- Poland

- /

- Diversified Financial

- /

- WSE:NOV

Is Now The Time To Put Novina Alternatywna Spólka Inwestycyjna Spólka Akcyjna (WSE:NOV) On Your Watchlist?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Novina Alternatywna Spólka Inwestycyjna Spólka Akcyjna (WSE:NOV). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Novina Alternatywna Spólka Inwestycyjna Spólka Akcyjna

Novina Alternatywna Spólka Inwestycyjna Spólka Akcyjna's Improving Profits

In a capitalist society capital chases profits, and that means share prices tend rise with earnings per share (EPS). So like a ray of sunshine through a gap in the clouds, improving EPS is considered a good sign. You can imagine, then, that it almost knocked my socks off when I realized that Novina Alternatywna Spólka Inwestycyjna Spólka Akcyjna grew its EPS from zł0.062 to zł0.20, in one short year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

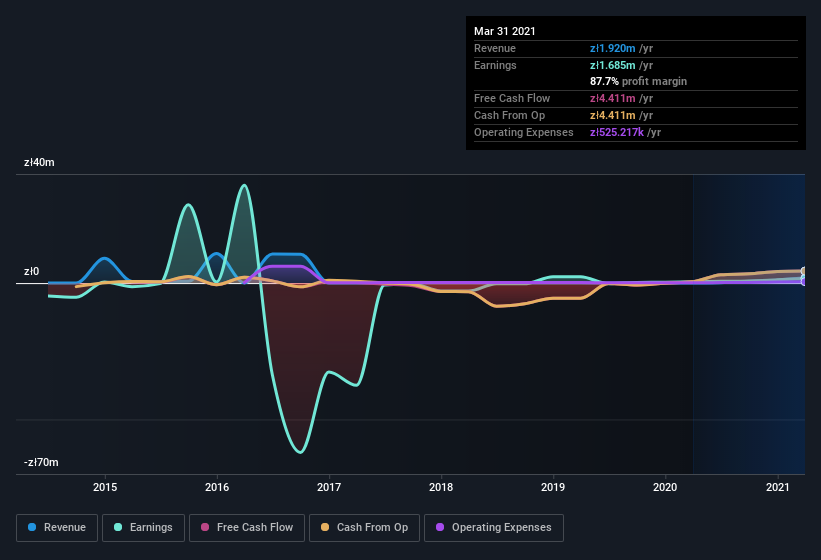

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Novina Alternatywna Spólka Inwestycyjna Spólka Akcyjna is growing revenues, and EBIT margins improved by 7740.2 percentage points to 63%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

Since Novina Alternatywna Spólka Inwestycyjna Spólka Akcyjna is no giant, with a market capitalization of zł7.5m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Novina Alternatywna Spólka Inwestycyjna Spólka Akcyjna Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So as you can imagine, the fact that Novina Alternatywna Spólka Inwestycyjna Spólka Akcyjna insiders own a significant number of shares certainly appeals to me. Indeed, with a collective holding of 74%, company insiders are in control and have plenty of capital behind the venture. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. Valued at only zł7.5m Novina Alternatywna Spólka Inwestycyjna Spólka Akcyjna is really small for a listed company. So despite a large proportional holding, insiders only have zł5.5m worth of stock. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

Does Novina Alternatywna Spólka Inwestycyjna Spólka Akcyjna Deserve A Spot On Your Watchlist?

Novina Alternatywna Spólka Inwestycyjna Spólka Akcyjna's earnings per share have taken off like a rocket aimed right at the moon. That sort of growth is nothing short of eye-catching, and the large investment held by insiders certainly brightens my view of the company. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So yes, on this short analysis I do think it's worth considering Novina Alternatywna Spólka Inwestycyjna Spólka Akcyjna for a spot on your watchlist. It is worth noting though that we have found 4 warning signs for Novina Alternatywna Spólka Inwestycyjna Spólka Akcyjna (2 don't sit too well with us!) that you need to take into consideration.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Novina Alternatywna Spólka Inwestycyjna Spólka Akcyjna or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if NOVINA pozyczkihipoteczne.eu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:NOV

NOVINA pozyczkihipoteczne.eu

Provides mortgage secured cash loans for business entities in Poland.

Outstanding track record with excellent balance sheet.

Market Insights

Community Narratives