- Poland

- /

- Auto Components

- /

- WSE:SNK

Reflecting on Sanok Rubber Company Spólka Akcyjna's (WSE:SNK) Share Price Returns Over The Last Five Years

This month, we saw the Sanok Rubber Company Spólka Akcyjna (WSE:SNK) up an impressive 36%. But that can't change the reality that over the longer term (five years), the returns have been really quite dismal. In fact, the share price has declined rather badly, down some 69% in that time. So we're not so sure if the recent bounce should be celebrated. But it could be that the fall was overdone.

See our latest analysis for Sanok Rubber Company Spólka Akcyjna

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

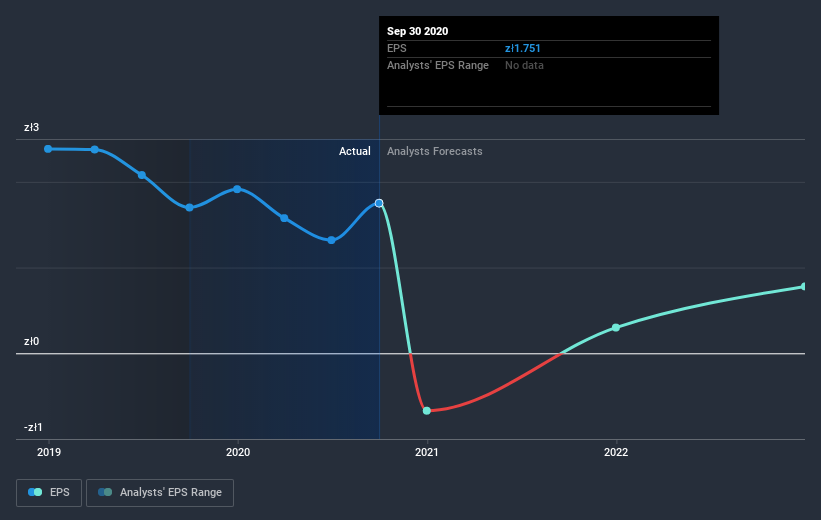

Looking back five years, both Sanok Rubber Company Spólka Akcyjna's share price and EPS declined; the latter at a rate of 11% per year. Readers should note that the share price has fallen faster than the EPS, at a rate of 21% per year, over the period. This implies that the market is more cautious about the business these days. The less favorable sentiment is reflected in its current P/E ratio of 9.31.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Sanok Rubber Company Spólka Akcyjna's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Sanok Rubber Company Spólka Akcyjna shareholders, and that cash payout explains why its total shareholder loss of 62%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

We regret to report that Sanok Rubber Company Spólka Akcyjna shareholders are down 16% for the year. Unfortunately, that's worse than the broader market decline of 4.6%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. However, the loss over the last year isn't as bad as the 10% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. It's always interesting to track share price performance over the longer term. But to understand Sanok Rubber Company Spólka Akcyjna better, we need to consider many other factors. Take risks, for example - Sanok Rubber Company Spólka Akcyjna has 2 warning signs we think you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on PL exchanges.

When trading Sanok Rubber Company Spólka Akcyjna or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About WSE:SNK

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives