- New Zealand

- /

- Hospitality

- /

- NZSE:SKC

Unveiling 3 Premier Undervalued Small Caps In The Asian Market With Insider Action

Reviewed by Simply Wall St

In recent weeks, the Asian markets have shown resilience, with small-cap stocks gaining attention amid shifting economic dynamics and investor sentiment. As these smaller companies navigate a landscape marked by evolving trade policies and technological advancements, identifying promising opportunities becomes crucial for investors looking to capitalize on potential growth. In this context, understanding key market trends and company fundamentals is essential for evaluating stocks that may offer value in the current environment.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.3x | 1.0x | 27.79% | ★★★★★★ |

| East West Banking | 3.1x | 0.7x | 20.00% | ★★★★☆☆ |

| Clover | 19.9x | 1.6x | 31.27% | ★★★★☆☆ |

| Centurion | 3.7x | 3.1x | -57.40% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 44.57% | ★★★★☆☆ |

| Dicker Data | 23.2x | 0.8x | -51.39% | ★★★☆☆☆ |

| Nickel Asia | 11.9x | 1.8x | 16.79% | ★★★☆☆☆ |

| Ever Sunshine Services Group | 6.6x | 0.4x | -439.58% | ★★★☆☆☆ |

| PSC | 9.9x | 0.4x | 18.94% | ★★★☆☆☆ |

| Chinasoft International | 22.2x | 0.7x | -1225.24% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

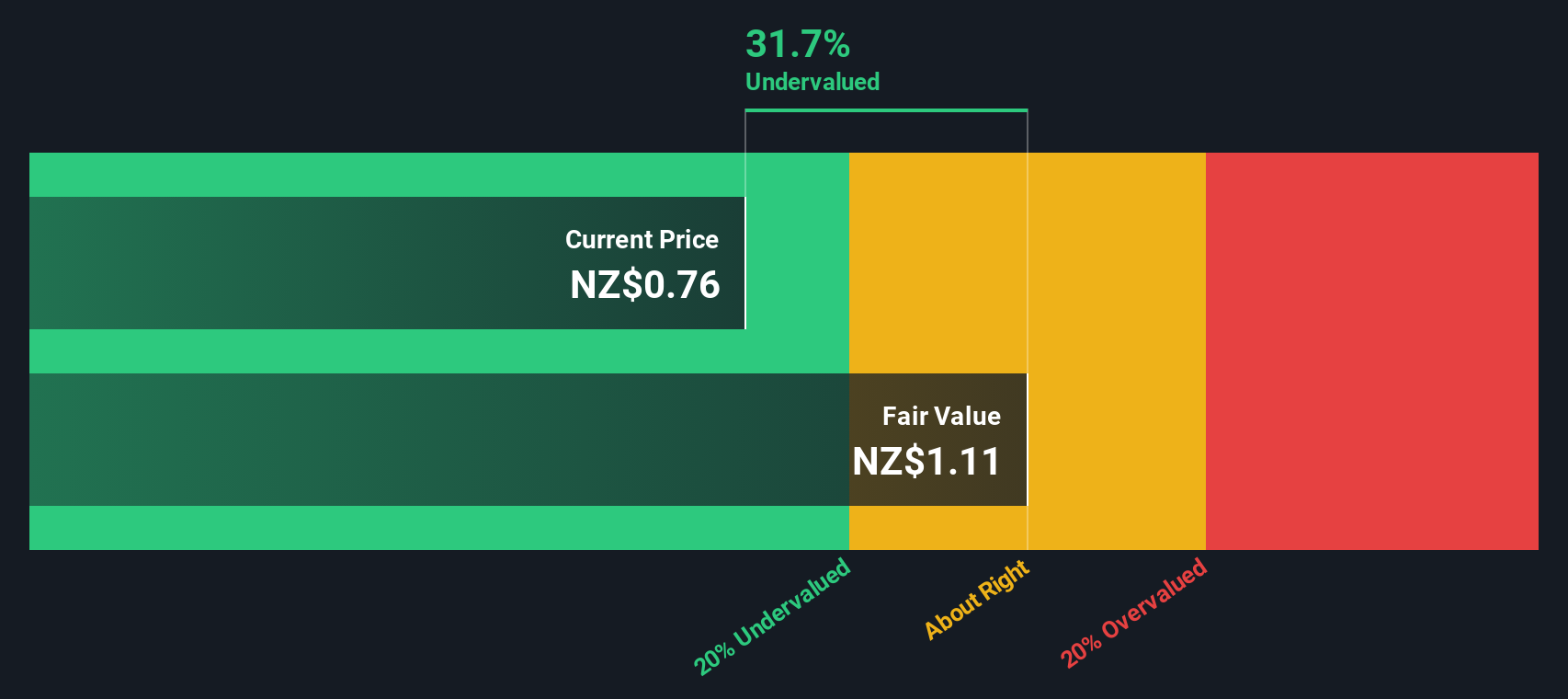

SkyCity Entertainment Group (NZSE:SKC)

