- Poland

- /

- Construction

- /

- WSE:TRK

Three Undiscovered European Gems with Strong Potential

Reviewed by Simply Wall St

Amid the backdrop of heightened global trade tensions and significant market volatility, European indices have experienced notable declines, with the STOXX Europe 600 Index posting its largest drop in five years. Despite these challenges, opportunities can still be found by identifying stocks that demonstrate resilience and potential for growth in uncertain economic climates.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Alantra Partners | NA | -3.99% | -23.83% | ★★★★★★ |

| Intellego Technologies | 11.59% | 68.05% | 72.76% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Dekpol | 73.04% | 15.36% | 16.35% | ★★★★★☆ |

| Infinity Capital Investments | NA | 9.92% | 22.16% | ★★★★★☆ |

| ABG Sundal Collier Holding | 0.61% | -4.24% | -12.70% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 5.17% | -13.11% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Scandi Standard (OM:SCST)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Scandi Standard AB (publ) is a company that produces and sells chilled, frozen, and ready-to-eat chicken products across several countries including Sweden, Norway, Ireland, Denmark, Finland, Germany, the United Kingdom as well as other parts of Europe and internationally; it has a market cap of approximately SEK5.27 billion.

Operations: Scandi Standard generates revenue primarily from its Ready-To-Cook segment, contributing SEK9.92 billion, followed by the Ready-To-Eat segment at SEK2.60 billion.

