- Philippines

- /

- Hospitality

- /

- PSE:PLUS

DigiPlus Interactive (PSE:PLUS) Expands Into Brazil's US$5 Billion iGaming Market

Reviewed by Simply Wall St

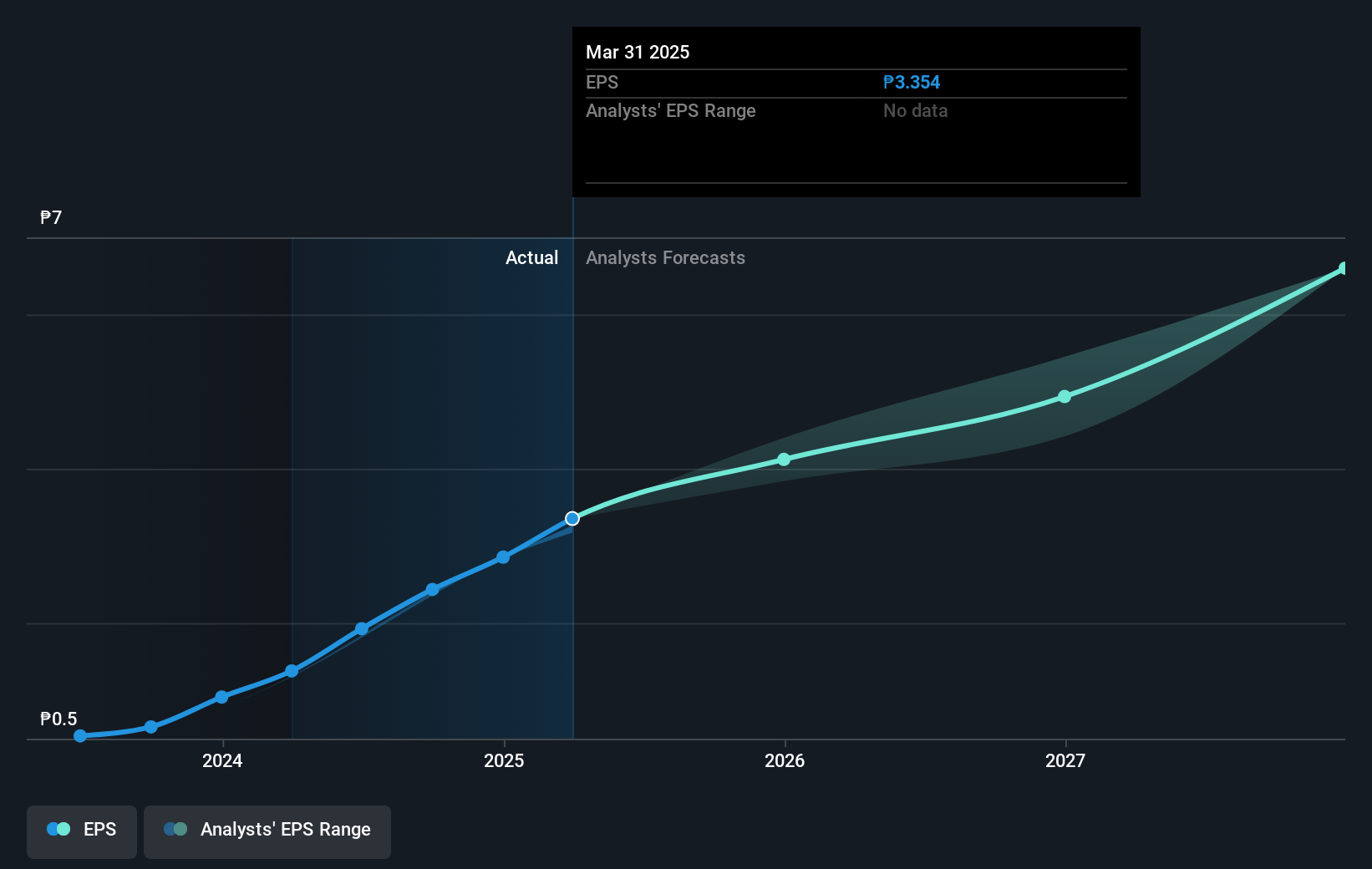

DigiPlus Interactive (PSE:PLUS) is poised to broaden its horizons with the announcement of its upcoming launch in Brazil by September 2025, targeting a gaming market estimated at USD 4.6 billion. This move, alongside DigiPlus Global Pte. Ltd.'s incorporation in Singapore for strengthening operations, highlights the company's commitment to global expansion. These developments join robust Q1 2025 earnings results, a new CEO, and a strategic focus on tech-driven offerings. During a period when market indices like the S&P 500 and Nasdaq experienced minor fluctuations, DigiPlus' impressive 26% rise suggests investor confidence in its expansion initiatives.

Over the past three years, DigiPlus Interactive Corp. experienced a very large total shareholder return of 3336.70%. In the shorter term, over the past year, DigiPlus has outperformed the broader Philippine market, which returned 8.9%, and the PH Hospitality industry, which saw a return of 21.4%. This signals robust investor confidence amidst its aggressive global expansion initiatives, which include entering the Brazilian market and fortifying operations in Singapore.

With the introduction of a new CEO and a focus on technological advancements, DigiPlus is positioned to potentially enhance its revenue and earnings forecasts. This strategic direction, combined with previously announced revenue growth and higher net profit margins, underscores optimistic growth expectations for the company. Despite these promising developments, its current share price, while impressive, trades at a 25% discount relative to the consensus analyst price target of PHP 78.77. This suggests that there may still be perceived value in the company's stock despite its recent performance, though the extent of analyst coverage may affect confidence levels in this target.

Evaluate DigiPlus Interactive's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:PLUS

DigiPlus Interactive

Through its subsidiaries, operates as a digital entertainment company in the Philippines.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives