Did You Manage To Avoid Rawlplug's (WSE:RWL) 24% Share Price Drop?

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But even the best stock picker will only win with some selections. At this point some shareholders may be questioning their investment in Rawlplug S.A. (WSE:RWL), since the last five years saw the share price fall 24%. It's up 3.7% in the last seven days.

Check out our latest analysis for Rawlplug

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

While the share price declined over five years, Rawlplug actually managed to increase EPS by an average of 30% per year. So it doesn't seem like EPS is a great guide to understanding how the market is valuing the stock. Alternatively, growth expectations may have been unreasonable in the past. Because of the sharp contrast between the EPS growth rate and the share price growth, we're inclined to look to other metrics to understand the changing market sentiment around the stock.

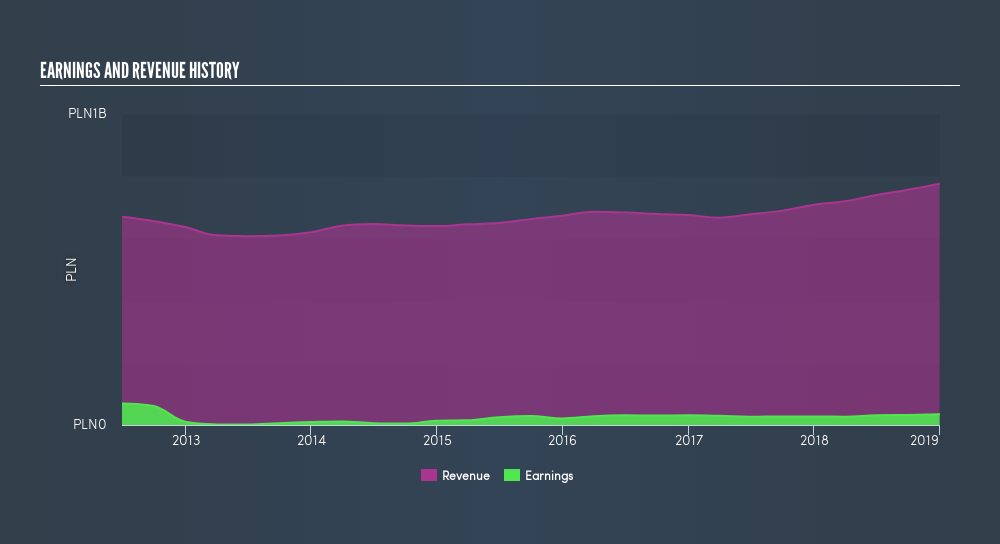

In contrast to the share price, revenue has actually increased by 3.6% a year in the five year period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

We know that Rawlplug has improved its bottom line lately, but what does the future have in store? This freereport showing analyst forecasts should help you form a view on Rawlplug

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Rawlplug, it has a TSR of -9.7% for the last 5 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Rawlplug shareholders are down 3.7% for the year (even including dividends), but the market itself is up 2.8%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 2.0% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Importantly, we haven't analysed Rawlplug's dividend history. This freevisual report on its dividends is a must-read if you're thinking of buying.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this freelist of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on PL exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About WSE:RWL

Rawlplug

Rawlplug S.A. design, manufacture, and sells fixings, fasteners, and tools under KOELNER, RAWPLUG, and MODECO EXPERT brands in Europe and internationally.

Proven track record average dividend payer.

Market Insights

Community Narratives