- Philippines

- /

- Trade Distributors

- /

- PSE:SBS

Discover 3 Penny Stocks With A Market Cap Of US$100M

Reviewed by Simply Wall St

Global markets are experiencing a mixed performance, with major indices like the S&P 500 and Nasdaq hitting record highs while others like the Russell 2000 have seen declines. In this context, penny stocks—often smaller or newer companies—continue to attract attention for their potential to offer both value and growth opportunities that larger firms may overlook. Despite being an outdated term, penny stocks remain relevant as they can provide unique investment prospects when backed by strong financials.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.755 | A$138.53M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.43 | MYR1.2B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.89 | MYR295.43M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.135 | £808.16M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.03 | HK$44.38B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.98 | £159.32M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.85 | HK$539.57M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.56 | £68.28M | ★★★★☆☆ |

Click here to see the full list of 5,717 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

SBS Philippines (PSE:SBS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: SBS Philippines Corporation, along with its subsidiaries, is involved in chemical trading and distribution in the Philippines and has a market capitalization of ₱5.72 billion.

Operations: The company generates revenue primarily from the sale of goods, amounting to ₱1.09 billion.

Market Cap: ₱5.72B

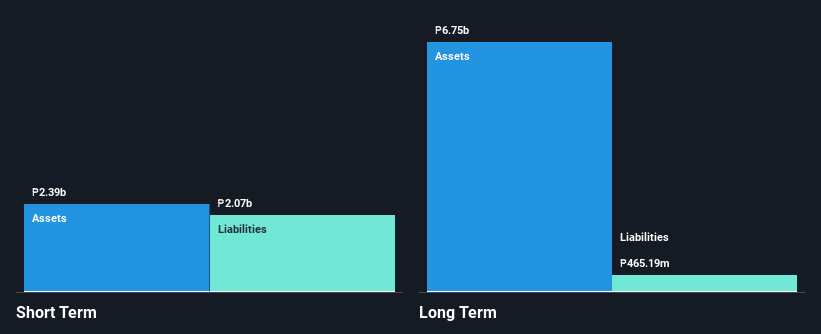

SBS Philippines Corporation, with a market cap of ₱5.72 billion, has faced challenges in earnings growth, declining by 25% annually over the past five years. Despite this, the company maintains high-quality earnings and a satisfactory net debt to equity ratio of 16.7%. Recent results show slight revenue growth to ₱270.27 million for Q3 2024 and improved quarterly net income from ₱6.72 million to ₱9.95 million year-over-year. The board and management team are experienced, contributing to stable operations amidst low return on equity at 0.6%. SBS's valuation appears attractive as it trades significantly below estimated fair value.

- Take a closer look at SBS Philippines' potential here in our financial health report.

- Assess SBS Philippines' previous results with our detailed historical performance reports.

VPower Group International Holdings (SEHK:1608)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: VPower Group International Holdings Limited is an investment holding company that designs, integrates, sells, and installs engine-based electricity generation units across Hong Kong, Macau, Mainland China, other Asian countries, and internationally with a market cap of HK$1.15 billion.

Operations: The company generates revenue primarily from its Investment, Building and Operating (IBO) segment, which accounts for HK$885.83 million, followed by the System Integration (SI) segment at HK$435.27 million.

Market Cap: HK$1.15B

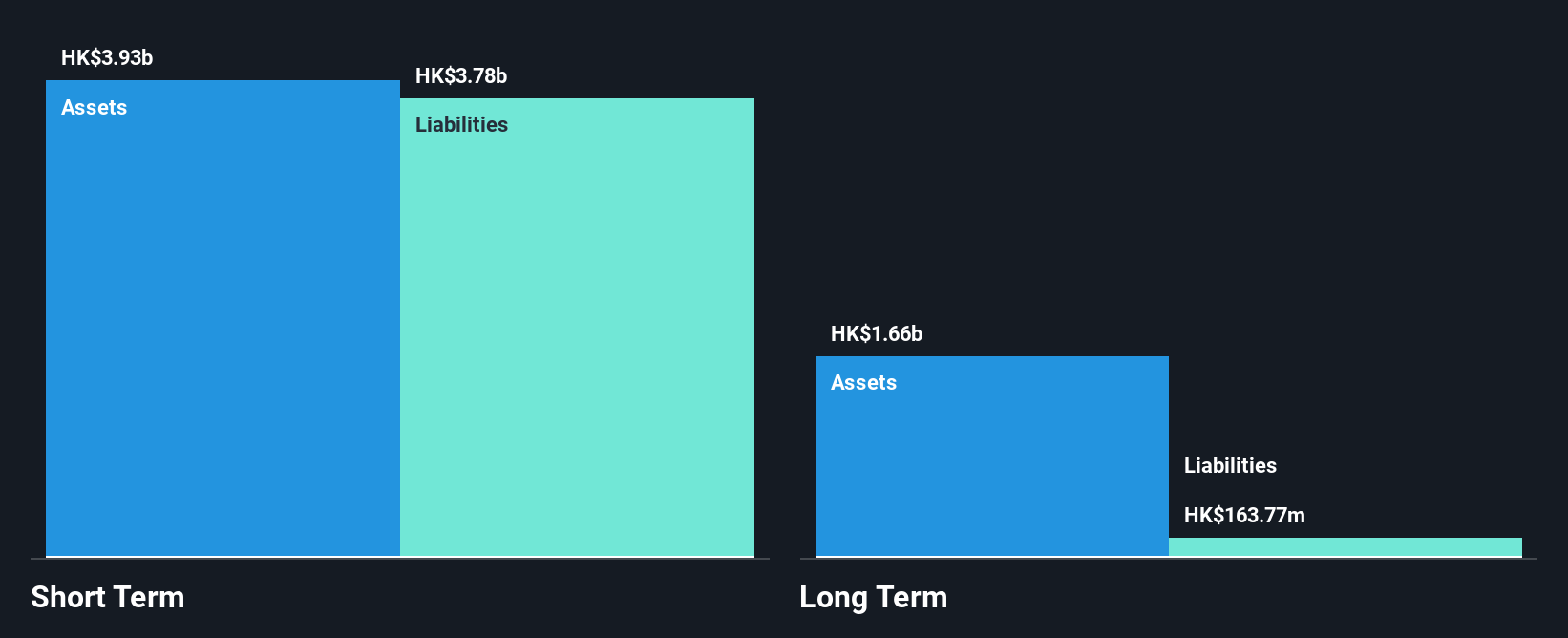

VPower Group International Holdings Limited, with a market cap of HK$1.15 billion, has seen its earnings decline significantly over the past five years at an annual rate of 79.7%. Despite positive free cash flow and a cash runway extending beyond three years, the company remains unprofitable. Recent half-year results reported sales of HK$816.57 million but a net loss of HK$138.6 million, showing improvement from the previous year's larger loss. The company's high net debt to equity ratio of 124.4% and inexperienced management team present challenges, while short-term liabilities exceed short-term assets by HK$1.2 billion.

- Click here and access our complete financial health analysis report to understand the dynamics of VPower Group International Holdings.

- Gain insights into VPower Group International Holdings' past trends and performance with our report on the company's historical track record.

Zhejiang Giuseppe Garment (SZSE:002687)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhejiang Giuseppe Garment Co., Ltd operates in China, producing and selling business wear, men's wear, and casual wear under the George White brands with a market capitalization of CN¥2.42 billion.

Operations: The company generates revenue of CN¥1.31 billion from its operations in China.

Market Cap: CN¥2.42B

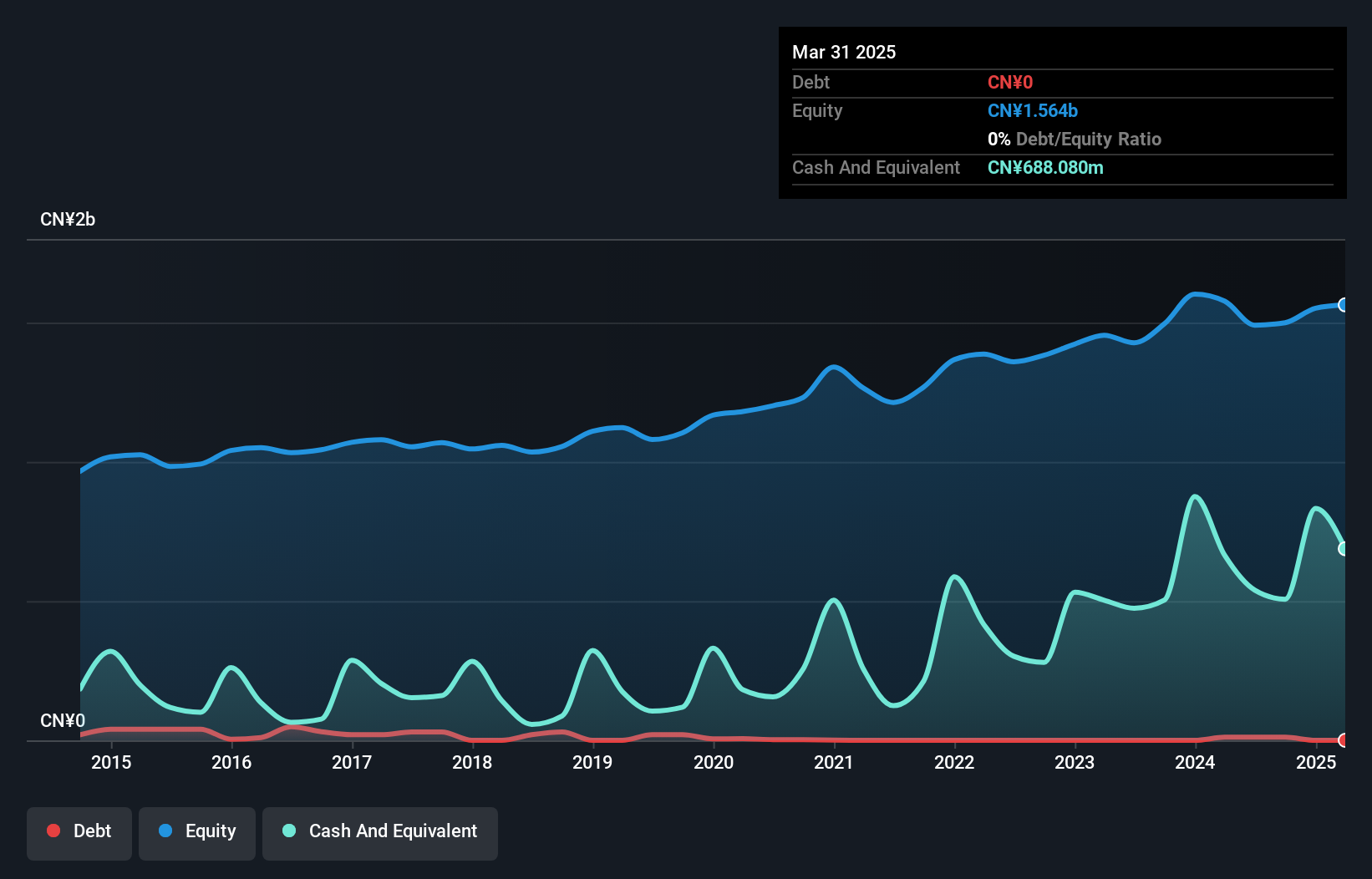

Zhejiang Giuseppe Garment Co., Ltd, with a market cap of CN¥2.42 billion, has seen its revenue and net income decline over the past year, reporting sales of CN¥784.9 million and net income of CN¥52.88 million for the first nine months of 2024. Despite this downturn, the company maintains a strong balance sheet with short-term assets exceeding liabilities and more cash than debt. It has also completed a share buyback program worth CN¥80.04 million, reflecting confidence in its stock value despite negative earnings growth and reduced profit margins compared to last year.

- Jump into the full analysis health report here for a deeper understanding of Zhejiang Giuseppe Garment.

- Evaluate Zhejiang Giuseppe Garment's prospects by accessing our earnings growth report.

Make It Happen

- Investigate our full lineup of 5,717 Penny Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:SBS

SBS Philippines

Engages in chemical trading and distribution in the Philippines.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives