- Poland

- /

- Trade Distributors

- /

- WSE:HRS

These 4 Measures Indicate That Herkules (WSE:HRS) Is Using Debt Extensively

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Herkules S.A. (WSE:HRS) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Herkules

What Is Herkules's Debt?

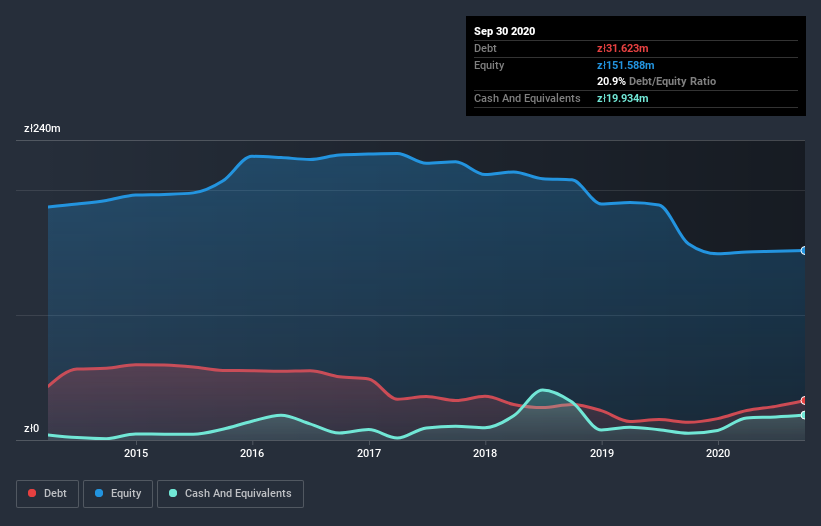

You can click the graphic below for the historical numbers, but it shows that as of September 2020 Herkules had zł31.6m of debt, an increase on zł14.1m, over one year. However, it does have zł19.9m in cash offsetting this, leading to net debt of about zł11.7m.

How Strong Is Herkules' Balance Sheet?

We can see from the most recent balance sheet that Herkules had liabilities of zł106.0m falling due within a year, and liabilities of zł99.0m due beyond that. Offsetting these obligations, it had cash of zł19.9m as well as receivables valued at zł61.9m due within 12 months. So it has liabilities totalling zł123.2m more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the zł45.4m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. After all, Herkules would likely require a major re-capitalisation if it had to pay its creditors today.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

While Herkules's low debt to EBITDA ratio of 0.36 suggests only modest use of debt, the fact that EBIT only covered the interest expense by 4.6 times last year does give us pause. So we'd recommend keeping a close eye on the impact financing costs are having on the business. Notably, Herkules made a loss at the EBIT level, last year, but improved that to positive EBIT of zł13m in the last twelve months. When analysing debt levels, the balance sheet is the obvious place to start. But it is Herkules's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. In the last year, Herkules created free cash flow amounting to 17% of its EBIT, an uninspiring performance. That limp level of cash conversion undermines its ability to manage and pay down debt.

Our View

We'd go so far as to say Herkules's level of total liabilities was disappointing. But at least it's pretty decent at managing its debt, based on its EBITDA,; that's encouraging. We're quite clear that we consider Herkules to be really rather risky, as a result of its balance sheet health. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Be aware that Herkules is showing 3 warning signs in our investment analysis , and 1 of those is significant...

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

When trading Herkules or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Herkules might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:HRS

Herkules

Engages in the hoisting equipment rental and oversize load shipping activities in Poland.

Adequate balance sheet with low risk.

Market Insights

Community Narratives