Bank Handlowy w Warszawie's (WSE:BHW) Shareholders Are Down 56% On Their Shares

As an investor its worth striving to ensure your overall portfolio beats the market average. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. Unfortunately, that's been the case for longer term Bank Handlowy w Warszawie S.A. (WSE:BHW) shareholders, since the share price is down 56% in the last three years, falling well short of the market decline of around 13%. And more recent buyers are having a tough time too, with a drop of 34% in the last year. On top of that, the share price is down 5.5% in the last week.

Check out our latest analysis for Bank Handlowy w Warszawie

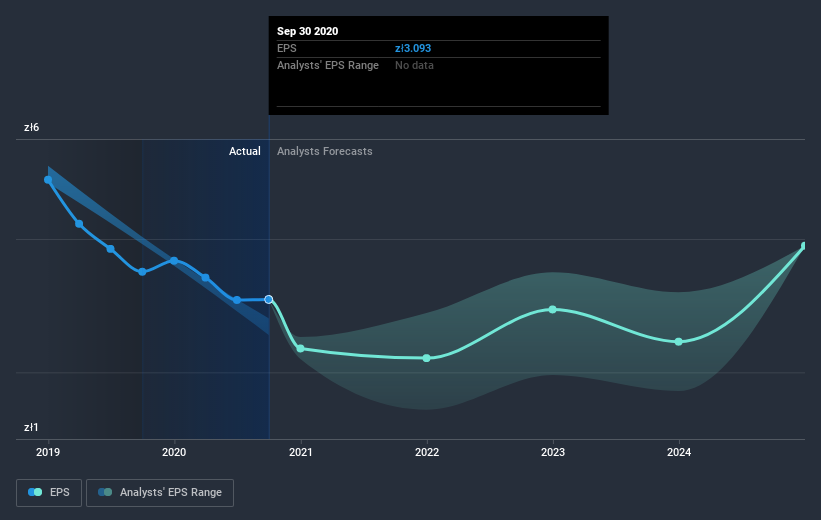

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the three years that the share price fell, Bank Handlowy w Warszawie's earnings per share (EPS) dropped by 7.0% each year. This reduction in EPS is slower than the 24% annual reduction in the share price. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy. This increased caution is also evident in the rather low P/E ratio, which is sitting at 11.15.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into Bank Handlowy w Warszawie's key metrics by checking this interactive graph of Bank Handlowy w Warszawie's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Bank Handlowy w Warszawie's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that Bank Handlowy w Warszawie's TSR, which was a 50% drop over the last 3 years, was not as bad as the share price return.

A Different Perspective

While the broader market lost about 1.5% in the twelve months, Bank Handlowy w Warszawie shareholders did even worse, losing 34%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 7% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Bank Handlowy w Warszawie , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on PL exchanges.

If you’re looking to trade Bank Handlowy w Warszawie, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bank Handlowy w Warszawie might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About WSE:BHW

Bank Handlowy w Warszawie

Provides a range of commercial banking services for individual and corporate clients in Poland and internationally.

Undervalued established dividend payer.

Market Insights

Community Narratives