3 Reliable Dividend Stocks To Consider With Up To 5.4% Yield

Reviewed by Simply Wall St

In recent weeks, global markets have experienced fluctuations as rising U.S. Treasury yields exert pressure on stocks, with the S&P 500 Index finishing lower after a streak of gains. Amidst this backdrop of cautious economic growth and shifting interest rate expectations, dividend stocks can offer a measure of stability and income for investors seeking reliable returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.12% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.27% | ★★★★★★ |

| Globeride (TSE:7990) | 4.28% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 5.00% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.21% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.20% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.38% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.97% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.89% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.85% | ★★★★★★ |

Click here to see the full list of 2049 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

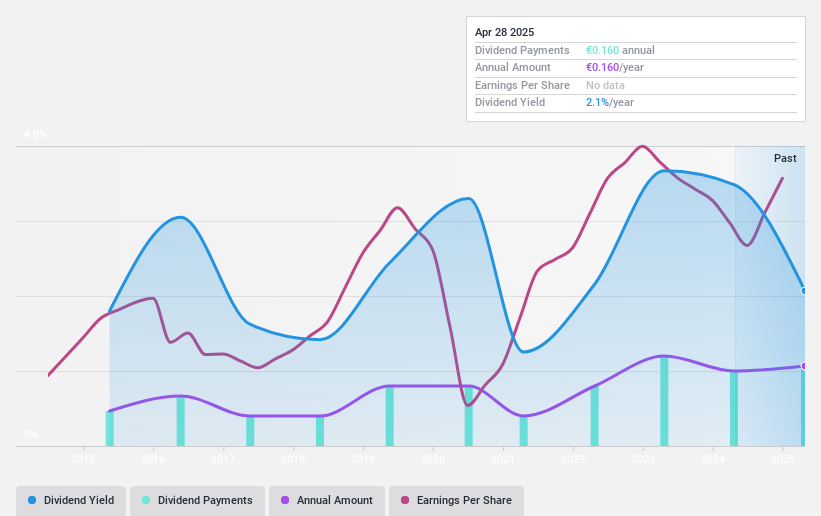

BasicNet (BIT:BAN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BasicNet S.p.A. operates in the sports and casual clothing, footwear, and accessories sectors across Europe, the Americas, Asia, Oceania, the Middle East, and Africa with a market cap of €187.49 million.

Operations: BasicNet S.p.A. generates revenue of €329.53 million from its segments in clothing, footwear, and accessories.

Dividend Yield: 3.9%

BasicNet's dividend payments are well-covered by both earnings and cash flows, with payout ratios of 37.4% and 28.2% respectively, suggesting sustainability despite a volatile track record over the past decade. Recent earnings showed a decline in net income to €2.82 million from €7.43 million, potentially impacting future dividends if this trend continues. Trading below estimated fair value may offer some appeal, but its dividend yield of 3.92% is lower than top-tier Italian market payers.

- Click here and access our complete dividend analysis report to understand the dynamics of BasicNet.

- Our expertly prepared valuation report BasicNet implies its share price may be lower than expected.

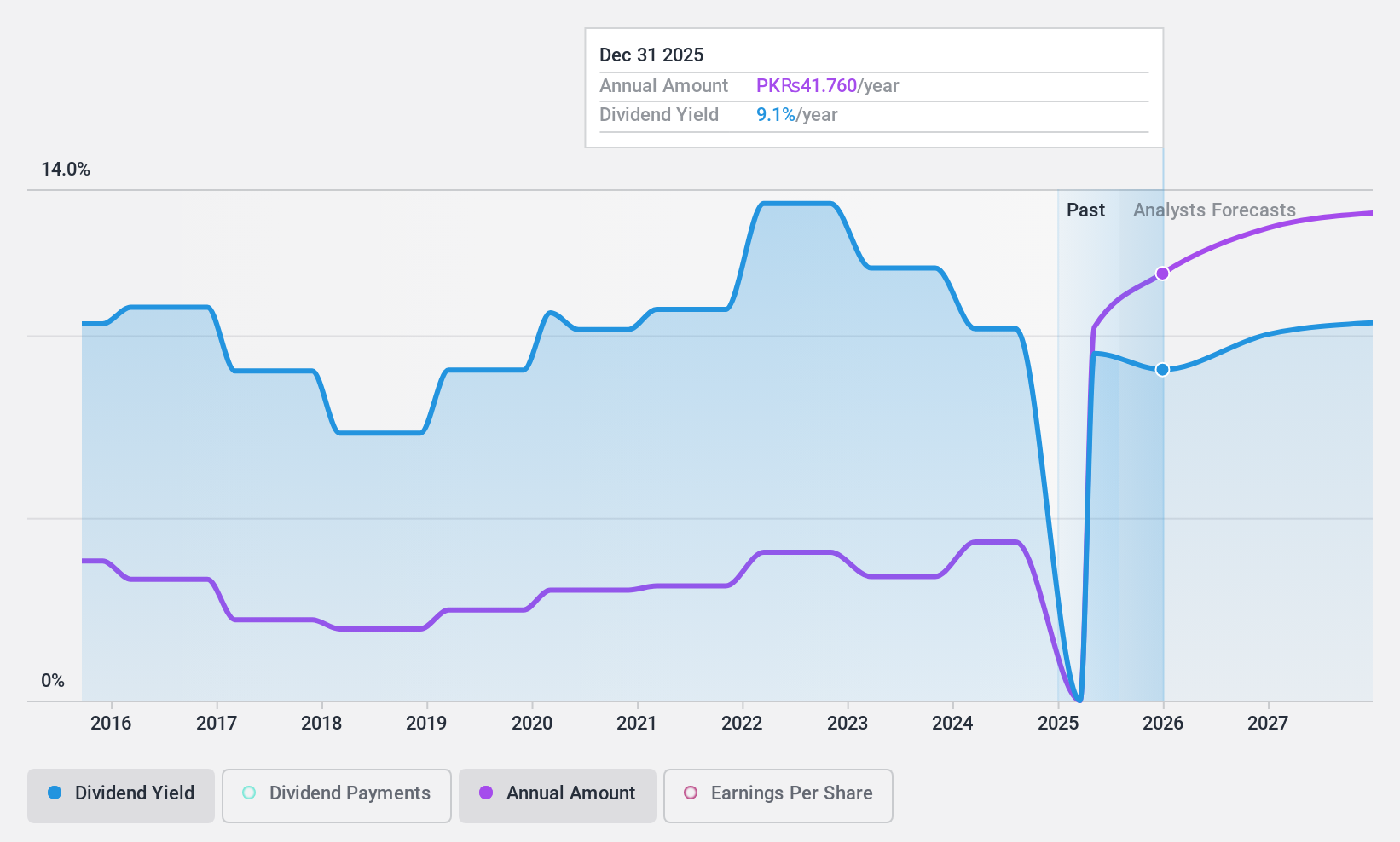

Fauji Fertilizer (KASE:FFC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fauji Fertilizer Company Limited, along with its subsidiaries, is involved in the manufacturing, purchasing, and marketing of fertilizers and chemicals in Pakistan, with a market capitalization of PKR361.90 billion.

Operations: Fauji Fertilizer Company Limited generates revenue from several segments, including Fertilizers (PKR209.10 billion), Power (PKR16.52 billion), Food (PKR5.83 billion), and Technical Services (PKR466.76 million).

Dividend Yield: 5.4%

Fauji Fertilizer's dividend payments have been volatile over the past decade, yet recent financial performance shows a strong increase in earnings, with net income nearly doubling year-over-year. Despite a relatively low dividend yield of 5.45% compared to top-tier payers in Pakistan, the company's dividends are well-covered by both earnings and cash flows, with payout ratios of 47.4% and 29.4%, respectively. The price-to-earnings ratio is favorable at 5.7x against the market average of 7.2x.

- Take a closer look at Fauji Fertilizer's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Fauji Fertilizer is priced higher than what may be justified by its financials.

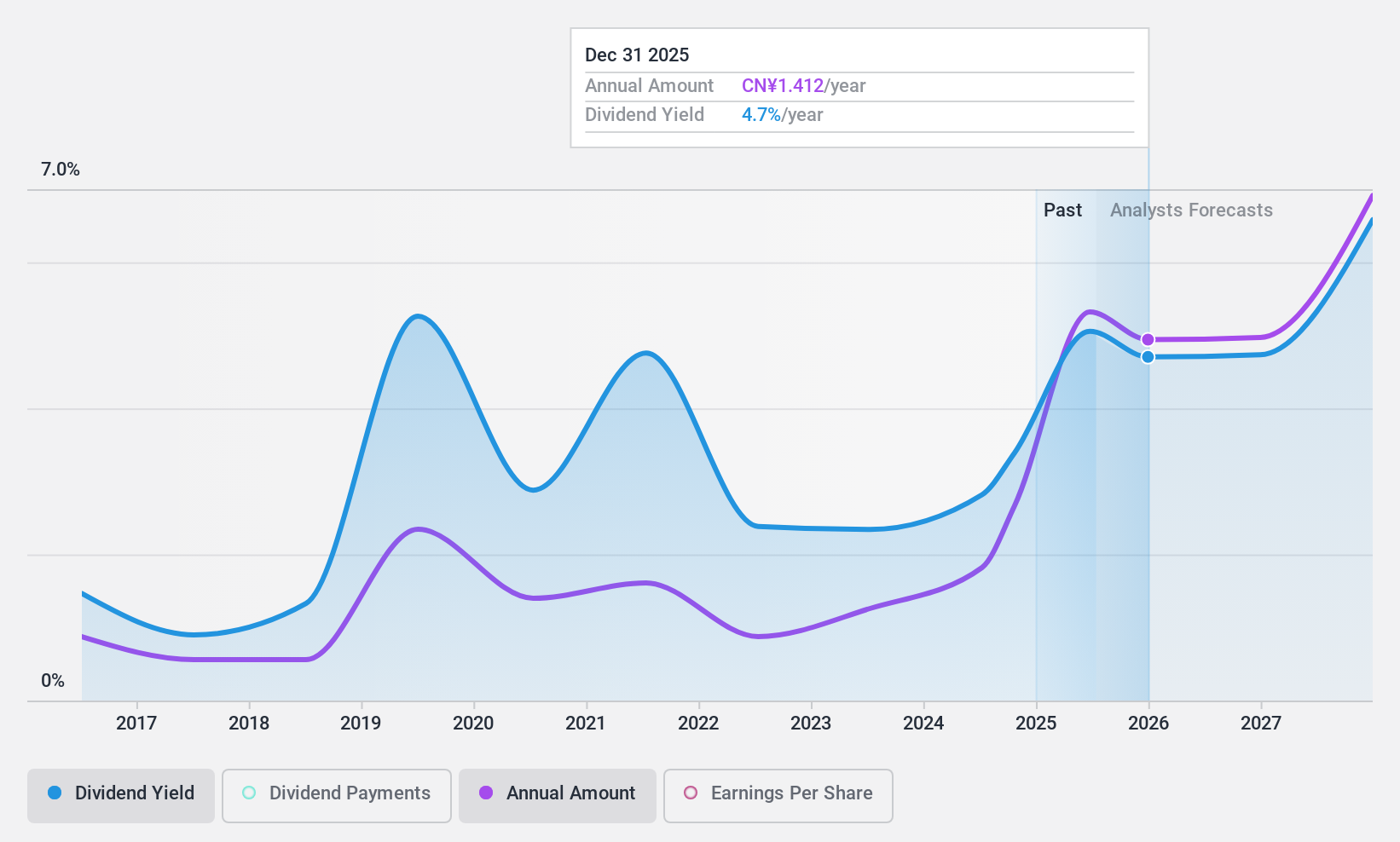

Neway Valve (Suzhou) (SHSE:603699)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Neway Valve (Suzhou) Co., Ltd. engages in the research, development, production, sale, and servicing of industrial valves both in China and internationally, with a market cap of CN¥17.67 billion.

Operations: Neway Valve (Suzhou) Co., Ltd. generates its revenue primarily from the valve industry, amounting to CN¥5.76 billion.

Dividend Yield: 3.1%

Neway Valve (Suzhou) has shown strong earnings growth, with net income reaching CNY 827.84 million for the first nine months of 2024. However, its dividend payments are not well covered by free cash flows due to a high cash payout ratio of 91.2%. Despite this, the dividend yield is among the top in China at 3.07%, though past dividends have been volatile and unreliable over the last decade. The price-to-earnings ratio stands attractively below market average at 19.6x.

- Delve into the full analysis dividend report here for a deeper understanding of Neway Valve (Suzhou).

- Upon reviewing our latest valuation report, Neway Valve (Suzhou)'s share price might be too optimistic.

Seize The Opportunity

- Embark on your investment journey to our 2049 Top Dividend Stocks selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KASE:FFC

Fauji Fertilizer

Manufactures, purchases, and markets fertilizers and chemicals in Pakistan.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives