As global markets navigate the complexities of tariff uncertainties and fluctuating economic indicators, investors are keenly observing how these factors influence stock performance. With U.S. job growth slowing and manufacturing showing signs of recovery, dividend stocks offer a potential avenue for stability amid market volatility. In this context, selecting dividend stocks with strong earnings growth and resilient fundamentals can be an effective strategy to weather economic shifts while potentially providing consistent income streams.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.78% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.56% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.84% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.48% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.54% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.19% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.94% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.69% | ★★★★★★ |

Click here to see the full list of 1965 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

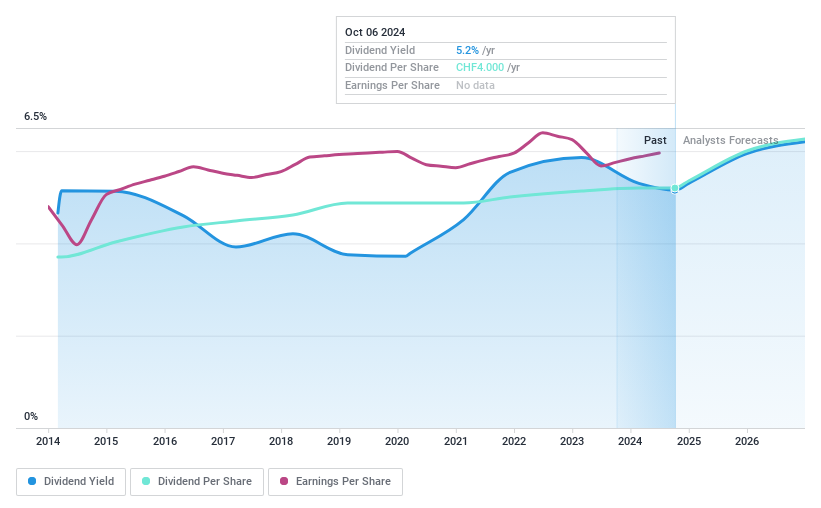

Cembra Money Bank (SWX:CMBN)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Cembra Money Bank AG offers consumer finance products and services in Switzerland, with a market cap of CHF2.69 billion.

Operations: Cembra Money Bank AG's revenue segments include personal loans, auto leases and loans, credit cards, and insurance products.

Dividend Yield: 4.4%

Cembra Money Bank offers a reliable dividend yield of 4.36%, ranking in the top 25% of Swiss dividend payers. Its dividends have been stable and growing over the past decade, with a sustainable payout ratio currently at 72.7% and forecasted to be 69.3% in three years, ensuring coverage by earnings. Despite recent board changes, Cembra remains committed to delivering consistent returns to shareholders while trading at a discount to its estimated fair value.

- Click here to discover the nuances of Cembra Money Bank with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Cembra Money Bank is trading behind its estimated value.

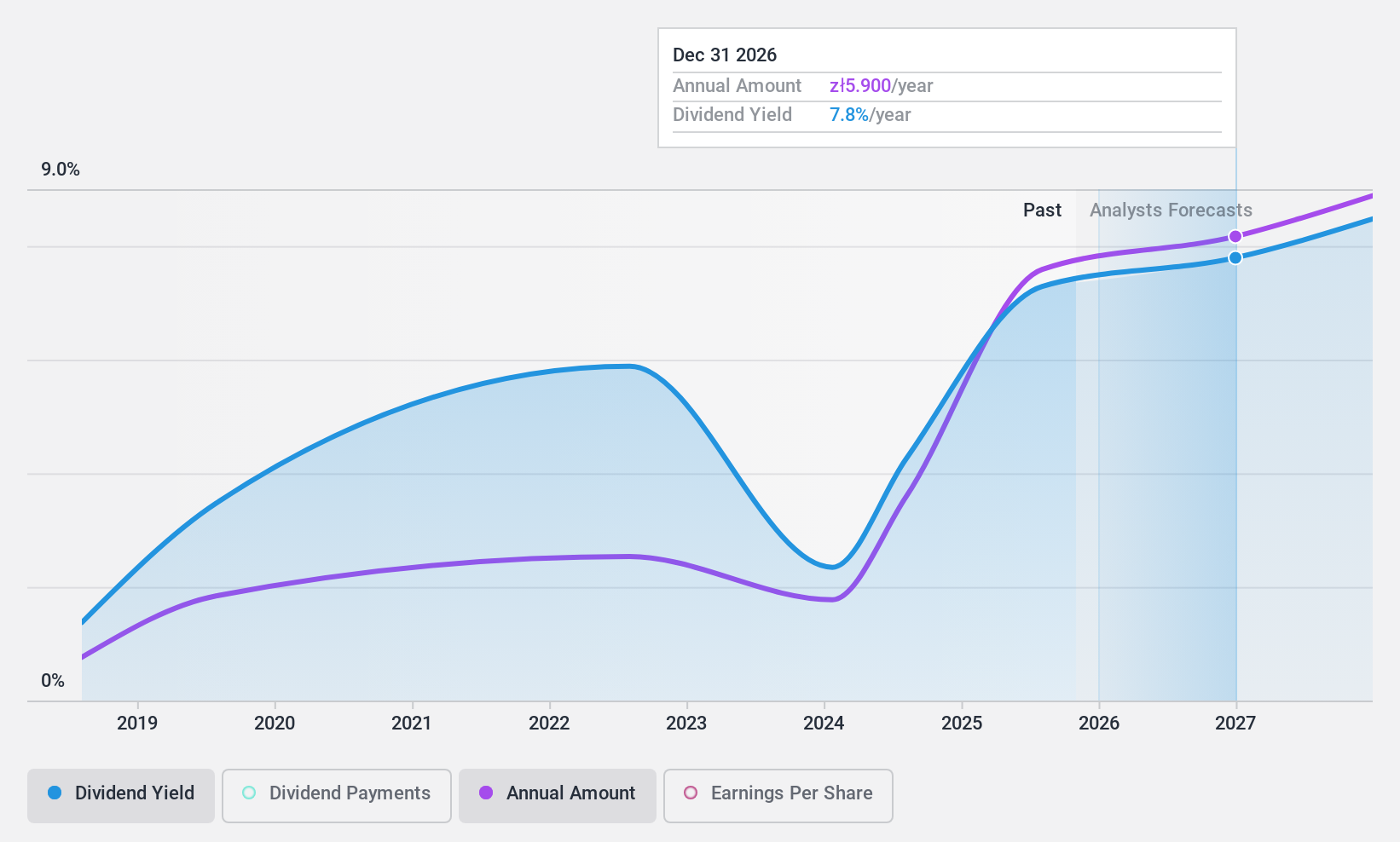

Powszechna Kasa Oszczednosci Bank Polski Spólka Akcyjna (WSE:PKO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Powszechna Kasa Oszczednosci Bank Polski Spólka Akcyjna offers a range of banking products and services in Poland and internationally, with a market cap of PLN84.35 billion.

Operations: Powszechna Kasa Oszczednosci Bank Polski Spólka Akcyjna generates revenue primarily from its Retail Segment, which accounts for PLN15.35 billion, and its Corporate and Investment Segment, contributing PLN7.53 billion.

Dividend Yield: 3.8%

Powszechna Kasa Oszczednosci Bank Polski Spólka Akcyjna has a dividend yield of 3.84%, below the top quartile in Poland. Despite a low payout ratio of 42.9% indicating strong earnings coverage, its dividends have been volatile over the past decade, with significant annual drops exceeding 20%. Earnings are projected to grow by 8.86% annually, supporting future dividend payments. However, the bank's high level of bad loans (3.6%) may pose risks to financial stability and dividend reliability.

- Delve into the full analysis dividend report here for a deeper understanding of Powszechna Kasa Oszczednosci Bank Polski Spólka Akcyjna.

- The valuation report we've compiled suggests that Powszechna Kasa Oszczednosci Bank Polski Spólka Akcyjna's current price could be inflated.

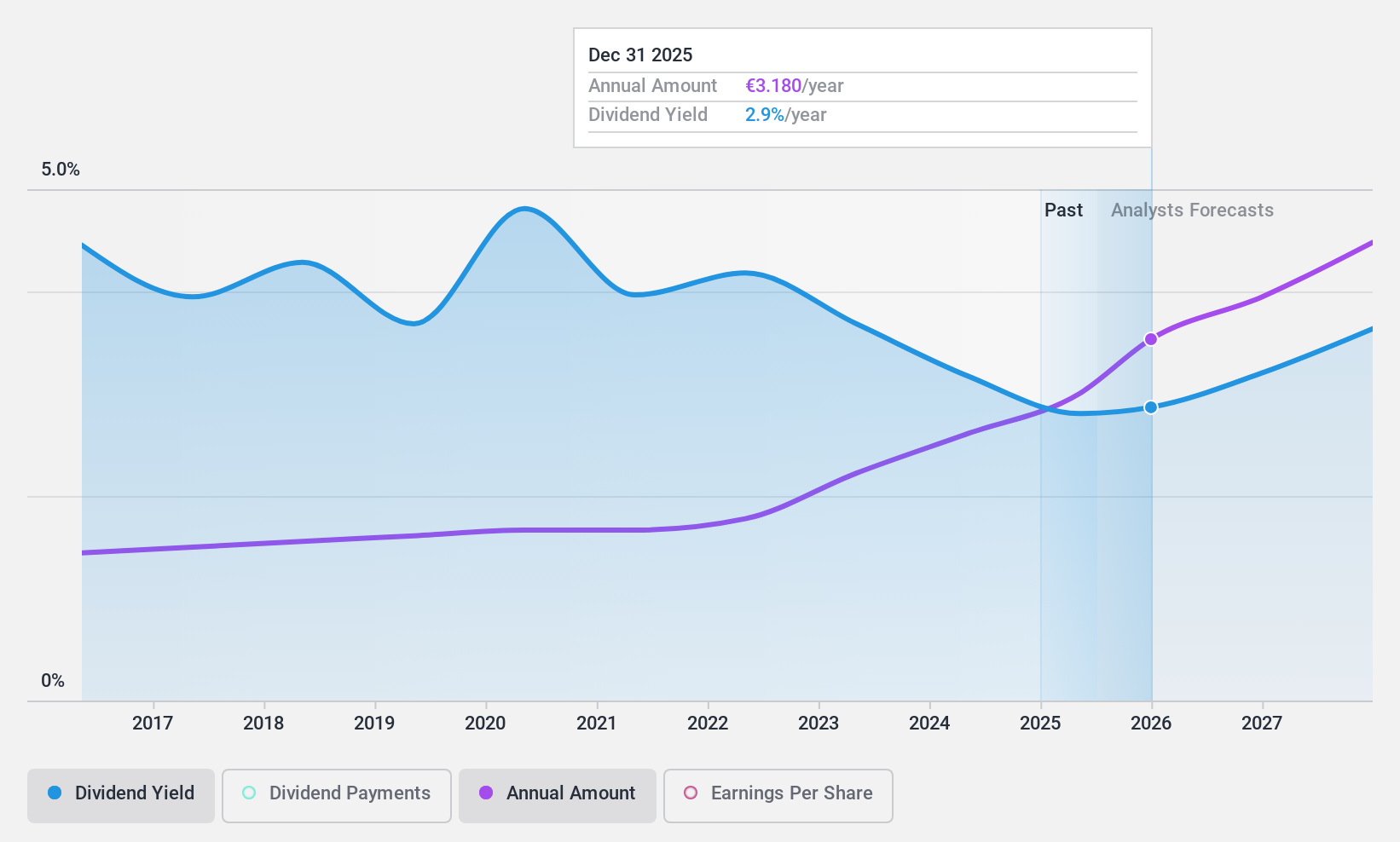

Talanx (XTRA:TLX)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Talanx AG is a global provider of insurance and reinsurance products and services, with a market capitalization of approximately €21.43 billion.

Operations: Talanx AG generates revenue through its primary segments, which include Industrial Lines (€8.33 billion), Retail Germany (€7.62 billion), Retail International (€6.41 billion), and Reinsurance (€23.35 billion).

Dividend Yield: 3.2%

Talanx AG offers a stable dividend profile with consistent growth over the past decade, supported by a low payout ratio of 32% and a cash payout ratio of 9%, indicating strong coverage by earnings and cash flows. Recent announcements include an increase in the dividend for 2024 to €2.70 per share, with plans to reach €4.00 by 2027, contingent on profit targets exceeding €2.5 billion. The current yield is modest at 3.25%, below Germany's top quartile payers.

- Click to explore a detailed breakdown of our findings in Talanx's dividend report.

- Our expertly prepared valuation report Talanx implies its share price may be lower than expected.

Make It Happen

- Click here to access our complete index of 1965 Top Dividend Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:PKO

Powszechna Kasa Oszczednosci Bank Polski Spólka Akcyjna

Provides various banking products and services in Poland and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives