- Australia

- /

- Specialized REITs

- /

- ASX:ARF

3 Undervalued Small Caps With Insider Action In The Asian Market

Reviewed by Simply Wall St

As the Asian markets respond to the recent de-escalation in U.S.-China trade tensions, investor sentiment has been buoyed, with key indices such as China's CSI 300 and Hong Kong's Hang Seng Index experiencing gains. Amid this backdrop, small-cap stocks in Asia are garnering attention for their potential value, particularly those that exhibit strong fundamentals and have seen insider activity, suggesting confidence from within the companies themselves.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.4x | 1.0x | 40.11% | ★★★★★★ |

| Puregold Price Club | 8.4x | 0.4x | 24.43% | ★★★★★☆ |

| East West Banking | 3.1x | 0.7x | 36.02% | ★★★★★☆ |

| Hansen Technologies | 292.9x | 2.8x | 22.39% | ★★★★★☆ |

| Viva Energy Group | NA | 0.1x | 46.54% | ★★★★★☆ |

| Dicker Data | 19.7x | 0.7x | -40.24% | ★★★★☆☆ |

| Atturra | 31.8x | 1.3x | 29.71% | ★★★★☆☆ |

| Sing Investments & Finance | 7.2x | 3.7x | 41.23% | ★★★★☆☆ |

| Smart Parking | 74.9x | 6.6x | 44.55% | ★★★☆☆☆ |

| Charter Hall Long WALE REIT | NA | 11.7x | 21.46% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

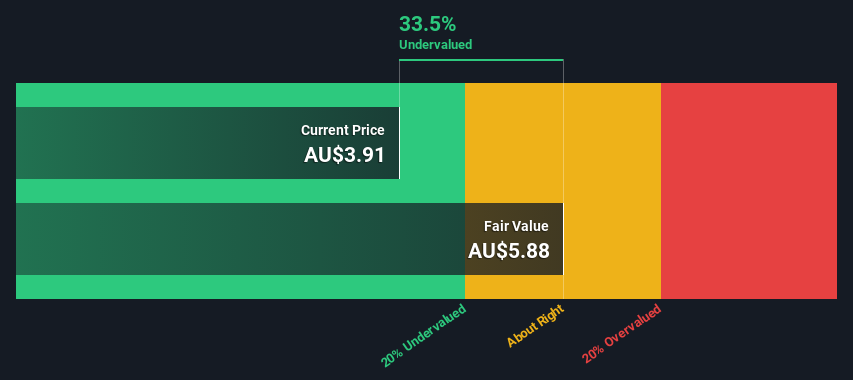

Arena REIT (ASX:ARF)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Arena REIT is an Australian real estate investment trust focusing on investing in social infrastructure properties, with a market cap of A$1.55 billion.

Operations: The primary revenue stream is derived from its investment in real estate, with the latest reported revenue at A$102.45 million. The cost of goods sold (COGS) was A$8.37 million, resulting in a gross profit of A$94.09 million and a gross profit margin of 91.83%. Operating expenses were minimal at A$0.64 million, while non-operating expenses amounted to A$19.06 million, contributing to a net income of A$74.38 million with a net income margin of 72.60%.

PE: 20.7x

Arena REIT, a smaller player in Asia's investment landscape, has caught attention due to its perceived undervaluation. Recent insider confidence is evident with share purchases over the past year. The company announced a quarterly dividend of A$0.046 per stapled security for March 2025, signaling stable cash flow management. Despite relying solely on external borrowing, Arena's earnings are projected to grow by 8% annually, suggesting potential for future growth amidst its riskier funding profile.

- Navigate through the intricacies of Arena REIT with our comprehensive valuation report here.

Explore historical data to track Arena REIT's performance over time in our Past section.

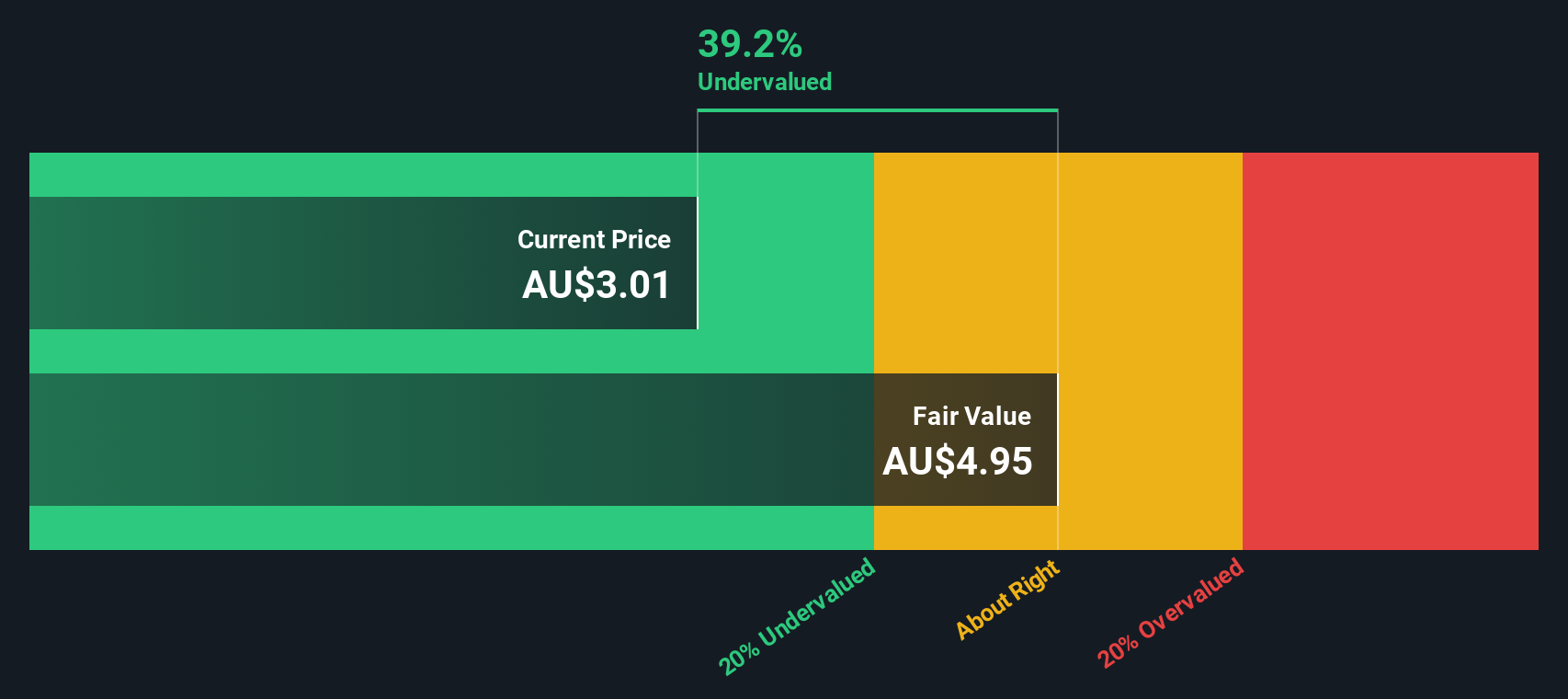

NRW Holdings (ASX:NWH)

Simply Wall St Value Rating: ★★★★★★

Overview: NRW Holdings is an Australian company specializing in civil, mining, and urban infrastructure services with a market cap of A$1.25 billion.

Operations: NRW Holdings generates revenue primarily from its Mining, MET, and Civil segments, with Mining being the largest contributor at A$1.56 billion. The company's gross profit margin has shown a trend of gradual increase, reaching 48.10% in recent periods. Operating expenses are significant and include general and administrative costs as a major component.

PE: 10.8x

NRW Holdings, a small company in the construction and mining services industry, recently reported sales of A$1.65 billion for the half-year ending December 2024, up from A$1.43 billion the previous year. Net income increased to A$51.69 million from A$41.64 million, indicating financial growth despite relying on external borrowing for funding. Insider confidence is evident with recent share purchases by executives, suggesting optimism about future prospects. With earnings projected to grow annually by 7.52%, NRW's strategic positioning and leadership changes could drive further value creation in the sector.

- Click here and access our complete valuation analysis report to understand the dynamics of NRW Holdings.

Review our historical performance report to gain insights into NRW Holdings''s past performance.

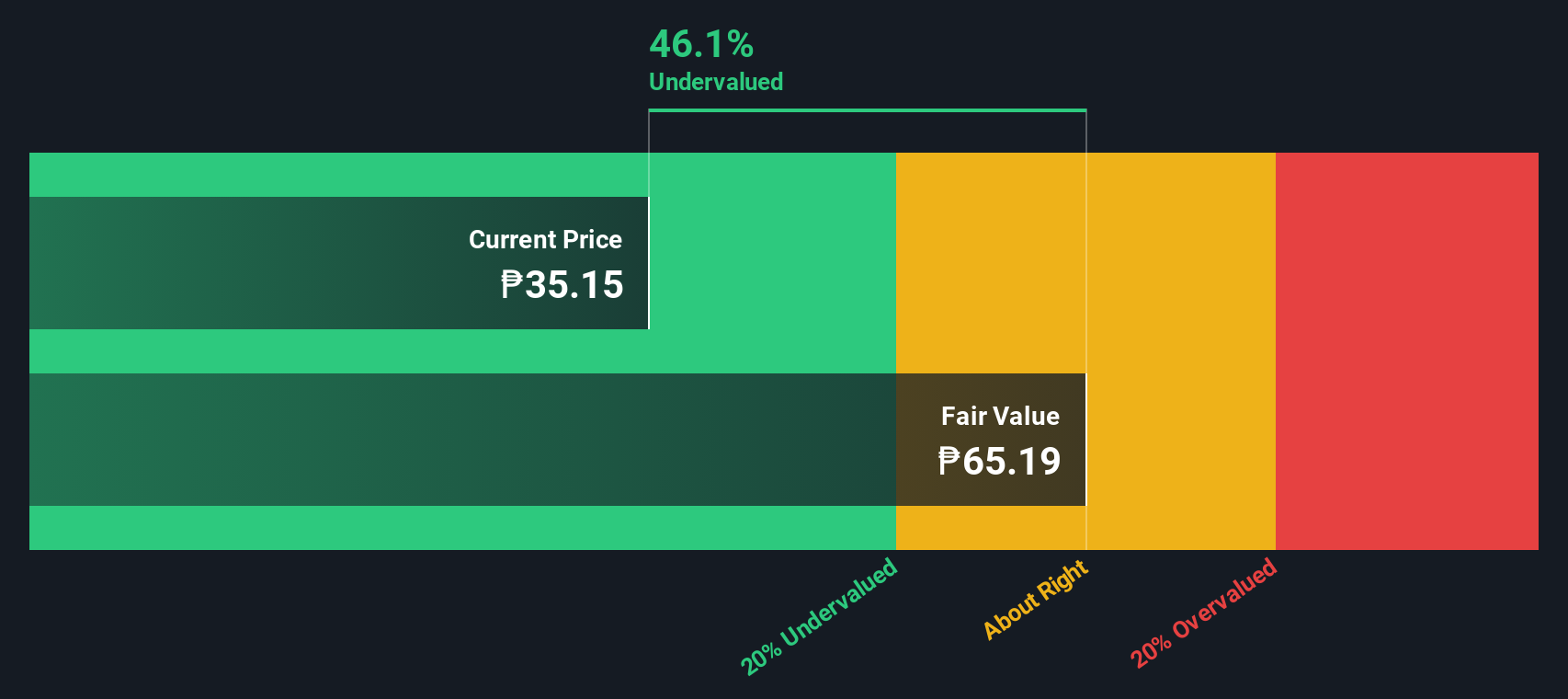

Puregold Price Club (PSE:PGOLD)

Simply Wall St Value Rating: ★★★★★☆

Overview: Puregold Price Club operates a chain of supermarkets in the Philippines, focusing on providing a wide range of consumer goods and services, with a market capitalization of approximately ₱116.42 billion.

Operations: PGOLD's revenue is primarily derived from its sales, with a noticeable increase over time, reaching ₱224.27 billion by March 2025. The cost of goods sold (COGS) also shows a rising trend, impacting the gross profit margin which fluctuated around 17% in recent periods. Operating expenses include significant allocations to general and administrative costs and depreciation & amortization. The net income margin has varied but was approximately 4.72% as of March 2025, reflecting the company's ability to manage costs relative to its revenue growth.

PE: 8.4x

Puregold Price Club, a smaller player in the Asian retail sector, showcases potential with its recent financial performance. For 2024, sales increased to PHP 219.2 billion and net income rose to PHP 10.4 billion from the previous year. Despite relying on external borrowing for funding, which carries higher risk compared to customer deposits, insider confidence is evident with share purchases by management in early 2025. Recent amendments to company bylaws suggest strategic shifts that could influence future growth and stability within its market niche.

- Take a closer look at Puregold Price Club's potential here in our valuation report.

Assess Puregold Price Club's past performance with our detailed historical performance reports.

Next Steps

- Dive into all 65 of the Undervalued Asian Small Caps With Insider Buying we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ARF

Arena REIT

An ASX200 listed property group that develops, owns and manages social infrastructure properties across Australia.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives