- Poland

- /

- Construction

- /

- WSE:PXM

Polimex-Mostostal S.A. (WSE:PXM) Stock Rockets 32% As Investors Are Less Pessimistic Than Expected

Polimex-Mostostal S.A. (WSE:PXM) shares have had a really impressive month, gaining 32% after a shaky period beforehand. The last month tops off a massive increase of 127% in the last year.

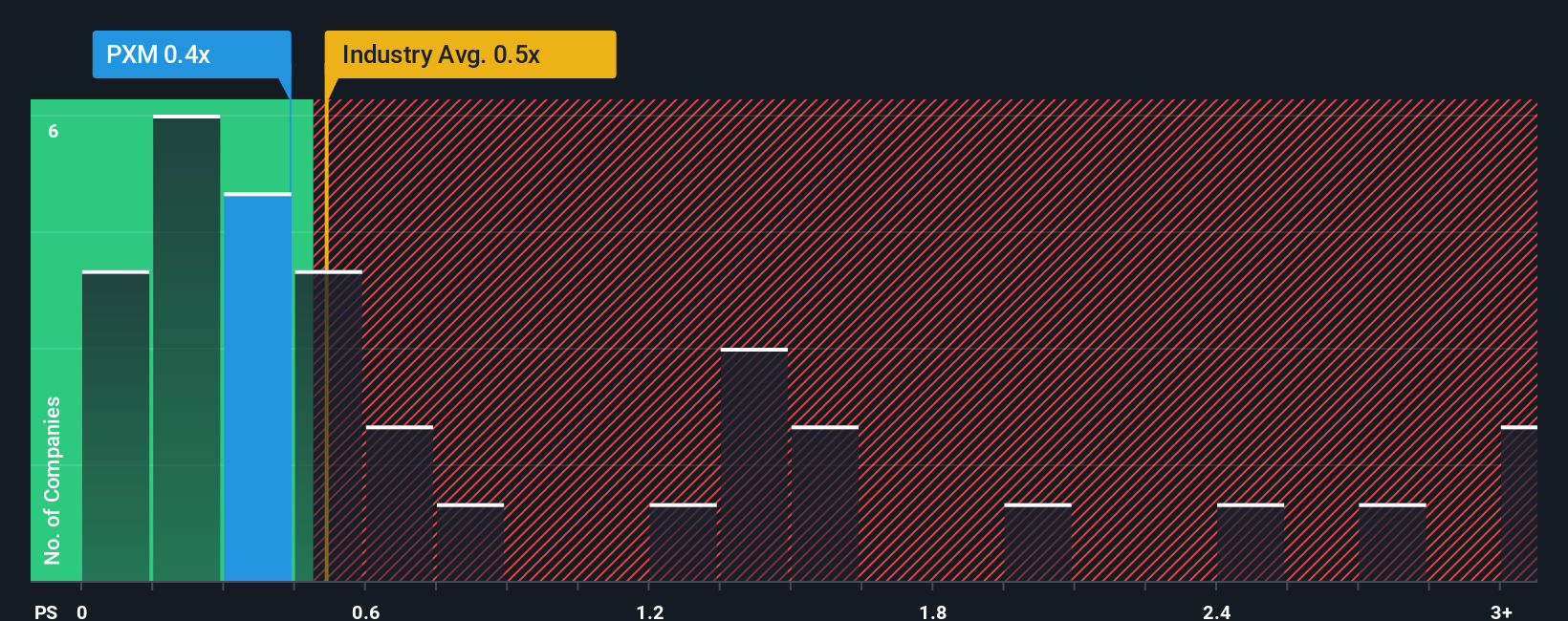

In spite of the firm bounce in price, there still wouldn't be many who think Polimex-Mostostal's price-to-sales (or "P/S") ratio of 0.4x is worth a mention when the median P/S in Poland's Construction industry is similar at about 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Polimex-Mostostal

How Polimex-Mostostal Has Been Performing

Revenue has risen firmly for Polimex-Mostostal recently, which is pleasing to see. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Polimex-Mostostal will help you shine a light on its historical performance.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Polimex-Mostostal's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 24%. Still, revenue has barely risen at all from three years ago in total, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 19% shows it's noticeably less attractive.

With this in mind, we find it intriguing that Polimex-Mostostal's P/S is comparable to that of its industry peers. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Bottom Line On Polimex-Mostostal's P/S

Polimex-Mostostal's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Polimex-Mostostal's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. If recent medium-term revenue trends continue, the probability of a share price decline will become quite substantial, placing shareholders at risk.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Polimex-Mostostal that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:PXM

Polimex-Mostostal

Operates as an engineering and construction company in Poland and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives