- France

- /

- Auto Components

- /

- ENXTPA:OPM

3 European Dividend Stocks Yielding Up To 7.9%

Reviewed by Simply Wall St

As the European markets navigate a landscape marked by mixed performances across major indices, with the STOXX Europe 600 Index seeing a modest rise and Germany's DAX experiencing a decline, investors are increasingly seeking stability through dividend stocks. In such an environment, stocks that offer reliable dividend yields can provide an attractive income stream for investors looking to balance potential market volatility with steady returns.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.37% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.39% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.80% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.54% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.18% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.15% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.69% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.02% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.72% | ★★★★★☆ |

| Banca Popolare di Sondrio (BIT:BPSO) | 5.91% | ★★★★★☆ |

Click here to see the full list of 223 stocks from our Top European Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

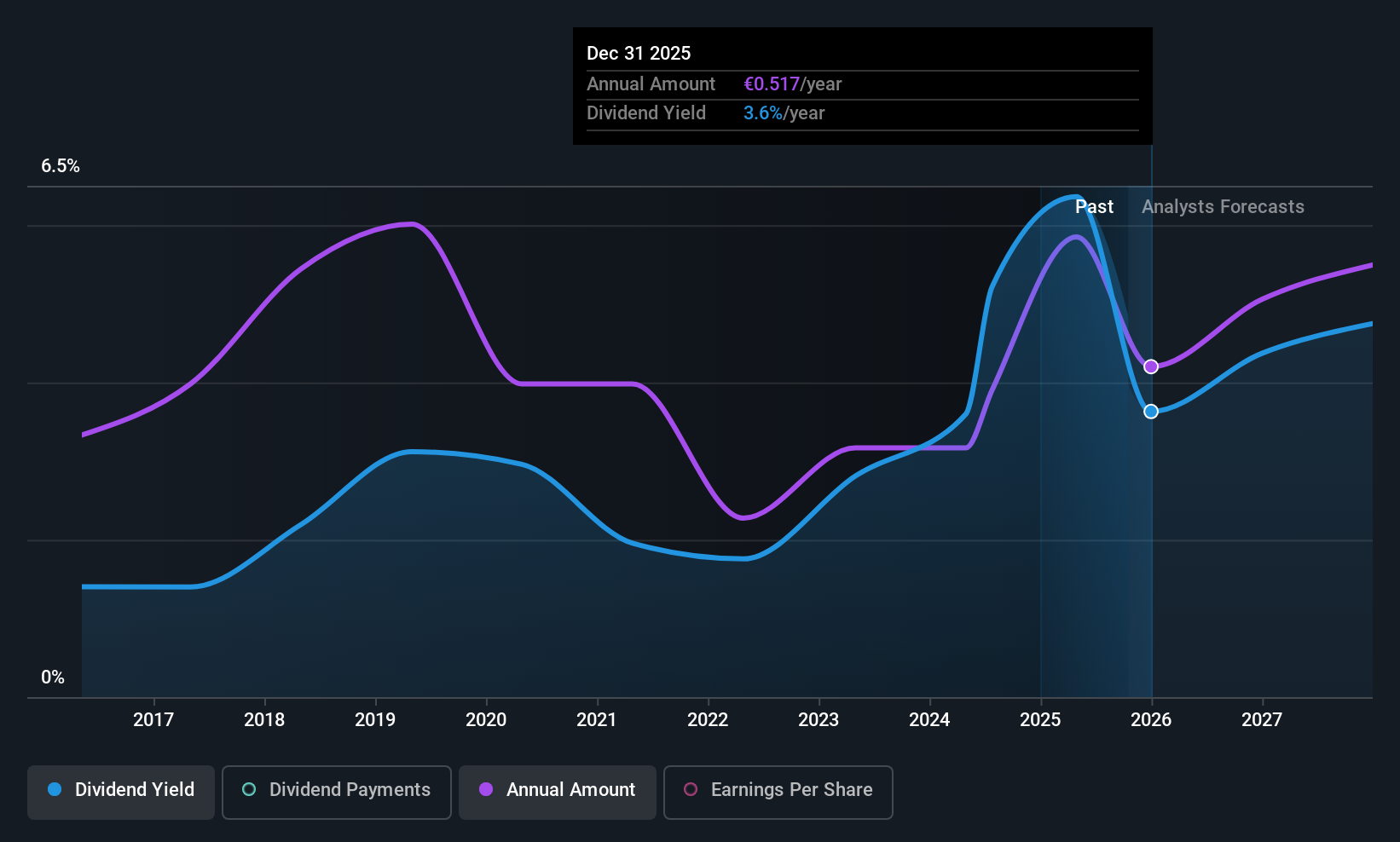

OPmobility (ENXTPA:OPM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: OPmobility SE designs and produces intelligent exterior systems, customized complex modules, lighting systems, energy storage systems, and electrification solutions for mobility players globally, with a market cap of approximately €2.04 billion.

Operations: OPmobility SE generates revenue from various segments, including €4.70 billion from Exterior Systems, €3.15 billion from Modules, and €2.62 billion from Powertrain.

Dividend Yield: 5%

OPmobility's dividend payments have been volatile over the past decade, with significant annual drops. Despite this instability, dividends are well-covered by earnings and cash flows, with payout ratios of 32.2% and 50.2%, respectively. However, the dividend yield of 5.05% is below the top quartile in France. Recent guidance suggests efforts to improve financial metrics and reduce debt levels, although revenue has declined slightly year-over-year for both Q3 and nine months ending September 2025.

- Take a closer look at OPmobility's potential here in our dividend report.

- Our valuation report here indicates OPmobility may be overvalued.

