As global markets navigate a mixed start to the new year, with U.S. equities experiencing both profit-taking and notable gains, investors are turning their attention to stable income opportunities amidst economic uncertainties. In this environment, dividend stocks stand out as attractive options for those seeking consistent returns and potential resilience against market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.22% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.83% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.41% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.39% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.95% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.89% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.44% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.35% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.01% | ★★★★★★ |

Click here to see the full list of 1983 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

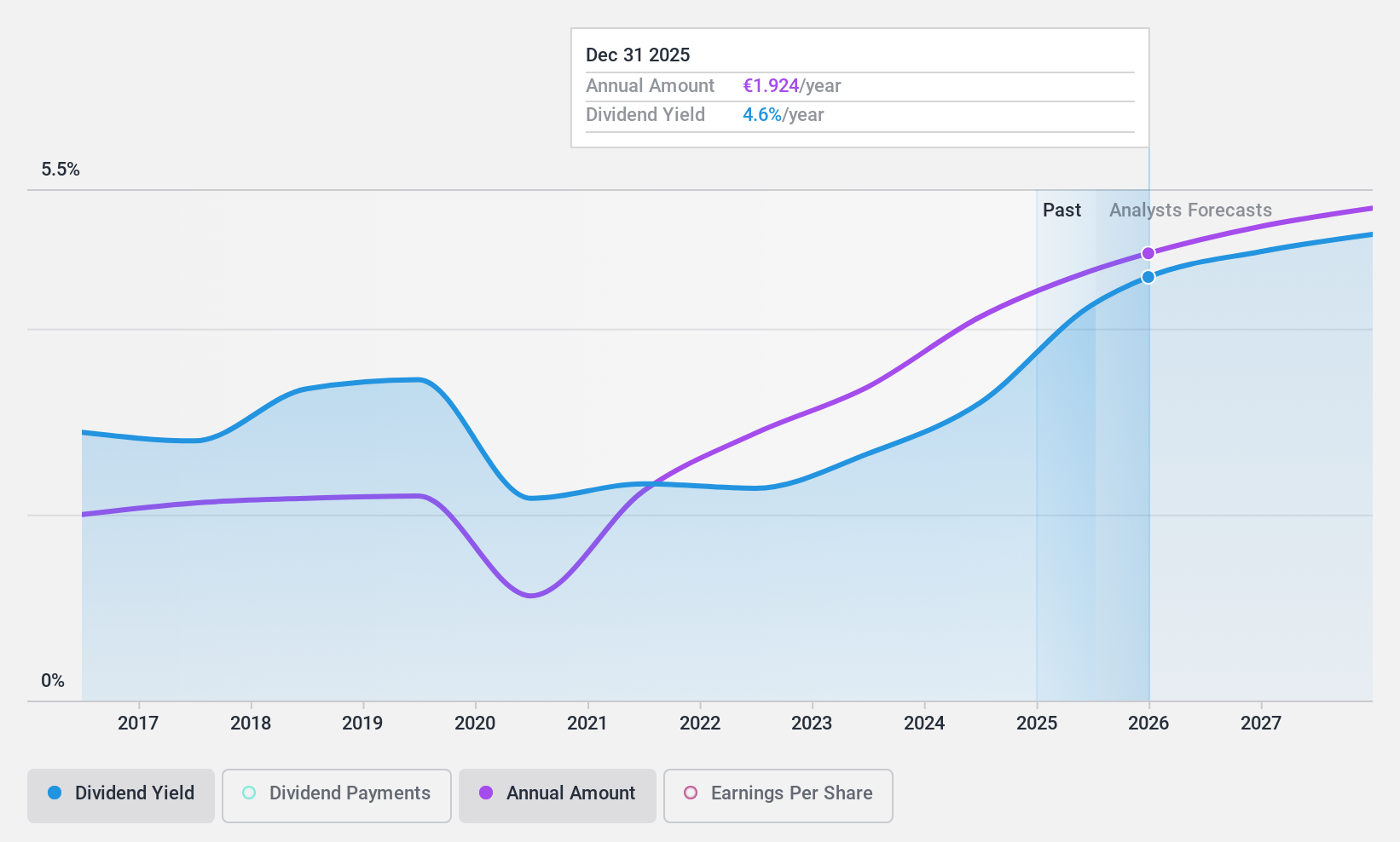

Ipsos (ENXTPA:IPS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ipsos SA, with a market cap of €1.99 billion, operates through its subsidiaries to provide survey-based research services for companies and institutions across Europe, the Middle East, Africa, the Americas, and the Asia-Pacific.

Operations: Ipsos SA generates revenue of €2.44 billion from its survey-based research services offered globally.

Dividend Yield: 3.6%

Ipsos's dividend is well covered by both earnings and cash flows, with payout ratios of 39.3% and 25.3%, respectively, suggesting sustainability despite a volatile track record over the past decade. The dividend yield of 3.57% is below the top quartile in France but offers potential value as the stock trades significantly below estimated fair value. Recent guidance adjustments indicate modest growth challenges, potentially affecting future dividend stability and growth prospects.

- Dive into the specifics of Ipsos here with our thorough dividend report.

- According our valuation report, there's an indication that Ipsos' share price might be on the cheaper side.

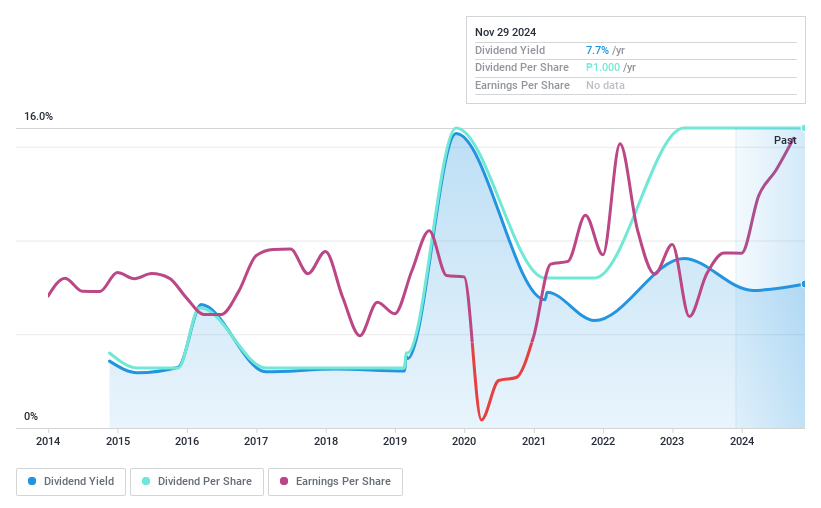

A. Soriano (PSE:ANS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: A. Soriano Corporation, with a market cap of ₱16.94 billion, operates in the Philippines through its subsidiaries in resort management and cable and wire manufacturing, among other sectors.

Operations: A. Soriano Corporation generates revenue from its subsidiaries primarily through wire manufacturing (₱10.95 billion) and resort operations (₱1.46 billion).

Dividend Yield: 7.2%

A. Soriano Corporation's dividend yield is among the top 25% in the Philippine market, supported by a low payout ratio of 10.5%, indicating strong earnings coverage. Despite a volatile dividend history over the past decade, recent financial performance shows significant growth with net income rising to PHP 1.28 billion in Q3 2024 from PHP 365.97 million a year ago. The company declared a special cash dividend funded by unrestricted retained earnings, suggesting robust financial health and potential for continued dividends.

- Click to explore a detailed breakdown of our findings in A. Soriano's dividend report.

- The valuation report we've compiled suggests that A. Soriano's current price could be quite moderate.

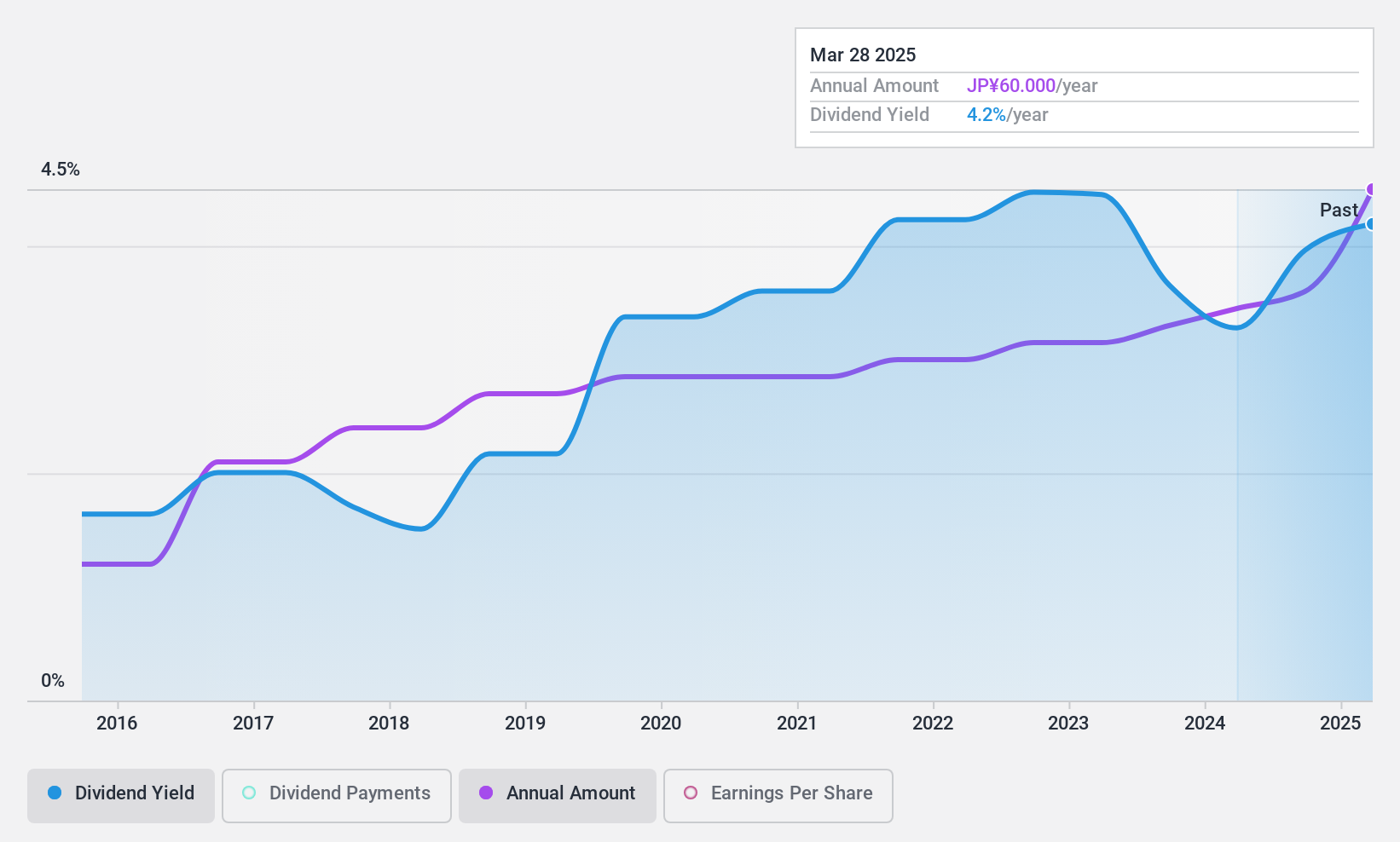

Nihon Tokushu Toryo (TSE:4619)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nihon Tokushu Toryo Co., Ltd. manufactures and sells automobile products, as well as paints and coatings in Japan, with a market cap of ¥27.95 billion.

Operations: Nihon Tokushu Toryo Co., Ltd.'s revenue is derived from its automotive products-related segment, which accounts for ¥43.29 billion, and its paint-related segment, contributing ¥22.61 billion.

Dividend Yield: 3.7%

Nihon Tokushu Toryo's dividends have shown consistent growth and stability over the past decade, with recent increases from JPY 21.00 to JPY 22.00 per share for the six months ended September 2024. The company's dividends are well-covered by earnings and cash flows, with payout ratios of 24% and 33.4% respectively. Although its dividend yield of 3.66% is slightly below Japan’s top-tier payers, it trades at a significant discount to its estimated fair value, enhancing its appeal for income-focused investors.

- Delve into the full analysis dividend report here for a deeper understanding of Nihon Tokushu Toryo.

- Insights from our recent valuation report point to the potential undervaluation of Nihon Tokushu Toryo shares in the market.

Summing It All Up

- Click here to access our complete index of 1983 Top Dividend Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Ipsos, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:IPS

Ipsos

Through its subsidiaries, provides survey-based research services for companies and institutions in Europe, the Middle East, Africa, the Americas, and the Asia-Pacific.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives