Global markets have been experiencing a challenging period, with U.S. stocks facing losses due to inflation concerns and trade policy uncertainties. For investors exploring beyond well-known names, penny stocks—typically representing smaller or newer companies—can present intriguing opportunities despite their somewhat outdated moniker. This article will explore three such global penny stocks that exhibit strong financial foundations, offering potential value and stability amidst current market conditions.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.36 | SGD9.32B | ✅ 5 ⚠️ 0 View Analysis > |

| NEXG Berhad (KLSE:DSONIC) | MYR0.26 | MYR723.36M | ✅ 4 ⚠️ 2 View Analysis > |

| Cloudpoint Technology Berhad (KLSE:CLOUDPT) | MYR0.81 | MYR430.6M | ✅ 3 ⚠️ 2 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.495 | MYR2.46B | ✅ 5 ⚠️ 0 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.01 | HK$47.34B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.29 | HK$818.88M | ✅ 4 ⚠️ 1 View Analysis > |

| Next 15 Group (AIM:NFG) | £3.065 | £304.83M | ✅ 4 ⚠️ 5 View Analysis > |

| Warpaint London (AIM:W7L) | £3.80 | £306.99M | ✅ 5 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.69 | £419.72M | ✅ 4 ⚠️ 1 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £3.792 | £2.1B | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 5,696 stocks from our Global Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Atlas Consolidated Mining and Development (PSE:AT)

Simply Wall St Financial Health Rating: ★★★★☆☆

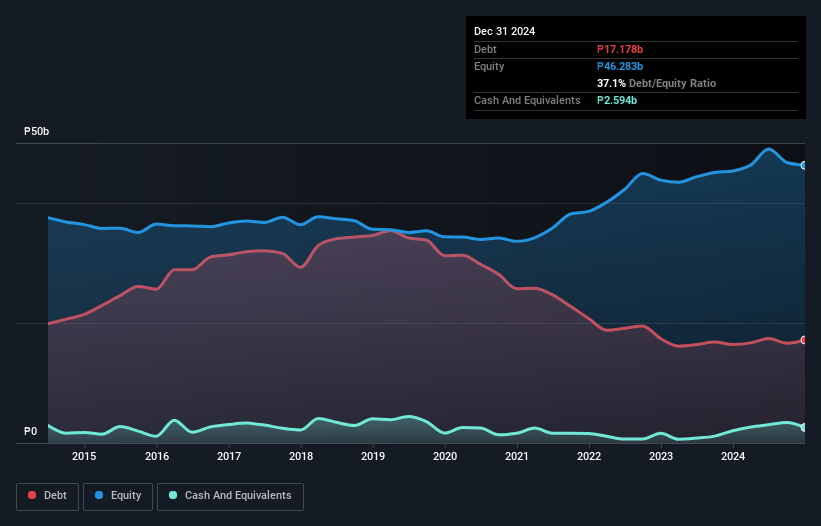

Overview: Atlas Consolidated Mining and Development Corporation, with a market cap of ₱15.72 billion, operates through its subsidiaries in the exploration and mining of metallic mineral properties in the Philippines.

Operations: The company generates revenue of ₱19.65 billion from its operations in the Philippines.

Market Cap: ₱15.72B

Atlas Consolidated Mining and Development Corporation, trading at 17% below its estimated fair value, has shown improved profitability with net profit margins increasing from 6% to 7%. The company's earnings growth of 33% over the past year surpasses the industry average and its own five-year average. Despite strong earnings growth, short-term assets of ₱5.1 billion do not cover short-term liabilities of ₱6.4 billion or long-term liabilities of ₱16.7 billion. Recent board decisions include amending articles to incorporate leasing as a revenue source and dissolving non-operational subsidiaries, indicating strategic shifts for future operations.

- Click here and access our complete financial health analysis report to understand the dynamics of Atlas Consolidated Mining and Development.

- Learn about Atlas Consolidated Mining and Development's historical performance here.

Lepu Biopharma (SEHK:2157)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lepu Biopharma Co., Ltd. is a biopharmaceutical company engaged in the discovery, development, and commercialization of cancer targeted therapy and immunotherapy drugs in China and internationally, with a market cap of approximately HK$5.99 billion.

Operations: The company generates revenue of CN¥205.08 million from the sales of pharmaceutical products and the research and development of new drugs.

Market Cap: HK$5.99B

Lepu Biopharma Co., Ltd. is navigating the complexities of the biotech sector with a focus on cancer therapies, highlighted by its recent strategic moves. The company has entered an exclusive licensing agreement with ArriVent BioPharma for MRG007, potentially yielding up to $1.16 billion in milestone payments and royalties outside Greater China. Despite being unprofitable, Lepu's cash runway exceeds a year, supported by CN¥744.1 million in short-term assets covering long-term liabilities of CN¥553.2 million but not its short-term liabilities of CN¥985.8 million. Recent NDA resubmission for MRG003 shows commitment to advancing its drug pipeline amid regulatory challenges.

- Unlock comprehensive insights into our analysis of Lepu Biopharma stock in this financial health report.

- Review our historical performance report to gain insights into Lepu Biopharma's track record.

Qinghai Huading Industrial (SHSE:600243)

Simply Wall St Financial Health Rating: ★★★★★★

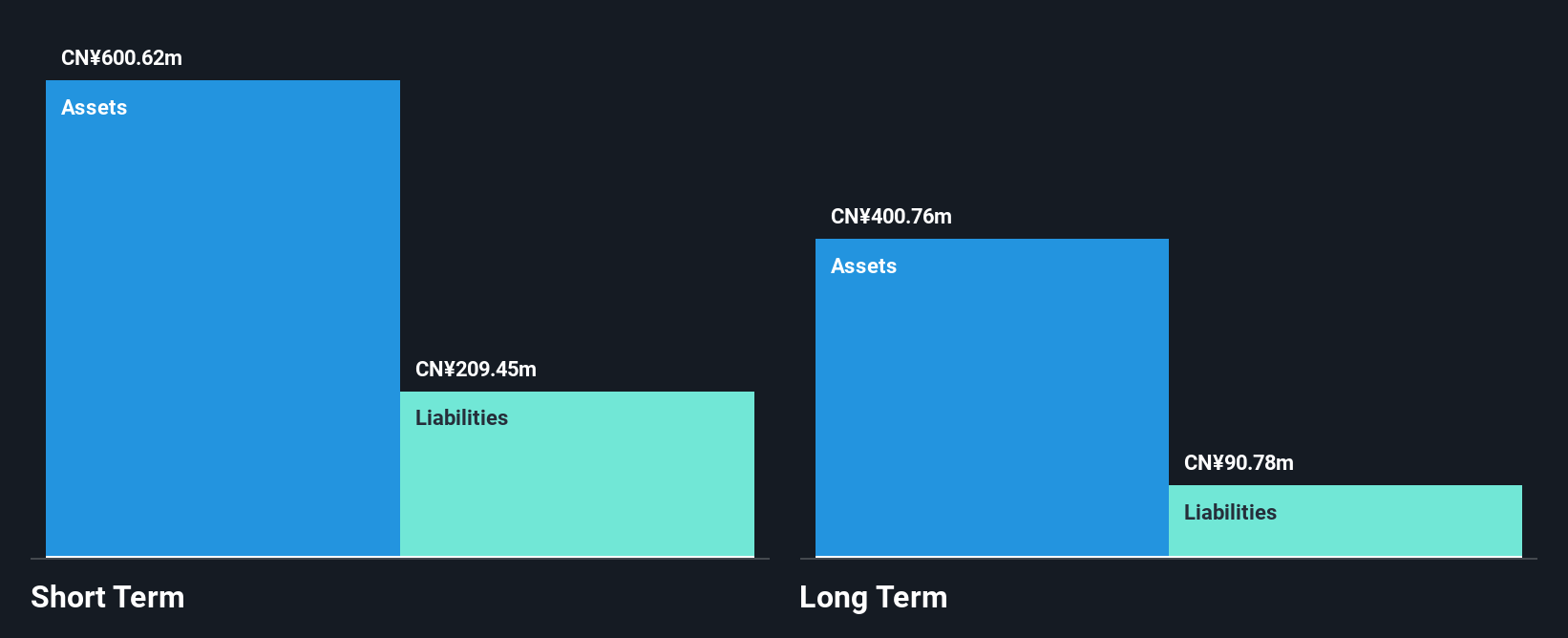

Overview: Qinghai Huading Industrial Co., Ltd. focuses on the research and development, production, and sale of CNC machine tools and elevator accessories in China, with a market cap of CN¥1.44 billion.

Operations: The company's revenue from China amounts to CN¥269.85 million.

Market Cap: CN¥1.44B

Qinghai Huading Industrial Co., Ltd. operates within the CNC machine tools and elevator accessories market in China, with a market cap of CN¥1.44 billion and revenue of CN¥269.85 million. Despite being unprofitable, the company has reduced its debt to equity ratio significantly over five years from 25.7% to 8.6%, indicating improved financial management. Its short-term assets of CN¥552.9 million comfortably cover both short-term liabilities (CN¥165.5 million) and long-term liabilities (CN¥66.8 million). While its share price remains highly volatile, Qinghai Huading's cash reserves exceed total debt, providing a stable financial runway for future operations amidst current challenges like negative return on equity (-21.92%).

- Navigate through the intricacies of Qinghai Huading Industrial with our comprehensive balance sheet health report here.

- Gain insights into Qinghai Huading Industrial's historical outcomes by reviewing our past performance report.

Where To Now?

- Explore the 5,696 names from our Global Penny Stocks screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qinghai Huading Industrial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600243

Qinghai Huading Industrial

Engages in the research and development, production, and sale of CNC machine tools, gear boxes, and elevator accessories in China.

Flawless balance sheet with minimal risk.

Market Insights

Community Narratives