3 Global Stocks Estimated To Be Trading At Discounts Of 34.7% To 47.8%

Reviewed by Simply Wall St

As global markets navigate a landscape marked by dovish Federal Reserve comments, subdued inflation in the eurozone, and resilient economic indicators in Japan, investors are increasingly focused on identifying opportunities amid these shifting conditions. In this context, undervalued stocks can offer potential value by trading at prices below their estimated worth, making them attractive options for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥81.57 | CN¥162.42 | 49.8% |

| Stellantis (BIT:STLAM) | €10.184 | €20.10 | 49.3% |

| Roche Bobois (ENXTPA:RBO) | €35.00 | €68.97 | 49.3% |

| Ningxia Building Materials GroupLtd (SHSE:600449) | CN¥13.05 | CN¥26.03 | 49.9% |

| Micro Systemation (OM:MSAB B) | SEK64.40 | SEK126.75 | 49.2% |

| KIYO LearningLtd (TSE:7353) | ¥695.00 | ¥1382.72 | 49.7% |

| KB Components (OM:KBC) | SEK42.00 | SEK83.11 | 49.5% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.39 | €0.77 | 49.5% |

| Allcore (BIT:CORE) | €1.34 | €2.65 | 49.5% |

| ALEC Holdings PJSC (DFM:ALEC) | AED1.40 | AED2.79 | 49.8% |

We'll examine a selection from our screener results.

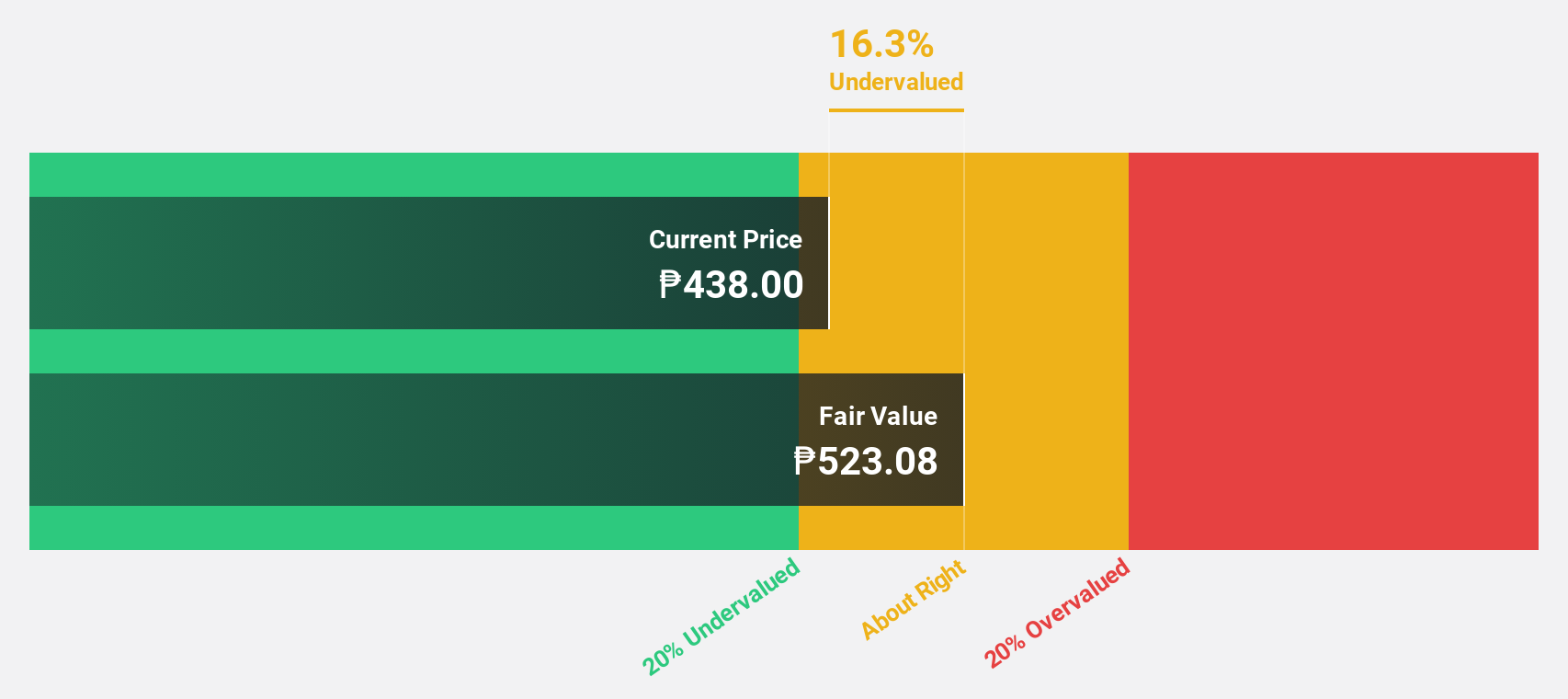

International Container Terminal Services (PSE:ICT)

Overview: International Container Terminal Services, Inc. operates and manages container ports and terminals across Asia, Europe, the Middle East, Africa, and the Americas with a market cap of ₱1.11 trillion.

Operations: The company generates revenue primarily from Cargo Handling and Related Services, amounting to $3.07 billion.

Estimated Discount To Fair Value: 40.9%

International Container Terminal Services is trading at 40.9% below its estimated fair value of ₱993.59, with a current price of ₱587. Despite high debt levels, the company shows strong cash flow potential, as evidenced by recent earnings growth and revenue increases to US$850.19 million in Q3 2025 from US$715.36 million a year ago. Revenue growth is forecasted to outpace the Philippine market, supporting its undervaluation based on discounted cash flow analysis.

- The growth report we've compiled suggests that International Container Terminal Services' future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in International Container Terminal Services' balance sheet health report.

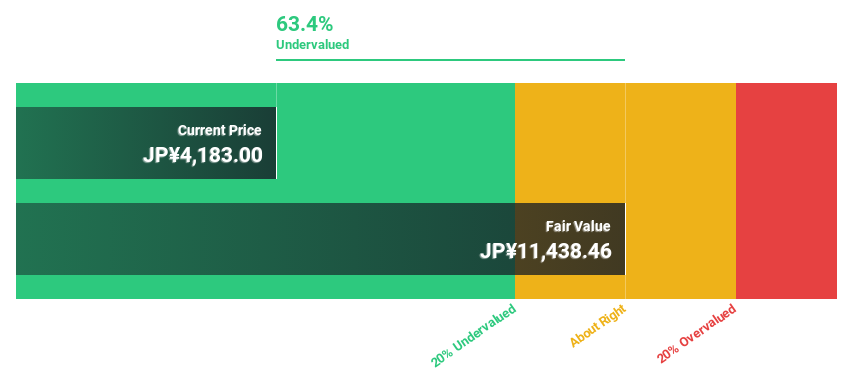

IbidenLtd (TSE:4062)

Overview: Ibiden Co., Ltd. and its subsidiaries manufacture and sell electronic and ceramics products across Japan, Asia, North America, and internationally, with a market cap of ¥1.66 trillion.

Operations: The company's revenue is primarily derived from its Electronics segment, which accounts for ¥212.54 billion, and its Ceramics segment, contributing ¥80.77 billion.

Estimated Discount To Fair Value: 47.8%

Ibiden Ltd. trades at ¥12,705, significantly below its estimated fair value of ¥24,359.49, highlighting its potential undervaluation based on cash flows. Earnings are expected to grow substantially at 22.82% annually over the next three years, outpacing the Japanese market's growth rate of 8.3%. Recent inclusion in the Nikkei 225 Index and a shift to progressive dividends further enhance its investment appeal despite recent share price volatility and low forecasted return on equity.

- In light of our recent growth report, it seems possible that IbidenLtd's financial performance will exceed current levels.

- Click here to discover the nuances of IbidenLtd with our detailed financial health report.

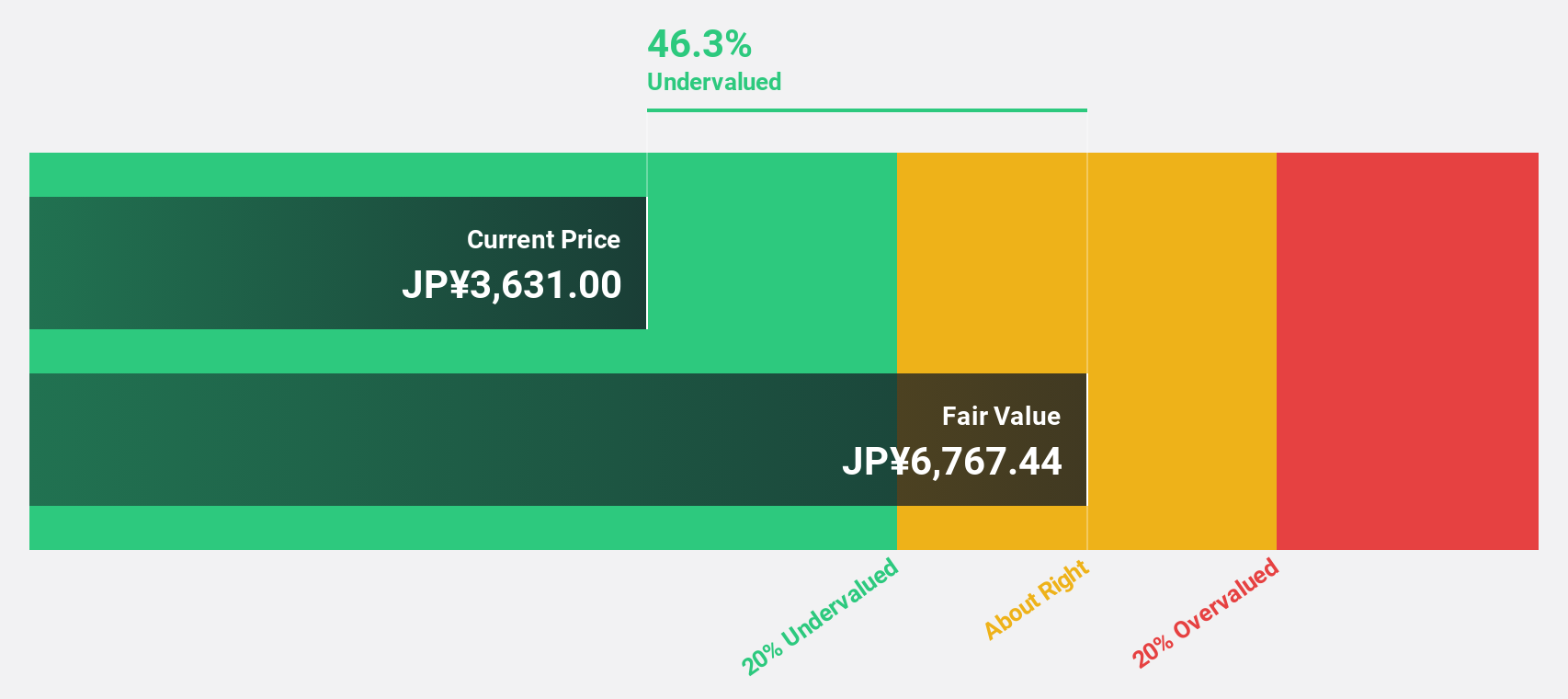

Sumitomo Mitsui Financial Group (TSE:8316)

Overview: Sumitomo Mitsui Financial Group, Inc., with a market cap of ¥18.81 trillion, operates globally offering banking, leasing, securities, consumer finance, and other financial services.

Operations: Revenue Segments (in millions of ¥): Banking ¥2,500,000; Leasing ¥1,200,000; Securities ¥800,000; Consumer Finance ¥600,000.

Estimated Discount To Fair Value: 34.7%

Sumitomo Mitsui Financial Group is trading at ¥4,931, significantly below its estimated fair value of ¥7,550.66, suggesting undervaluation based on cash flows. The company's earnings are projected to grow 16.42% annually, surpassing the Japanese market's average growth rate of 8.3%. Despite a recent dividend cut and low return on equity forecasted at 10.7%, revenue growth is expected to outpace the market significantly at 27.2% per year.

- Our growth report here indicates Sumitomo Mitsui Financial Group may be poised for an improving outlook.

- Get an in-depth perspective on Sumitomo Mitsui Financial Group's balance sheet by reading our health report here.

Turning Ideas Into Actions

- Click this link to deep-dive into the 508 companies within our Undervalued Global Stocks Based On Cash Flows screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8316

Sumitomo Mitsui Financial Group

Provides banking, leasing, securities, consumer finance, and other services in Japan, the Americas, Europe, the Middle East, Asia, and Oceania.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026