Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Newag S.A. (WSE:NWG) does carry debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Newag

How Much Debt Does Newag Carry?

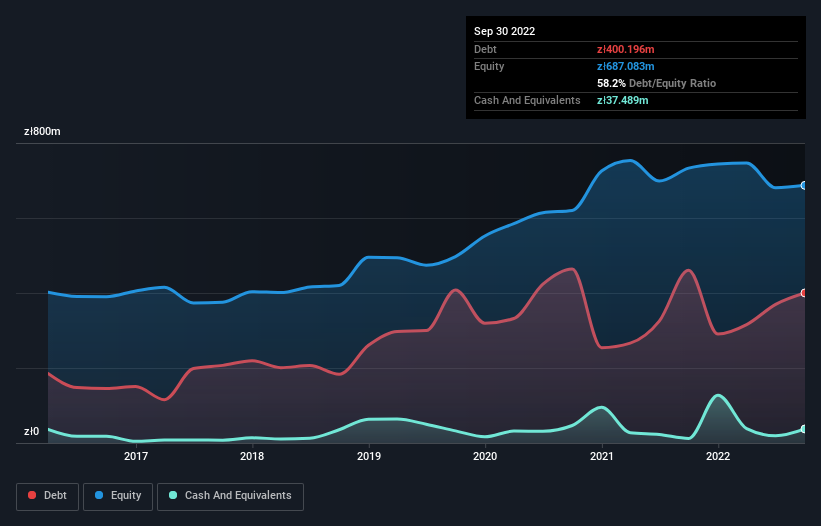

As you can see below, Newag had zł400.2m of debt at September 2022, down from zł460.7m a year prior. On the flip side, it has zł37.5m in cash leading to net debt of about zł362.7m.

A Look At Newag's Liabilities

According to the last reported balance sheet, Newag had liabilities of zł697.0m due within 12 months, and liabilities of zł140.6m due beyond 12 months. Offsetting this, it had zł37.5m in cash and zł357.6m in receivables that were due within 12 months. So it has liabilities totalling zł442.4m more than its cash and near-term receivables, combined.

This deficit is considerable relative to its market capitalization of zł729.0m, so it does suggest shareholders should keep an eye on Newag's use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While Newag's debt to EBITDA ratio (4.6) suggests that it uses some debt, its interest cover is very weak, at 2.0, suggesting high leverage. So shareholders should probably be aware that interest expenses appear to have really impacted the business lately. Even worse, Newag saw its EBIT tank 72% over the last 12 months. If earnings keep going like that over the long term, it has a snowball's chance in hell of paying off that debt. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Newag will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, Newag's free cash flow amounted to 37% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Our View

To be frank both Newag's interest cover and its track record of (not) growing its EBIT make us rather uncomfortable with its debt levels. Having said that, its ability to convert EBIT to free cash flow isn't such a worry. Overall, it seems to us that Newag's balance sheet is really quite a risk to the business. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 3 warning signs we've spotted with Newag (including 1 which is concerning) .

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Newag might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:NWG

Newag

Engages in the production and sale of railway locomotives and rolling stocks in Poland.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives