Do Pozbud T&R Spolka Akcyjna's (WSE:POZ) Earnings Warrant Your Attention?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Pozbud T&R Spolka Akcyjna (WSE:POZ). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Pozbud T&R Spolka Akcyjna

Pozbud T&R Spolka Akcyjna's Earnings Per Share Are Growing.

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. I, for one, am blown away by the fact that Pozbud T&R Spolka Akcyjna has grown EPS by 39% per year, over the last three years. That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that Pozbud T&R Spolka Akcyjna is growing revenues, and EBIT margins improved by 13.1 percentage points to 23%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

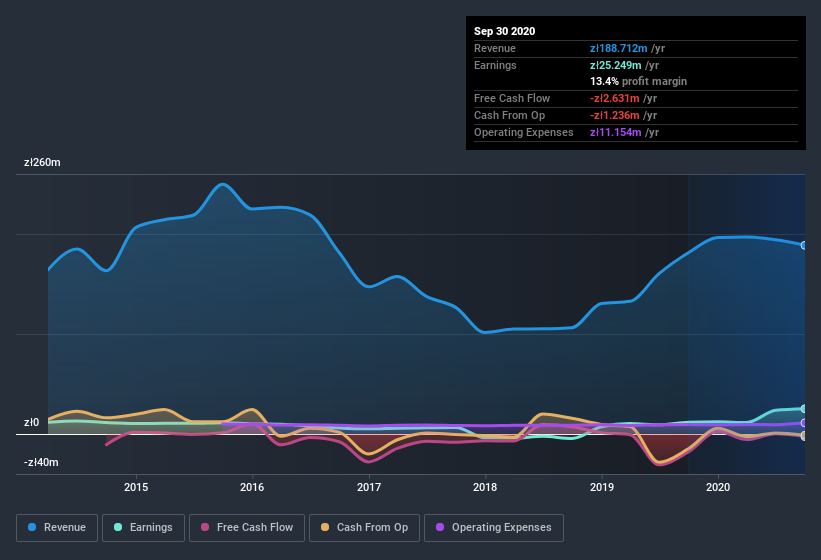

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Since Pozbud T&R Spolka Akcyjna is no giant, with a market capitalization of zł139m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Pozbud T&R Spolka Akcyjna Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So we're pleased to report that Pozbud T&R Spolka Akcyjna insiders own a meaningful share of the business. In fact, they own 54% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes me think they will be incentivised to plan for the long term - something I like to see. With that sort of holding, insiders have about zł74m riding on the stock, at current prices. That should be more than enough to keep them focussed on creating shareholder value!

Does Pozbud T&R Spolka Akcyjna Deserve A Spot On Your Watchlist?

Pozbud T&R Spolka Akcyjna's earnings have taken off like any random crypto-currency did, back in 2017. That sort of growth is nothing short of eye-catching, and the large investment held by insiders certainly brightens my view of the company. At times fast EPS growth is a sign the business has reached an inflection point; and I do like those. So yes, on this short analysis I do think it's worth considering Pozbud T&R Spolka Akcyjna for a spot on your watchlist. Before you take the next step you should know about the 4 warning signs for Pozbud T&R Spolka Akcyjna (2 are potentially serious!) that we have uncovered.

Although Pozbud T&R Spolka Akcyjna certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Pozbud T&R Spolka Akcyjna, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Compremum, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:CPR

Compremum

Engages in the manufacture and sale of windows and doors in Europe.

Good value with adequate balance sheet.

Market Insights

Community Narratives