Huhtamäki Oyj (HLSE:HUH1V)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Huhtamäki Oyj is a global provider of packaging solutions operating in countries such as the United States, Germany, and India, with a market cap of €3.10 billion.

Operations: Huhtamäki Oyj generates its revenue from several segments, including North America (€1.46 billion), Fiber Packaging (€376.60 million), Flexible Packaging (€1.30 billion), and Foodservice Europe-Asia-Oceania (€969.40 million).

Dividend Yield: 3.7%

Huhtamäki Oyj's dividend payments have been stable and growing over the past decade, supported by a payout ratio of 57.4% and cash flow coverage at 63.4%. Although the dividend yield of 3.73% is lower than Finland's top quartile, it remains reliable. The company has a high debt level but trades below its fair value estimate, suggesting potential upside. Recent debt financing activities include purchasing notes maturing in 2026 and 2027 to manage liabilities effectively.

- Get an in-depth perspective on Huhtamäki Oyj's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Huhtamäki Oyj's current price could be quite moderate.

ING Bank Slaski (WSE:ING)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ING Bank Slaski S.A., along with its subsidiaries, offers a range of banking products and services to retail clients and businesses in Poland, with a market capitalization of PLN41.31 billion.

Operations: ING Bank Slaski S.A. generates revenue through its Retail Banking segment, which accounts for PLN5.12 billion, and its Corporate Banking segment, contributing PLN5.12 billion.

Dividend Yield: 7.9%

ING Bank Slaski's dividend yield is among the top in Poland, yet its payments have been volatile over the past decade. The current payout ratio of 71.9% suggests dividends are covered by earnings, with forecasts indicating improved coverage at 52.4% in three years. Despite trading below fair value and consistent earnings growth, concerns include a high level of bad loans at 3.8% and a low allowance for these loans at 63%.

- Dive into the specifics of ING Bank Slaski here with our thorough dividend report.

- Upon reviewing our latest valuation report, ING Bank Slaski's share price might be too pessimistic.

Where To Now?

- Take a closer look at our Top European Dividend Stocks list of 223 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:OPM

OPmobility

Designs and produces intelligent exterior systems, customized complex modules, lighting systems, energy storage systems, and electrification solutions for all mobility players in Europe, North America, China, rest of Asia, South America, the Middle East, and Africa.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives