- New Zealand

- /

- Electric Utilities

- /

- NZSE:CEN

Shareholders Should Be Pleased With Contact Energy Limited's (NZSE:CEN) Price

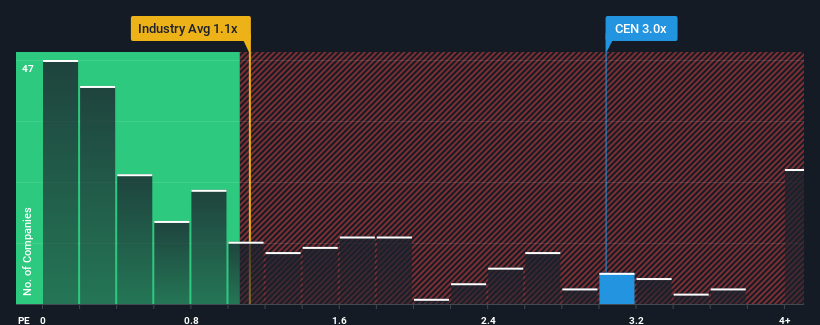

When close to half the companies in the Electric Utilities industry in New Zealand have price-to-sales ratios (or "P/S") below 2x, you may consider Contact Energy Limited (NZSE:CEN) as a stock to potentially avoid with its 3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Contact Energy

How Contact Energy Has Been Performing

With revenue growth that's superior to most other companies of late, Contact Energy has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Contact Energy will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as Contact Energy's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a decent 8.5% gain to the company's revenues. The latest three year period has also seen a 15% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 4.9% per annum over the next three years. With the industry only predicted to deliver 2.4% per annum, the company is positioned for a stronger revenue result.

With this information, we can see why Contact Energy is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Contact Energy's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Contact Energy shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

You should always think about risks. Case in point, we've spotted 2 warning signs for Contact Energy you should be aware of, and 1 of them is a bit unpleasant.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:CEN

Contact Energy

Generates and sells electricity and natural gas in New Zealand.

Fair value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives