Seco/Warwick has a market capitalization of zł130.3m, and so it could probably strengthen its balance sheet by raising capital if it needed to. However, it is still worthwhile taking a close look at its ability to pay off debt. While it does have liabilities worth noting, Seco/Warwick also has more cash than debt, so we're pretty confident it can manage its debt safely.

It is just as well that Seco/Warwick's load is not too heavy, because its EBIT was down 31% over the last year. When a company sees its earnings tank, it can sometimes find its relationships with its lenders turn sour. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Seco/Warwick's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While Seco/Warwick has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, Seco/Warwick actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Summing up

While Seco/Warwick does have more liabilities than liquid assets, it also has net cash of zł34.6m. The cherry on top was that in converted 127% of that EBIT to free cash flow, bringing in zł30m. So we are not troubled with Seco/Warwick's debt use. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 3 warning signs with Seco/Warwick , and understanding them should be part of your investment process.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you decide to trade Seco/Warwick, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Seco/Warwick, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:SWG

Seco/Warwick

Engages in manufacture and sale of heat treatment furnaces for metals in the European Union, Russia, the United States, Asia, and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives