- Australia

- /

- Metals and Mining

- /

- ASX:DRR

Undervalued Small Caps With Insider Action In Global For October 2025

Reviewed by Simply Wall St

As global markets navigate a period of cautious optimism, small-cap stocks have faced headwinds with the Russell 2000 Index recording its first weekly loss since early August. Amidst hawkish Federal Reserve commentary and steady inflation, investors are keenly observing opportunities within the small-cap sector where insider activity might signal potential value. In such an environment, identifying stocks that exhibit strong fundamentals and insider confidence can be crucial for those seeking to capitalize on market volatility.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Aurelia Metals | 9.0x | 1.3x | 33.09% | ★★★★★☆ |

| Bytes Technology Group | 17.3x | 4.4x | 11.49% | ★★★★☆☆ |

| East West Banking | 3.2x | 0.8x | 17.55% | ★★★★☆☆ |

| GDI Integrated Facility Services | 18.6x | 0.3x | 1.57% | ★★★★☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 6.7x | 1.8x | 20.42% | ★★★★☆☆ |

| BWP Trust | 10.1x | 13.2x | 12.95% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 45.08% | ★★★★☆☆ |

| Sagicor Financial | 7.2x | 0.4x | -74.00% | ★★★★☆☆ |

| Cettire | NA | 0.4x | 9.37% | ★★★☆☆☆ |

| CVS Group | 45.0x | 1.3x | 38.27% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

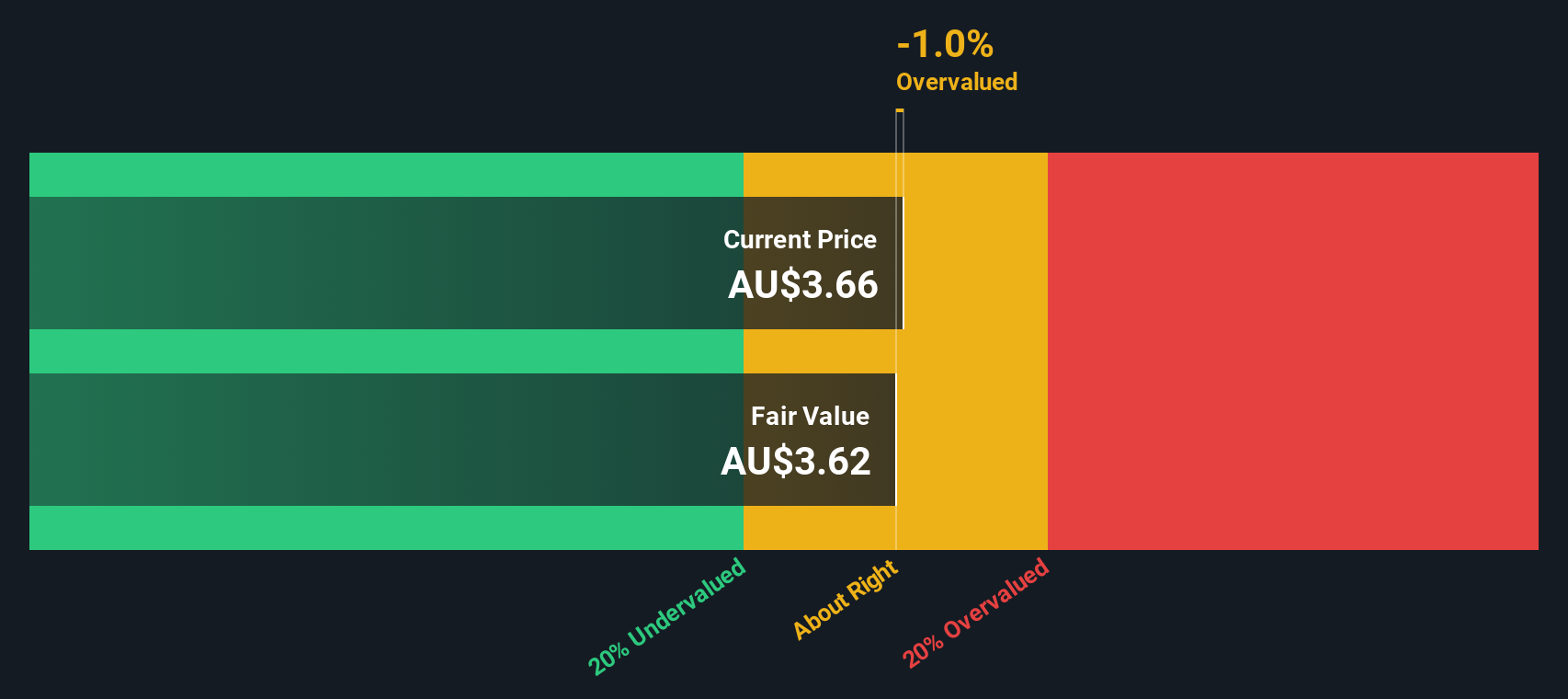

Cogstate (ASX:CGS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Cogstate is a cognitive science company specializing in the development and commercialization of digital brain health assessments, with a market cap of approximately A$0.24 billion.

Operations: Cogstate generates its revenue primarily from Clinical Trials, including precision recruitment tools and research, with a smaller contribution from Healthcare services. The company's cost of goods sold (COGS) significantly impacts its gross profit, which has shown variability over the periods analyzed. Notably, Cogstate's net income margin has experienced fluctuations but displayed positive trends in recent periods.

PE: 25.9x

Cogstate, a smaller company in the market, has shown promising financial performance with sales rising to US$50.81 million from US$39.72 million year-over-year and net income nearly doubling to US$10.14 million. Insider confidence is evident as Bradley O'Connor increased their stake by purchasing 50,327 shares for A$87,468. The company completed a share repurchase of 11.7 million shares for A$15.7 million by June 2025 and expects revenue growth pending additional contracts execution for fiscal year ending June 2026.

- Delve into the full analysis valuation report here for a deeper understanding of Cogstate.

Explore historical data to track Cogstate's performance over time in our Past section.

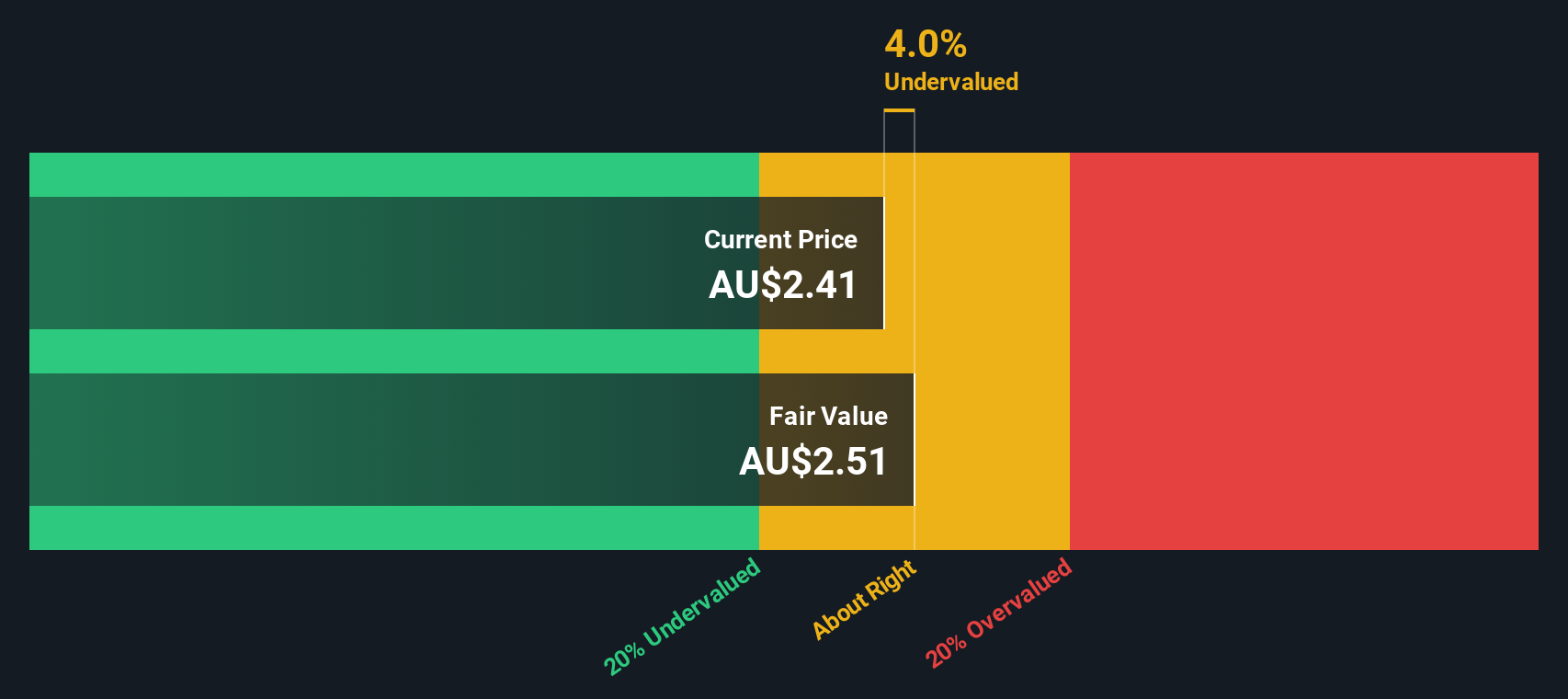

Deterra Royalties (ASX:DRR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Deterra Royalties is a company that focuses on managing and acquiring royalty interests in mining operations, with a market capitalization of A$2.44 billion.

Operations: Deterra Royalties generates revenue primarily from its bulk segment, contributing A$241.15 million, with additional income from the precious segment at A$21.80 million. The company has shown a gross profit margin trend peaking at 97.12% and most recently recorded at 95.40%. Operating expenses remain relatively low compared to revenue, with significant non-operating expenses impacting net income margins, which have been observed in the range of 59% to 67%.

PE: 14.2x

Deterra Royalties, a smaller company with potential for growth, reported net income of A$155.7 million for the year ending June 2025, slightly up from A$154.89 million the previous year. Despite high debt levels and reliance on external borrowing, insider confidence is evident through recent share purchases in July 2025. Earnings are expected to decline by an average of 5.4% annually over the next three years, challenging its future prospects amid dividend decreases announced in August 2025.

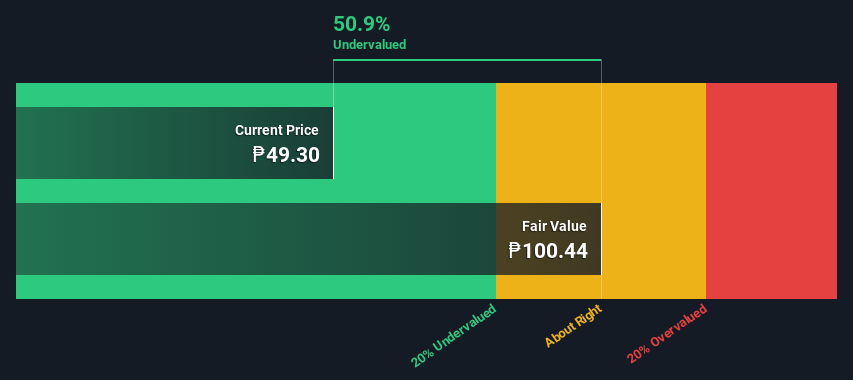

Philippine National Bank (PSE:PNB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Philippine National Bank is a financial institution engaged in retail and corporate banking, treasury operations, and other financial services with a market capitalization of ₱51.48 billion.

Operations: The primary revenue streams are Retail Banking and Corporate Banking, contributing ₱36.72 billion and ₱11.93 billion respectively. The net income margin has shown variability, with a peak of 46.17% in June 2021 and a recent figure of 38.24% in June 2025. Operating expenses have been significant, with General & Administrative Expenses consistently forming a substantial part of these costs, reaching ₱16.22 billion by mid-2025.

PE: 3.6x

Philippine National Bank, a smaller financial institution, recently saw insider confidence with Francis Albalate purchasing 260,000 shares for approximately PHP 13.5 million. This move highlights potential optimism about the bank's future despite challenges like a high bad loans ratio of 6.7% and low allowance coverage at 91%. The bank's recent addition to the S&P Global BMI Index could bolster its visibility and investor interest, while its revenue growth forecast of 7.63% annually suggests promising prospects ahead.

- Dive into the specifics of Philippine National Bank here with our thorough valuation report.

Gain insights into Philippine National Bank's past trends and performance with our Past report.

Taking Advantage

- Delve into our full catalog of 115 Undervalued Global Small Caps With Insider Buying here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DRR

Deterra Royalties

Operates as a royalty investment company in Australia, the United States, Mexico, Zambia, Peru, Canada, Mali, Kenya, Brazil, Cote D’Ivoire, and South Africa.

Fair value with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success