Simply Wall St Value Rating: ★★★☆☆☆

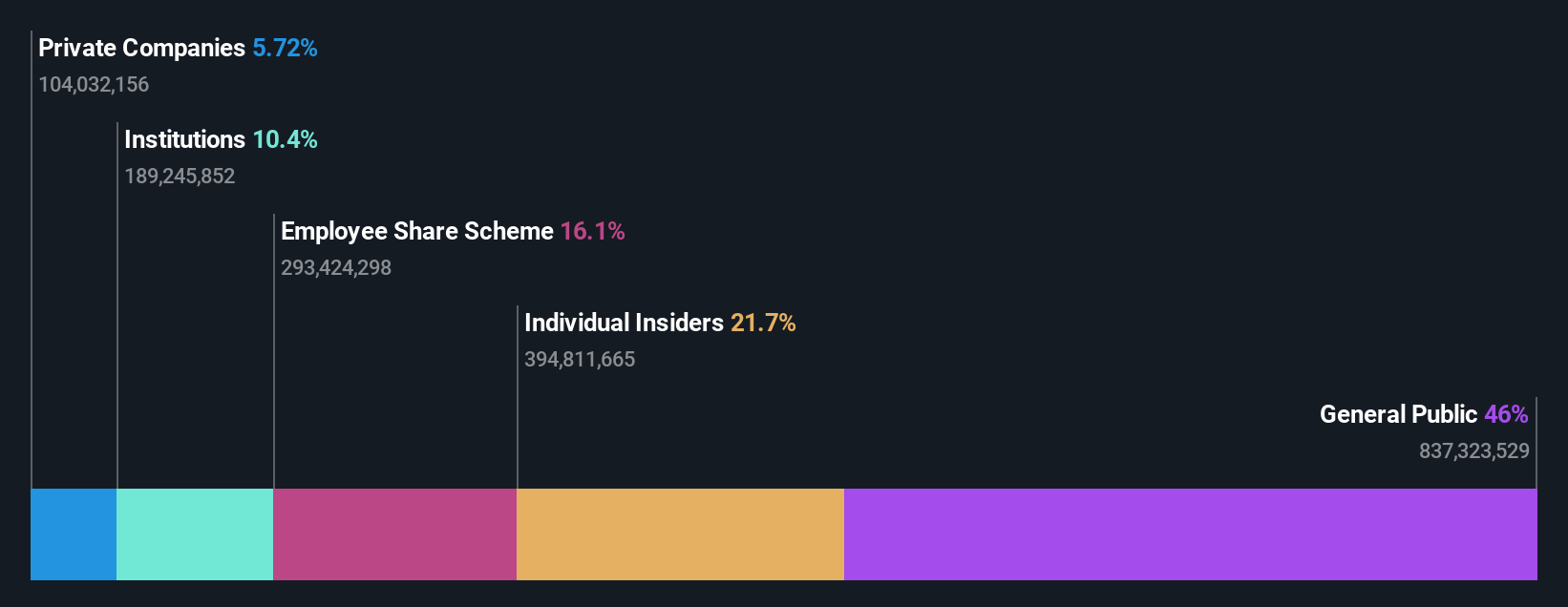

Overview: SkyCity Entertainment Group is a prominent entertainment and gaming company operating casinos, hotels, and restaurants primarily in New Zealand and Australia, with a market cap of approximately NZ$2.37 billion.

Operations: The company generates revenue primarily from SKYCITY Auckland and SKYCITY Adelaide, with contributions from other New Zealand operations and online services. The gross profit margin has shown fluctuations, reaching 57.74% in March 2023 before declining to 50.96% by June 2025. Operating expenses remain a significant cost factor, with depreciation and amortization consistently contributing to these expenses over the periods reviewed.

PE: 31.1x

SkyCity Entertainment Group, a player in the entertainment industry, has shown signs of insider confidence with Jason Walbridge purchasing 200,000 shares for approximately NZ$140,000. Despite recent challenges like being dropped from several indices and a significant equity offering of NZ$240 million in September 2025, the company forecasts earnings growth at 35.74% annually. Although reliant on higher-risk external borrowings and having experienced shareholder dilution last year, SkyCity's future prospects remain intriguing amid leadership changes as they search for a new CFO by March 2026.

- Navigate through the intricacies of SkyCity Entertainment Group with our comprehensive valuation report here.

Gain insights into SkyCity Entertainment Group's past trends and performance with our Past report.

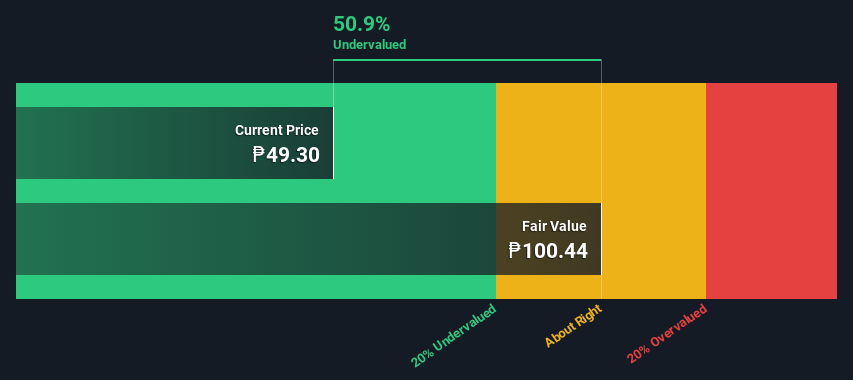

Philippine National Bank (PSE:PNB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Philippine National Bank is a financial institution offering services in retail and corporate banking, treasury operations, and other financial solutions, with a market capitalization of ₱53.05 billion.

Operations: Philippine National Bank generates revenue primarily from retail banking, corporate banking, and treasury operations. Retail banking is the largest segment, contributing ₱35.10 billion, followed by corporate banking with ₱14.49 billion and treasury operations at ₱12.50 billion. The gross profit margin has shown a high level of efficiency over multiple periods, reaching up to 99.94% in recent data points. Operating expenses are significant but have been managed alongside these substantial revenue streams to maintain profitability levels reflected in net income margins that have varied across different periods.

PE: 3.4x

Philippine National Bank, a smaller player in the Asian market, shows potential for growth amid its current challenges. With a low allowance for bad loans at 82% and high non-performing loans at 6.5%, risk management remains crucial. However, insider confidence is evident as Francis Albalate purchased 260,000 shares recently with a transaction value of PHP 13.52 million. Despite leadership changes and strategic adjustments within the board, the bank's net income rose to PHP 5.96 billion in Q3 from PHP 4.74 billion last year, suggesting resilience amidst operational shifts and economic pressures.

- Click here and access our complete valuation analysis report to understand the dynamics of Philippine National Bank.

Learn about Philippine National Bank's historical performance.

Shenzhen Pagoda Industrial (Group) (SEHK:2411)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Shenzhen Pagoda Industrial (Group) operates primarily in the trading and franchising sectors, with a focus on fresh produce distribution, and has a market capitalization of CN¥17.32 billion.

Operations: The company's primary revenue stream is from franchising, contributing CN¥8.02 billion, followed by trading at CN¥1.29 billion. The gross profit margin shows a declining trend from 11.63% to 3.94%. Operating expenses include significant allocations to sales and marketing as well as general and administrative expenses, impacting the overall profitability over time.

PE: -3.6x

Shenzhen Pagoda Industrial (Group) has attracted attention with its recent insider confidence, as Non-Executive Director Yue Jiao purchased 930,000 shares for HK$1.66 million, reflecting a 13.59% increase in their holdings. Despite highly volatile share prices over the past three months and reliance on external borrowing for funding, the company anticipates revenue growth of 10.71% annually. Recently completing a follow-on equity offering worth HK$327 million suggests strategic capital raising efforts amidst these dynamics.

Key Takeaways

- Navigate through the entire inventory of 48 Undervalued Asian Small Caps With Insider Buying here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:SKC

SkyCity Entertainment Group

Operates in the gaming, entertainment, hotel, convention, hospitality, and tourism sectors in New Zealand and Australia.

Fair value with moderate growth potential.

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026