- New Zealand

- /

- Electric Utilities

- /

- NZSE:GNE

Genesis Energy's (NZSE:GNE) Dividend Will Be Increased To NZ$0.10

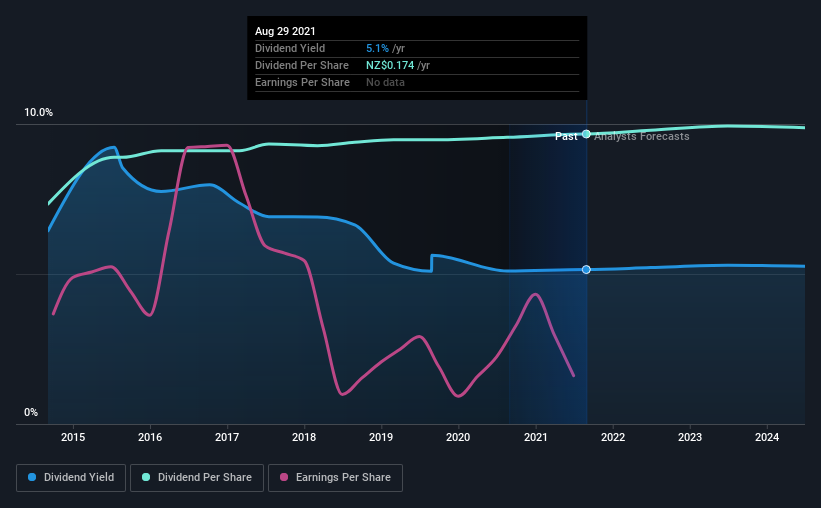

The board of Genesis Energy Limited (NZSE:GNE) has announced that it will be increasing its dividend on the 8th of October to NZ$0.10. This will take the dividend yield from 5.1% to 5.9%, providing a nice boost to shareholder returns.

View our latest analysis for Genesis Energy

Genesis Energy Is Paying Out More Than It Is Earning

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. But before making this announcement, Genesis Energy's earnings quite easily covered the dividend. The business is earning enough to make the dividend feasible, but the cash payout ratio of 76% shows that most of the cash is going back to the shareholders, which could constrain growth prospects going forward.

Over the next year, EPS is forecast to grow rapidly. Assuming the dividend continues along recent trends, we could see the payout ratio reach 176%, which is on the unsustainable side.

Genesis Energy Doesn't Have A Long Payment History

It is great to see that Genesis Energy has been paying a stable dividend for a number of years now, however we want to be a bit cautious about whether this will remain true through a full economic cycle. The first annual payment during the last 7 years was NZ$0.13 in 2014, and the most recent fiscal year payment was NZ$0.17. This means that it has been growing its distributions at 4.0% per annum over that time. We like that the dividend hasn't been shrinking. However we're conscious that the company hasn't got an overly long track record of dividend payments yet, which makes us wary of relying on its dividend income.

Dividend Growth Potential Is Shaky

Investors could be attracted to the stock based on the quality of its payment history. However, initial appearances might be deceiving. Genesis Energy's earnings per share has shrunk at 29% a year over the past five years. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future. Over the next year, however, earnings are actually predicted to rise, but we would still be cautious until a track record of earnings growth can be built.

Our Thoughts On Genesis Energy's Dividend

Overall, we always like to see the dividend being raised, but we don't think Genesis Energy will make a great income stock. The low payout ratio is a redeeming feature, but generally we are not too happy with the payments Genesis Energy has been making. This company is not in the top tier of income providing stocks.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. For instance, we've picked out 4 warning signs for Genesis Energy that investors should take into consideration. We have also put together a list of global stocks with a solid dividend.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NZSE:GNE

Genesis Energy

Generates, trades in, and sells electricity to residential and business customers in New Zealand.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives