Patentus S.A. (WSE:PAT) Held Back By Insufficient Growth Even After Shares Climb 30%

Patentus S.A. (WSE:PAT) shares have continued their recent momentum with a 30% gain in the last month alone. The annual gain comes to 230% following the latest surge, making investors sit up and take notice.

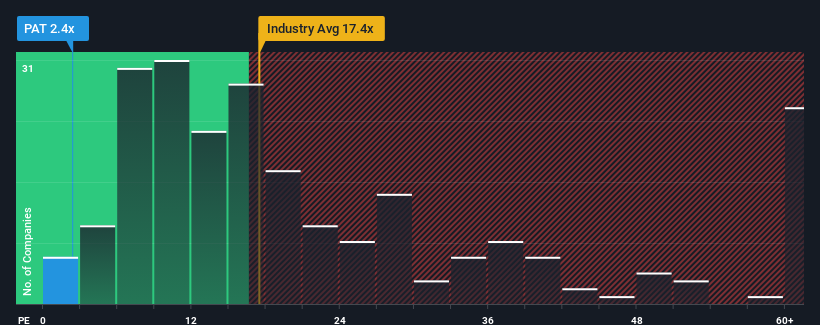

In spite of the firm bounce in price, Patentus' price-to-earnings (or "P/E") ratio of 2.4x might still make it look like a strong buy right now compared to the market in Poland, where around half of the companies have P/E ratios above 13x and even P/E's above 24x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times have been quite advantageous for Patentus as its earnings have been rising very briskly. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Patentus

How Is Patentus' Growth Trending?

The only time you'd be truly comfortable seeing a P/E as depressed as Patentus' is when the company's growth is on track to lag the market decidedly.

Taking a look back first, we see that the company grew earnings per share by an impressive 463% last year. Still, EPS has barely risen at all from three years ago in total, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 7.5% shows it's noticeably less attractive on an annualised basis.

With this information, we can see why Patentus is trading at a P/E lower than the market. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Bottom Line On Patentus' P/E

Patentus' recent share price jump still sees its P/E sitting firmly flat on the ground. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Patentus maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Patentus you should know about.

If you're unsure about the strength of Patentus' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:PAT

Patentus

Manufactures and sells mining machinery and equipment in Poland.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives