- United States

- /

- Semiconductors

- /

- NasdaqGS:MXL

Exploring 3 Undervalued Small Caps With Insider Action In None Region

Reviewed by Simply Wall St

In recent weeks, global markets have experienced significant volatility, with geopolitical tensions in the Middle East and unexpected job gains in the U.S. creating a complex backdrop for investors. Amidst these fluctuations, small-cap indices like the Russell 2000 have faced challenges, reflecting broader market sentiment and economic indicators that impact smaller companies uniquely. In such an environment, identifying stocks that exhibit strong fundamentals and potential for growth can be particularly appealing to investors seeking opportunities within the small-cap sector.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Nexus Industrial REIT | 3.6x | 3.6x | 23.33% | ★★★★★☆ |

| Citizens & Northern | 12.6x | 2.8x | 44.87% | ★★★★☆☆ |

| Rogers Sugar | 15.5x | 0.6x | 47.90% | ★★★★☆☆ |

| Sagicor Financial | 1.3x | 0.3x | -42.98% | ★★★★☆☆ |

| CVS Group | 28.9x | 1.2x | 37.42% | ★★★★☆☆ |

| Genus | 171.0x | 2.0x | -2.10% | ★★★★☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Orion Group Holdings | NA | 0.3x | -119.01% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -197.13% | ★★★☆☆☆ |

| National Vision Holdings | NA | 0.4x | -35.25% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

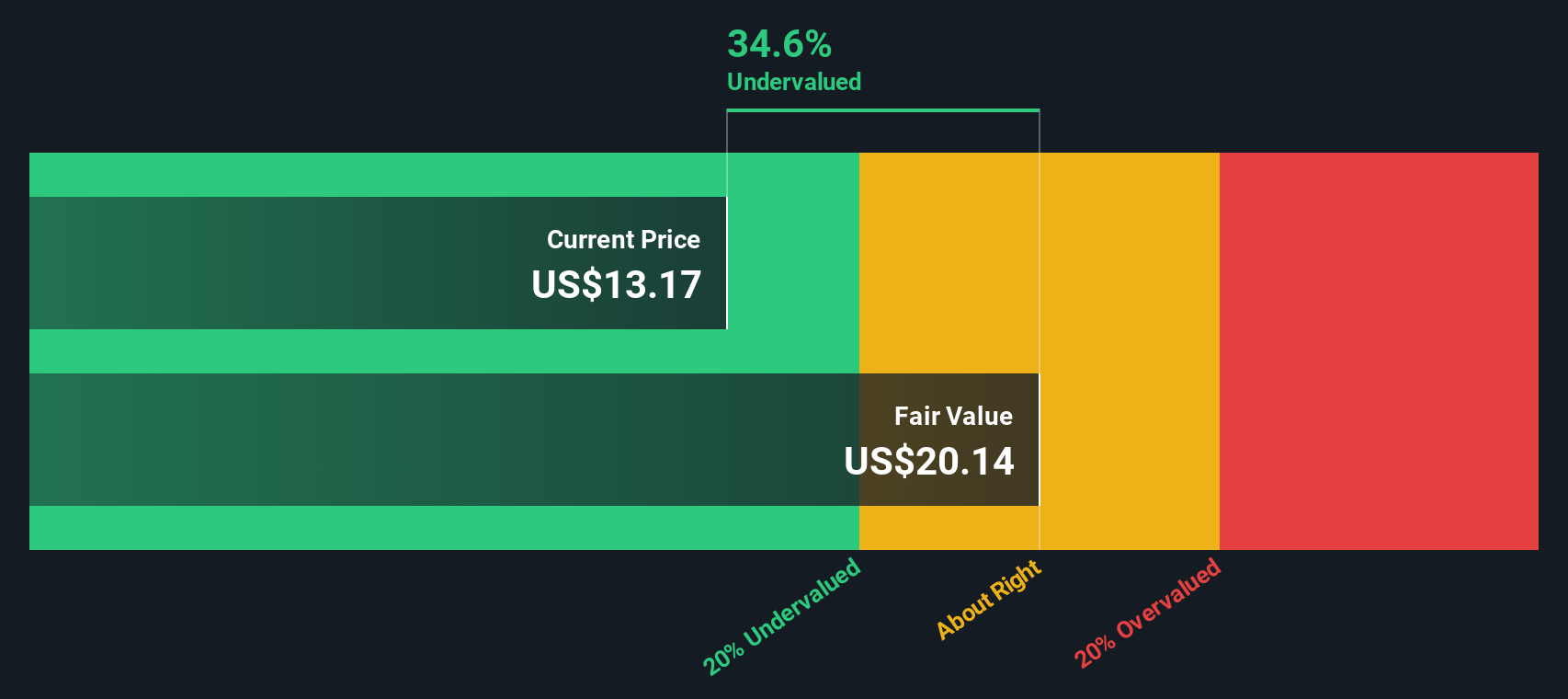

MaxLinear (NasdaqGS:MXL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: MaxLinear is a company specializing in semiconductor solutions, with a focus on broadband communications and connectivity technologies, and has a market capitalization of approximately $2.50 billion.

Operations: MaxLinear generates its revenue primarily from the semiconductor segment, with recent quarterly revenue at $448.14 million. The company's cost of goods sold (COGS) was $206.21 million, leading to a gross profit margin of 53.99%. Operating expenses are significant, driven by research and development costs totaling $252.86 million in the latest quarter, contributing to a net income margin of -42.38%.

PE: -6.0x

MaxLinear, a company in the semiconductor sector, is navigating challenges with its innovative MaxAI framework, aimed at enhancing user experience and reducing costs for service providers. Despite recent financial setbacks, including a net loss of US$39 million in Q2 2024 and declining revenue expectations for Q3 2024, insider confidence is evident as their CEO purchased over 108,000 shares valued at approximately US$1.4 million. This purchase suggests belief in the company's potential amidst its strategic advancements like Panther III storage solutions that promise significant cost efficiencies.

- Click to explore a detailed breakdown of our findings in MaxLinear's valuation report.

Explore historical data to track MaxLinear's performance over time in our Past section.

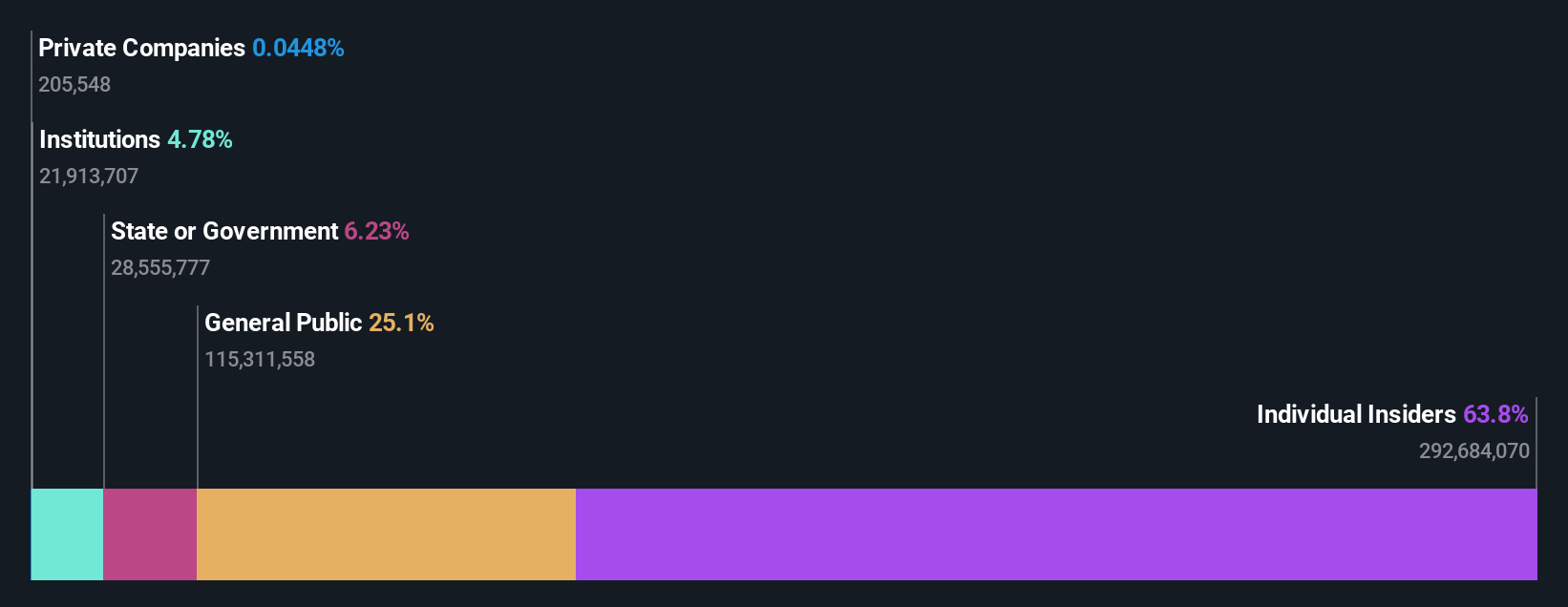

Gujarat Ambuja Exports (NSEI:GAEL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Gujarat Ambuja Exports operates in the agro-processing industry with divisions in agro products, spinning, renewable power, and maize processing, and has a market capitalization of ₹90.18 billion.

Operations: The company generates revenue primarily from its maize processing division, which contributes significantly to its overall earnings. The gross profit margin has shown variability over time, with a recent figure of 27.68%. Operating expenses are substantial and include costs such as depreciation and administrative expenses.

PE: 18.6x

Gujarat Ambuja Exports, a smaller company in the industry, has shown signs of being undervalued. Despite relying entirely on external borrowing for funding, which carries higher risk, the company is poised for a projected annual earnings growth of 15.93%. Insider confidence is evident as Sandeep Agrawal increased their shareholding by 7% with a transaction valued at ₹389,235. Recent financials revealed net income growth to ₹767 million from ₹709 million year-over-year. Additionally, they declared a final dividend of ₹0.35 per share for fiscal 2023-24 at their August AGM.

- Delve into the full analysis valuation report here for a deeper understanding of Gujarat Ambuja Exports.

Understand Gujarat Ambuja Exports' track record by examining our Past report.

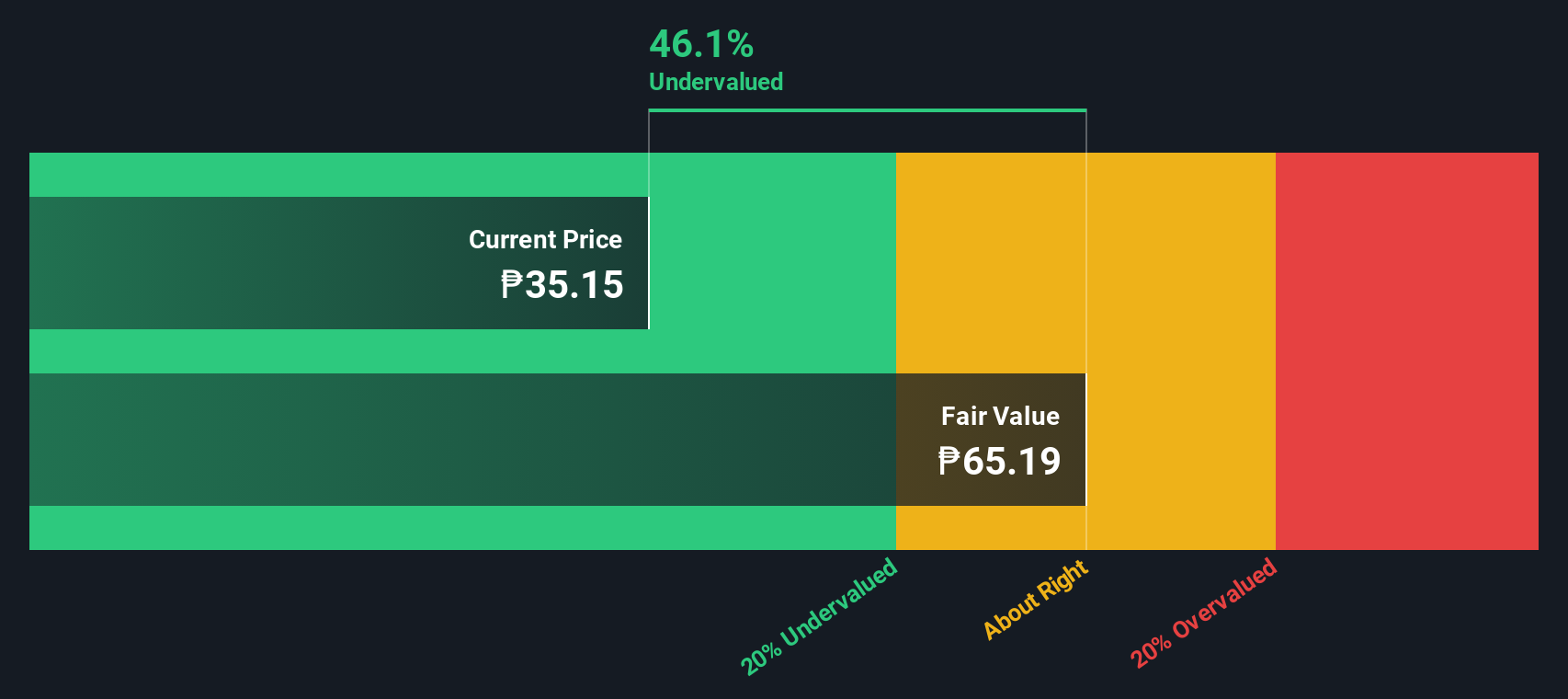

Puregold Price Club (PSE:PGOLD)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Puregold Price Club operates a retailing business with a focus on supermarket chains, and it has a market capitalization of ₱88.56 billion.

Operations: The company generates revenue primarily from its retailing business, with a recent figure of ₱206.30 billion. The cost of goods sold (COGS) for the same period was ₱170.21 billion, resulting in a gross profit margin of 17.49%. Operating expenses include significant allocations to general and administrative costs, depreciation and amortization, and non-operating expenses. Net income for the latest period stood at ₱9.14 billion, reflecting a net income margin of 4.43%.

PE: 10.3x

Puregold Price Club, a smaller company in its sector, recently reported half-year sales of PHP 98.5 billion and net income of PHP 4.9 billion, showing growth from the previous year. Despite relying solely on external borrowing for funding, which carries more risk than customer deposits, earnings are projected to increase by 11% annually. Insider confidence is evident as insiders have been purchasing shares throughout the year. With these factors in mind, Puregold's future appears promising amidst its current market valuation challenges.

- Navigate through the intricacies of Puregold Price Club with our comprehensive valuation report here.

Assess Puregold Price Club's past performance with our detailed historical performance reports.

Next Steps

- Embark on your investment journey to our 188 Undervalued Small Caps With Insider Buying selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MXL

Excellent balance sheet with reasonable growth potential.