- Philippines

- /

- Infrastructure

- /

- PSE:ICT

Global Growth Stocks With Strong Insider Ownership

Reviewed by Simply Wall St

As global markets show resilience with U.S. stock indexes rising on dovish Federal Reserve signals and the potential for rate cuts, investors are increasingly focusing on growth opportunities amid a complex economic backdrop. In such an environment, companies with strong insider ownership often stand out as they suggest confidence from those most familiar with the business's prospects, making them compelling candidates for consideration in a growth-focused portfolio.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Rasan Information Technology (SASE:8313) | 31.1% | 21% |

| Pharma Mar (BME:PHM) | 12% | 41.5% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

Let's take a closer look at a couple of our picks from the screened companies.

Hyosung Heavy Industries (KOSE:A298040)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hyosung Heavy Industries Corporation manufactures and sells heavy electrical equipment in South Korea, with a market cap of ₩17.21 trillion.

Operations: The company's revenue segments consist of Heavy Industry, contributing ₩4.97 billion, and Construction, contributing ₩1.77 billion.

Insider Ownership: 21.5%

Hyosung Heavy Industries demonstrates potential as a growth company with high insider ownership, highlighted by its inclusion in the FTSE All-World Index. Despite recent share price volatility, earnings are forecast to grow significantly at 29.85% annually, outpacing the domestic market's 28.5%. Revenue growth is expected at 11.9%, surpassing the Korean market average of 10.3%. The company's Return on Equity is projected to reach a robust 25.2% in three years, indicating strong future profitability prospects.

- Take a closer look at Hyosung Heavy Industries' potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Hyosung Heavy Industries shares in the market.

International Container Terminal Services (PSE:ICT)

Simply Wall St Growth Rating: ★★★★☆☆

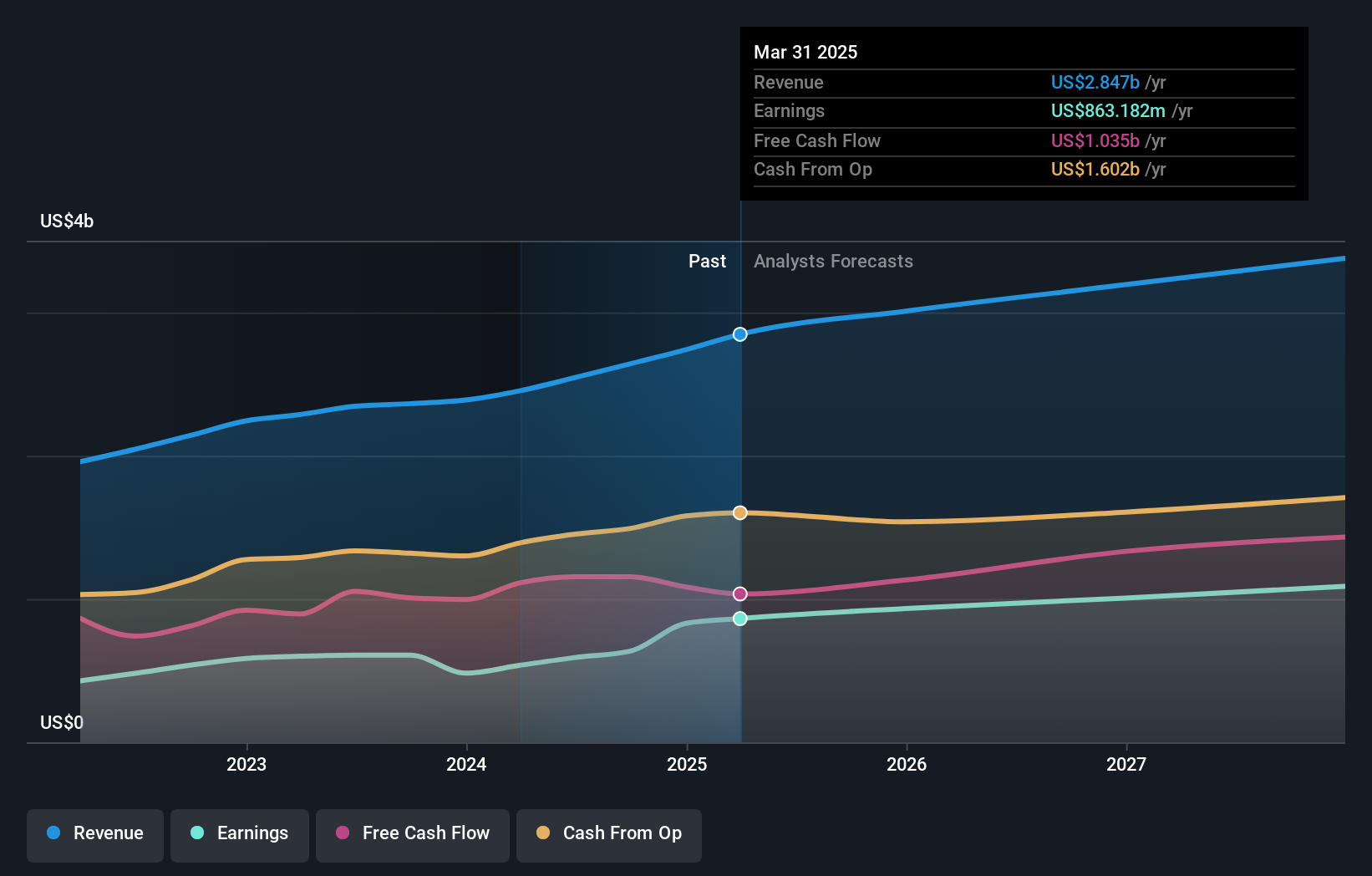

Overview: International Container Terminal Services, Inc. operates and manages container ports and terminals across Asia, Europe, the Middle East, Africa, and the Americas with a market cap of ₱1.11 trillion.

Operations: The company's revenue is primarily derived from Cargo Handling and Related Services, totaling $3.07 billion.

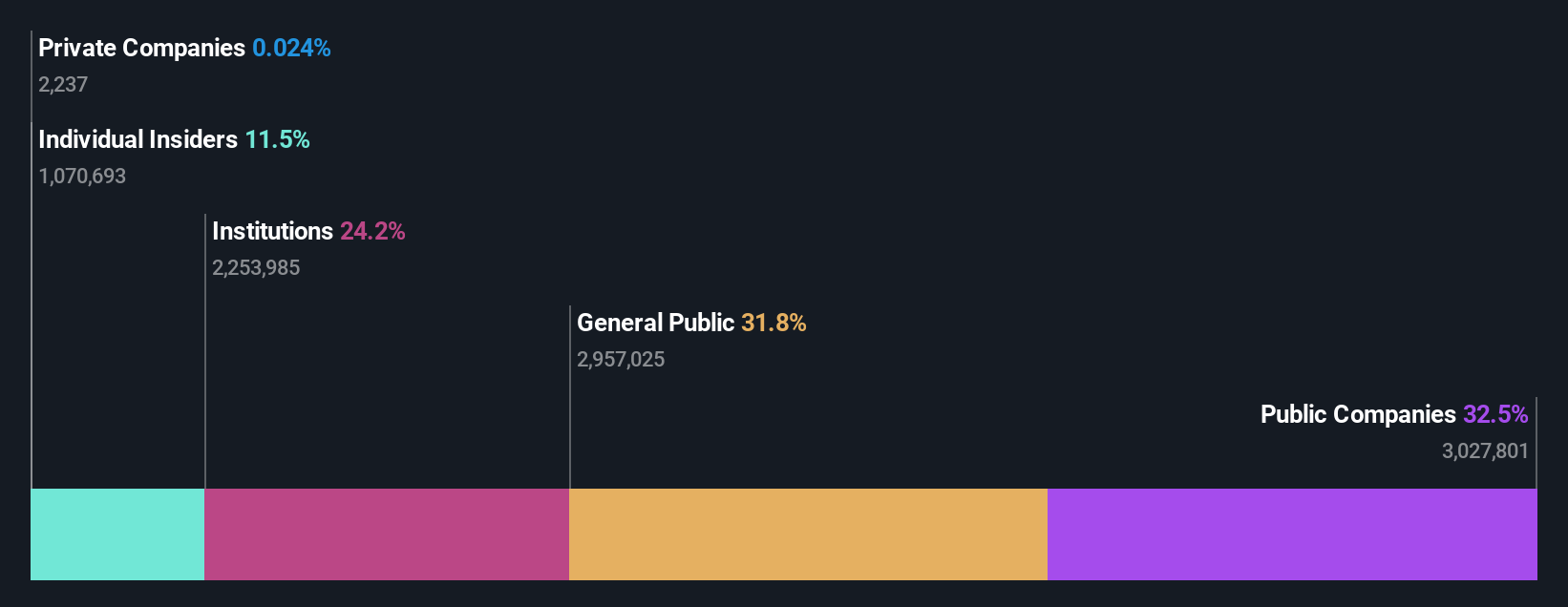

Insider Ownership: 36.8%

International Container Terminal Services shows promise with its high insider ownership and solid financial performance. Recent earnings reveal a revenue increase to US$850.19 million in Q3 2025, up from US$715.36 million the previous year, and net income rising to US$267.72 million. Despite high debt levels, ICT's earnings are forecasted to grow at 10.8% annually, slightly above the Philippine market average of 10.7%. The stock trades below estimated fair value by 40.9%, suggesting potential investment appeal despite modest insider trading activity recently.

- Click here and access our complete growth analysis report to understand the dynamics of International Container Terminal Services.

- Our valuation report here indicates International Container Terminal Services may be overvalued.

Zhejiang XCC GroupLtd (SHSE:603667)

Simply Wall St Growth Rating: ★★★★☆☆

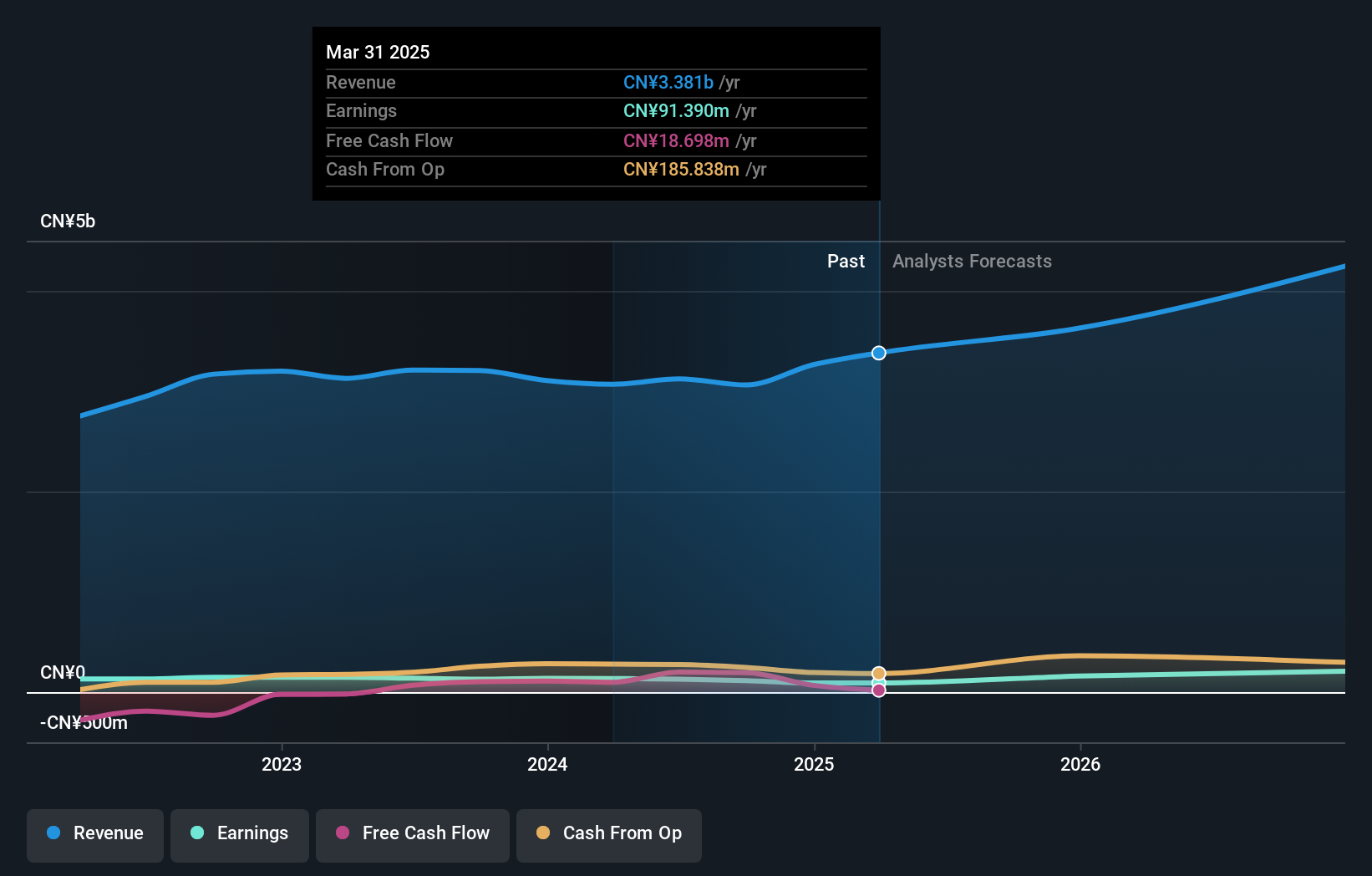

Overview: Zhejiang XCC Group Co., Ltd is involved in the research, development, manufacture, and sale of bearings across various international markets including the United States, Japan, Korea, and Brazil, with a market cap of CN¥16.81 billion.

Operations: The company generates revenue primarily through the research, development, manufacture, and sale of bearings in international markets such as the United States, Japan, Korea, and Brazil.

Insider Ownership: 30.2%

Zhejiang XCC Group Ltd demonstrates potential with its significant insider ownership and expected robust earnings growth of 52.36% annually, outpacing the Chinese market average. Although recent results show stable net income at CNY 98.48 million for the first nine months of 2025, revenue increased to CNY 2.66 billion from CNY 2.47 billion a year ago. The company's share price has been highly volatile recently, and financial results are affected by large one-off items, highlighting both opportunities and risks for investors.

- Dive into the specifics of Zhejiang XCC GroupLtd here with our thorough growth forecast report.

- According our valuation report, there's an indication that Zhejiang XCC GroupLtd's share price might be on the expensive side.

Where To Now?

- Reveal the 858 hidden gems among our Fast Growing Global Companies With High Insider Ownership screener with a single click here.

- Contemplating Other Strategies? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:ICT

International Container Terminal Services

Acquires, develops, manages, and operates container ports and terminals for container shipping industry in Asia, Europe, the Middle East, Africa, and the Americas.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026