- Poland

- /

- Industrials

- /

- WSE:GKI

Grupa Kapitalowa IMMOBILE S.A. (WSE:GKI) Soars 29% But It's A Story Of Risk Vs Reward

Despite an already strong run, Grupa Kapitalowa IMMOBILE S.A. (WSE:GKI) shares have been powering on, with a gain of 29% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 52% in the last year.

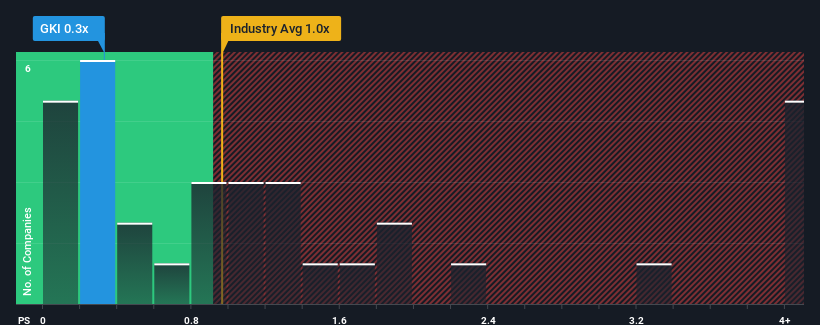

Even after such a large jump in price, given about half the companies operating in Poland's Industrials industry have price-to-sales ratios (or "P/S") above 1x, you may still consider Grupa Kapitalowa IMMOBILE as an attractive investment with its 0.3x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Grupa Kapitalowa IMMOBILE

What Does Grupa Kapitalowa IMMOBILE's Recent Performance Look Like?

Grupa Kapitalowa IMMOBILE could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Grupa Kapitalowa IMMOBILE will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Grupa Kapitalowa IMMOBILE's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 1.2%. Still, the latest three year period has seen an excellent 69% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 14% each year as estimated by the one analyst watching the company. That's shaping up to be materially higher than the 5.1% per annum growth forecast for the broader industry.

In light of this, it's peculiar that Grupa Kapitalowa IMMOBILE's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Grupa Kapitalowa IMMOBILE's P/S?

Despite Grupa Kapitalowa IMMOBILE's share price climbing recently, its P/S still lags most other companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Grupa Kapitalowa IMMOBILE's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Having said that, be aware Grupa Kapitalowa IMMOBILE is showing 3 warning signs in our investment analysis, and 1 of those shouldn't be ignored.

If these risks are making you reconsider your opinion on Grupa Kapitalowa IMMOBILE, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Grupa Kapitalowa IMMOBILE, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:GKI

Grupa Kapitalowa IMMOBILE

Operates in the industry, construction and development, hotel industry, clothing industry, and automation and power engineering in Poland and internationally.

Undervalued low.