- Poland

- /

- Auto Components

- /

- WSE:SNK

We Think Shareholders Are Less Likely To Approve A Pay Rise For Sanok Rubber Company Spólka Akcyjna's (WSE:SNK) CEO For Now

Key Insights

- Sanok Rubber Company Spólka Akcyjna's Annual General Meeting to take place on 25th of June

- CEO Piotr Szamburski's total compensation includes salary of zł816.0k

- Total compensation is similar to the industry average

- Sanok Rubber Company Spólka Akcyjna's three-year loss to shareholders was 15% while its EPS grew by 20% over the past three years

Shareholders of Sanok Rubber Company Spólka Akcyjna (WSE:SNK) will have been dismayed by the negative share price return over the last three years. Despite positive EPS growth in the past few years, the share price hasn't tracked the fundamental performance of the company. These are some of the concerns that shareholders may want to bring up at the next AGM held on 25th of June. Voting on resolutions such as executive remuneration and other matters could also be a way to influence management. We think shareholders might be reluctant to increase compensation for the CEO at the moment, according to our analysis below.

Check out our latest analysis for Sanok Rubber Company Spólka Akcyjna

Comparing Sanok Rubber Company Spólka Akcyjna's CEO Compensation With The Industry

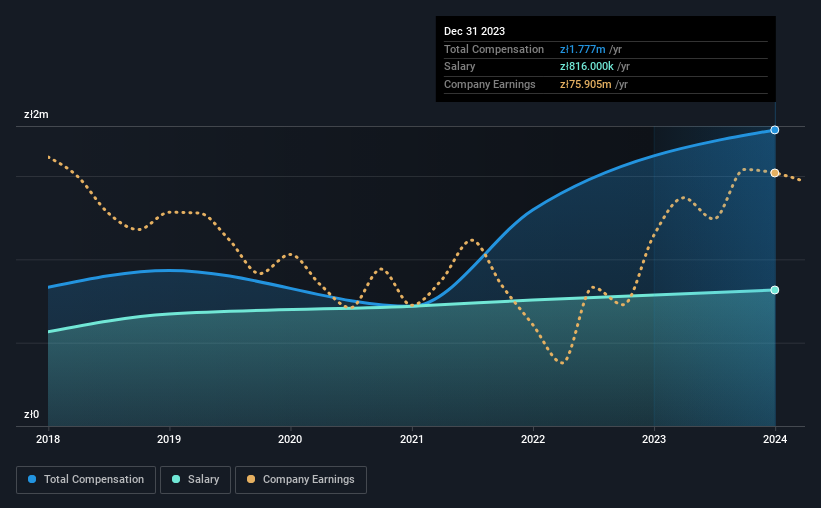

At the time of writing, our data shows that Sanok Rubber Company Spólka Akcyjna has a market capitalization of zł528m, and reported total annual CEO compensation of zł1.8m for the year to December 2023. That's a notable increase of 37% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at zł816k.

On comparing similar-sized companies in the Poland Auto Components industry with market capitalizations below zł808m, we found that the median total CEO compensation was zł1.5m. From this we gather that Piotr Szamburski is paid around the median for CEOs in the industry. Furthermore, Piotr Szamburski directly owns zł1.1m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2021 | Proportion (2023) |

| Salary | zł816k | zł756k | 46% |

| Other | zł961k | zł540k | 54% |

| Total Compensation | zł1.8m | zł1.3m | 100% |

On an industry level, around 47% of total compensation represents salary and 53% is other remuneration. Although there is a difference in how total compensation is set, Sanok Rubber Company Spólka Akcyjna more or less reflects the market in terms of setting the salary. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Sanok Rubber Company Spólka Akcyjna's Growth

Sanok Rubber Company Spólka Akcyjna's earnings per share (EPS) grew 20% per year over the last three years. In the last year, its revenue is down 3.3%.

Shareholders would be glad to know that the company has improved itself over the last few years. It's always a tough situation when revenues are not growing, but ultimately profits are more important. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Sanok Rubber Company Spólka Akcyjna Been A Good Investment?

Since shareholders would have lost about 15% over three years, some Sanok Rubber Company Spólka Akcyjna investors would surely be feeling negative emotions. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Shareholders have not seen their shares grow in value, rather they have seen their shares decline. A huge lag in share price growth when earnings have grown may indicate there could be other issues that are affecting the company at the moment that the market is focused on. Shareholders would probably be keen to find out what are the other factors could be weighing down the stock. These concerns should be addressed at the upcoming AGM, where shareholders can question the board and evaluate if their judgement and decision making is still in line with their expectations.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We identified 2 warning signs for Sanok Rubber Company Spólka Akcyjna (1 is potentially serious!) that you should be aware of before investing here.

Switching gears from Sanok Rubber Company Spólka Akcyjna, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:SNK

Excellent balance sheet and good value.