Global markets have been buoyed by the recent Federal Reserve rate cut, with the S&P 500 and Nasdaq Composite reaching new highs. Despite this optimism, smaller-cap indexes like the Russell 2000 remain below their previous peaks, indicating potential opportunities for discerning investors. In this environment, identifying promising yet overlooked stocks can be particularly rewarding. Here are three undiscovered gems that could enhance your portfolio in these dynamic market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Formula Systems (1985) | 35.62% | 10.91% | 13.89% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MOBI Industry | 28.24% | 6.15% | 18.49% | ★★★★★☆ |

| Terminal X Online | 22.05% | 11.54% | 9.32% | ★★★★★☆ |

| Standard Chartered Bank Kenya | 40.67% | 10.19% | 19.02% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Hellenic Bank (CSE:HB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hellenic Bank Public Company Limited offers a range of banking and financial services and has a market cap of approximately €1.51 billion.

Operations: The bank generates revenue primarily from its Banking & Financial Services segment (€717.98 million) and Insurance Operations (€15.03 million).

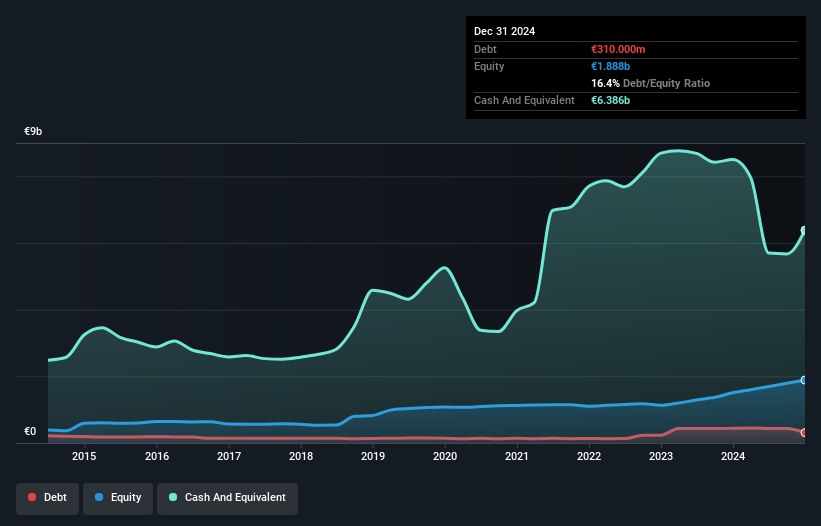

Hellenic Bank, with total assets of €17.5B and equity of €1.7B, has shown impressive earnings growth of 246% over the past year, outpacing the industry’s 12.6%. The bank's price-to-earnings ratio stands at a favorable 3.8x compared to the CY market's 7.2x, indicating good value. Despite high non-performing loans at 6.7%, it primarily relies on low-risk customer deposits for funding (95%). Recent news includes a €100M fixed-income offering and Eurobank’s takeover bid completion, increasing its stake to over 55%.

- Dive into the specifics of Hellenic Bank here with our thorough health report.

Gain insights into Hellenic Bank's past trends and performance with our Past report.

Premier Group (JSE:PMR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Premier Group Limited operates as a consumer-packaged goods company in South Africa and internationally with a market cap of ZAR15.34 billion.

Operations: Premier Group Limited generates revenue primarily from its Millbake segment (ZAR15.53 billion) and Groceries and International segment (ZAR3.06 billion).

Premier Group, a small player in the food industry, has shown promising signs despite some challenges. Trading at 66.8% below its fair value estimate and with revenue growth of 3.6% over the past year, it presents an intriguing investment case. However, its net debt to equity ratio stands at a high 49.2%, indicating significant leverage. Nonetheless, earnings are forecasted to grow annually by 12.91%, and interest payments on debt are well covered by EBIT at 4.4x coverage.

- Navigate through the intricacies of Premier Group with our comprehensive health report here.

Review our historical performance report to gain insights into Premier Group's's past performance.

Meezan Bank (KASE:MEBL)

Simply Wall St Value Rating: ★★★★★★

Overview: Meezan Bank Limited, an Islamic bank in Pakistan, provides corporate, commercial, consumer, investment, and retail banking services with a market cap of PKR423.58 billion.

Operations: Meezan Bank generates revenue primarily from retail banking (PKR455.50 billion), trading and sales (PKR316.07 billion), and corporate and commercial banking (PKR183.81 billion).

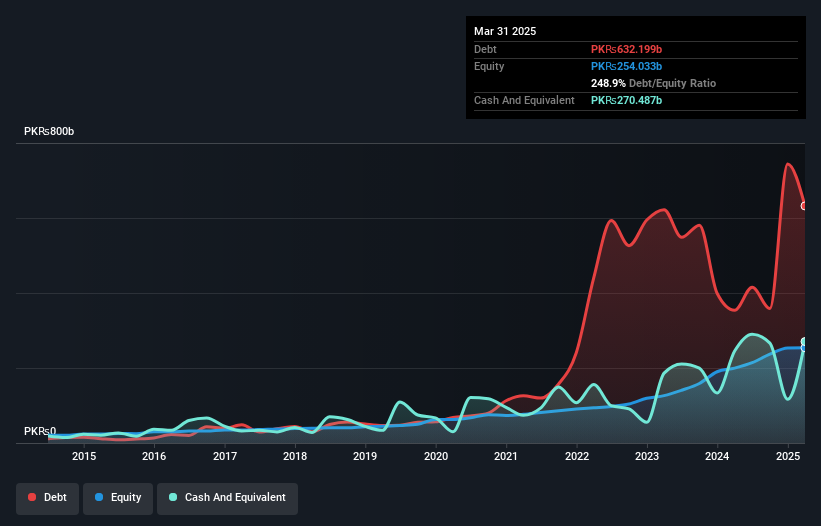

Meezan Bank, with total assets of PKR3,304.4B and equity of PKR214.2B, has shown impressive growth. Their earnings surged by 72.9% last year, outpacing the industry’s 48.7%. The bank's non-performing loans stand at a manageable 1.4%, supported by a sufficient bad loan allowance of 176%. With customer deposits making up 78% of its liabilities and a P/E ratio of just 4x compared to the market’s 6.3x, MEBL seems undervalued yet robust in its financial health.

- Get an in-depth perspective on Meezan Bank's performance by reading our health report here.

Assess Meezan Bank's past performance with our detailed historical performance reports.

Next Steps

- Delve into our full catalog of 4830 Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KASE:MEBL

Meezan Bank

An Islamic bank, engages in the provision of corporate, commercial, consumer, investment, and retail banking services in Pakistan.

Excellent balance sheet and good value.

Market Insights

Community Narratives