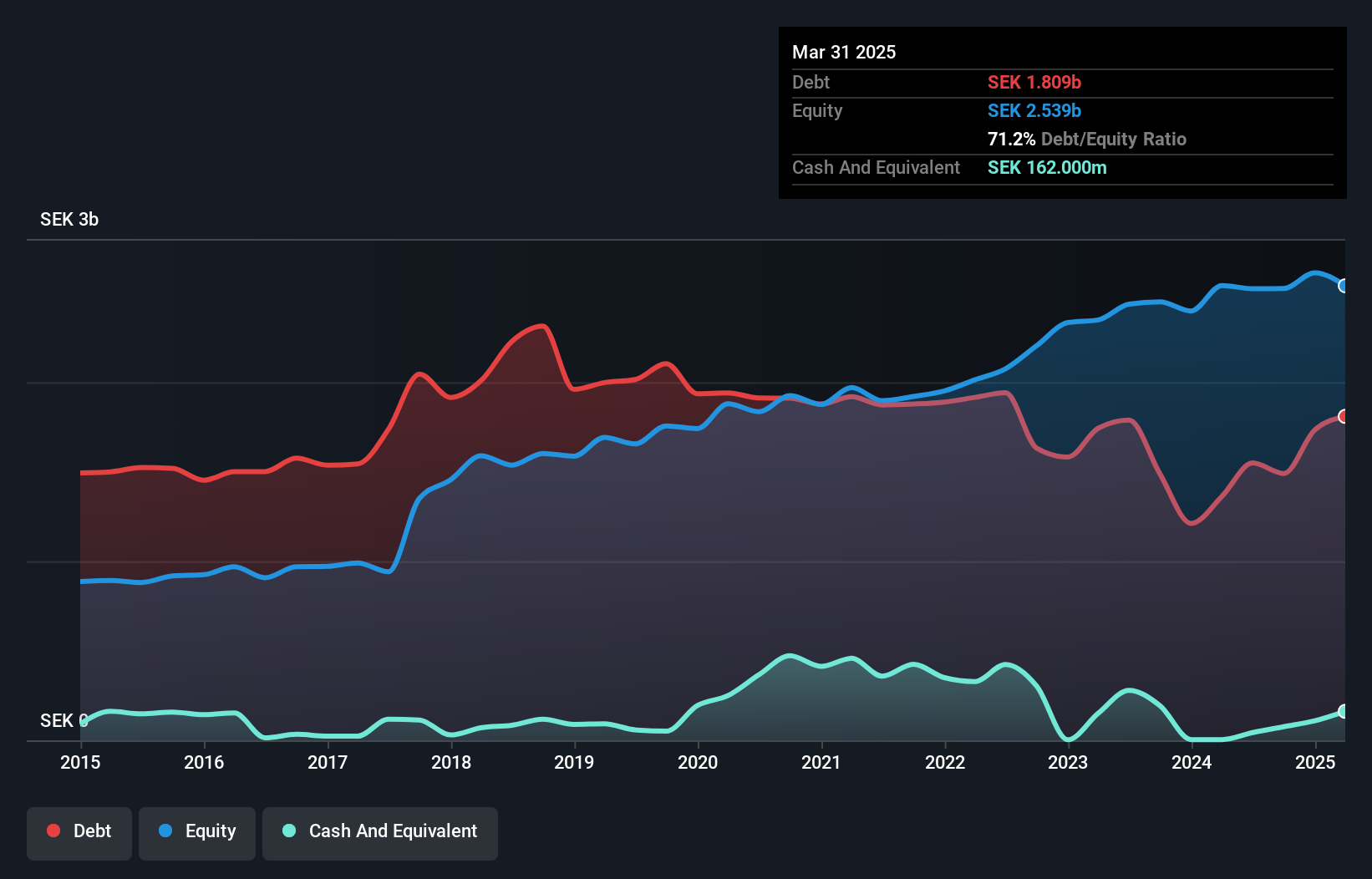

Scandi Standard, a notable player in the European poultry market, is poised for growth with recent investments in production facilities. The company reported sales of SEK 3.17 billion for Q4 2024, up from SEK 3.01 billion the previous year, although net income fell to SEK 40 million from SEK 66 million. Despite a high net debt to equity ratio of 62%, Scandi's earnings have grown by an average of 8.7% annually over five years and are forecasted to grow at nearly 19% per year moving forward. With planned expansions in Oosterwolde and Lithuania, the company aims to capitalize on increasing demand while managing risks like higher finance costs and operational inefficiencies.

Mirbud (WSE:MRB)

Simply Wall St Value Rating: ★★★★★★

Overview: Mirbud S.A. operates as a general contractor in the construction industry in Poland, with a market capitalization of PLN 1.43 billion.

Operations: Mirbud generates revenue primarily from its Construction and Assembly Activity, which accounts for PLN 3.26 billion, and Real Estate Development Activity, contributing PLN 345.14 million. Activities related to the lease of investment property add PLN 44.75 million to the revenue stream.

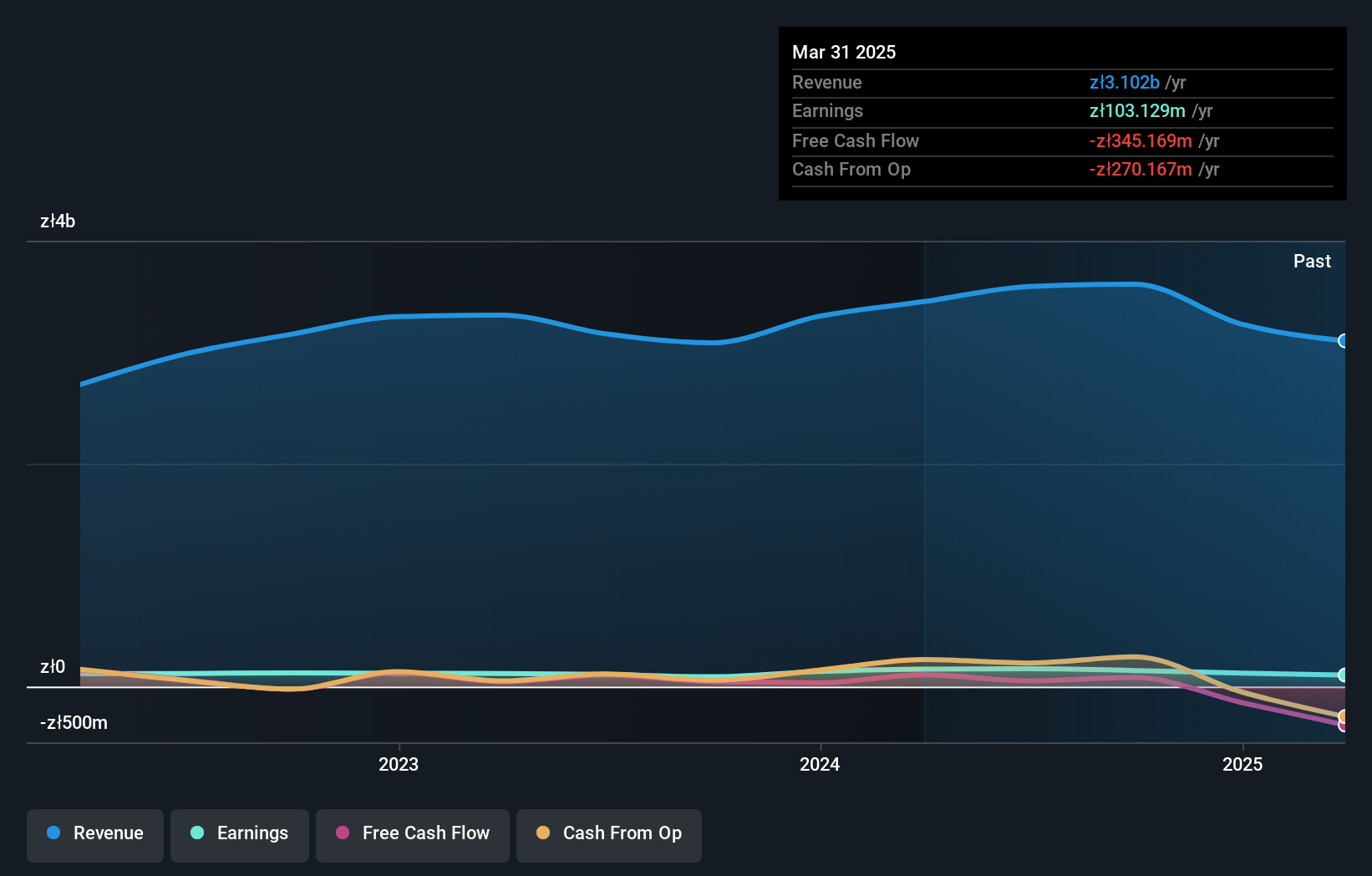

Mirbud, a construction company, has shown impressive earnings growth of 63.5% over the past year, outperforming its industry peers who faced a -9.1% trend. Despite a significant one-off loss of PLN158M impacting recent results, the company's fundamentals remain robust with its debt to equity ratio improving from 71.3% to 16% over five years. Mirbud trades at an attractive valuation, reportedly 95.6% below estimated fair value and maintains positive free cash flow status which suggests financial health despite shareholder dilution in the past year and large capital expenditures amounting to PLN187M recently affecting cash flow dynamics.

- Take a closer look at Mirbud's potential here in our health report.

Evaluate Mirbud's historical performance by accessing our past performance report.

Trakcja (WSE:TRK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Trakcja S.A. operates in the infrastructure and energy construction sector both in Poland and internationally, with a market capitalization of PLN1.03 billion.

Operations: Trakcja S.A. generates revenue primarily from Civil Construction Works in Poland, amounting to PLN1.12 billion, and Construction, Engineering, and Concession Agreements in the Baltic Countries at PLN845.39 million.

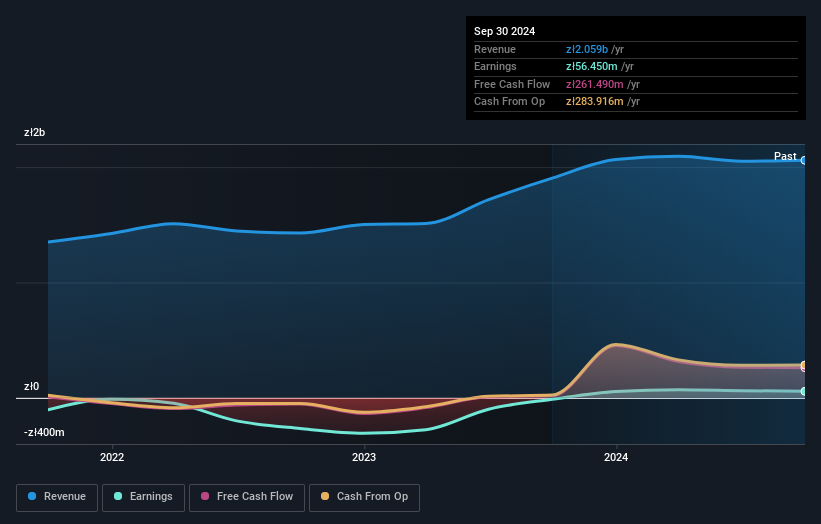

Trakcja, a notable player in the construction sector, has recently turned profitable, contrasting with the industry's -9.1% performance. The firm’s debt to equity ratio has climbed from 54.6% to 74.3% over five years, yet its interest payments are comfortably covered by EBIT at 3.6 times coverage. A significant PLN12 million one-off gain has bolstered recent financial results, though this may not reflect ongoing operations' quality fully. With a net debt to equity ratio of 11.7%, Trakcja's financial health appears satisfactory despite past shareholder dilution and its shares trading significantly below estimated fair value might intrigue investors seeking undervalued opportunities in Europe’s market landscape.

- Dive into the specifics of Trakcja here with our thorough health report.

Gain insights into Trakcja's past trends and performance with our Past report.

Summing It All Up

- Get an in-depth perspective on all 351 European Undiscovered Gems With Strong Fundamentals by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trakcja might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:TRK

Trakcja

Operates in the infrastructure and energy construction sector in Poland and internationally.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives