- New Zealand

- /

- Infrastructure

- /

- NZSE:POT

Port of Tauranga (NZSE:POT): Assessing Valuation After Strong EPS Growth and Recent Insider Buying

Reviewed by Kshitija Bhandaru

Port of Tauranga (NZSE:POT) just posted an impressive jump in earnings per share over the last year, far outpacing its share price gains. In addition, insiders have been buyers lately, hinting at growing confidence from within.

See our latest analysis for Port of Tauranga.

Port of Tauranga's share price has rallied 23.8% year-to-date and posted a 12.5% jump over the past quarter. Its one-year total shareholder return stands even higher at 36.4%. This momentum reflects renewed optimism, especially with insiders supporting their confidence by buying in recently.

If you're curious about what other investors are noticing, this could be the moment to broaden your search and discover fast growing stocks with high insider ownership

With earnings growth outpacing the share price rally and insider confidence on display, the big question now is whether Port of Tauranga’s recent surge leaves room for further upside, or if future gains are already priced in.

Price-to-Earnings of 30.8x: Is it justified?

Port of Tauranga is trading on a price-to-earnings ratio of 30.8x, making it significantly more expensive than both industry peers and the broader market based on recent earnings data. At the last close of NZ$7.85, this valuation suggests investors are paying a premium for each dollar of profit relative to alternatives.

The price-to-earnings (P/E) ratio compares a company’s current share price to its per-share earnings. For Port of Tauranga, a P/E of 30.8x is notably above the global infrastructure industry average of 14.5x as well as the estimated fair P/E ratio of 23.1x. This high multiple could signal that the market expects stronger future earnings, or it may indicate the price has run ahead of fundamentals after recent profit growth.

Compared to industry benchmarks, Port of Tauranga’s valuation is stretched. The market is assigning it a premium far above both sector norms and its own fair value estimate. This may be factoring in its robust earnings surge and established position. However, if sentiment normalises or growth slows, the valuation multiple could revert toward the sector’s average or the fair ratio level.

Explore the SWS fair ratio for Port of Tauranga

Result: Price-to-Earnings of 30.8x (OVERVALUED)

However, a premium valuation could quickly unwind if Port of Tauranga’s earnings momentum slows or if investor enthusiasm for the sector cools unexpectedly.

Find out about the key risks to this Port of Tauranga narrative.

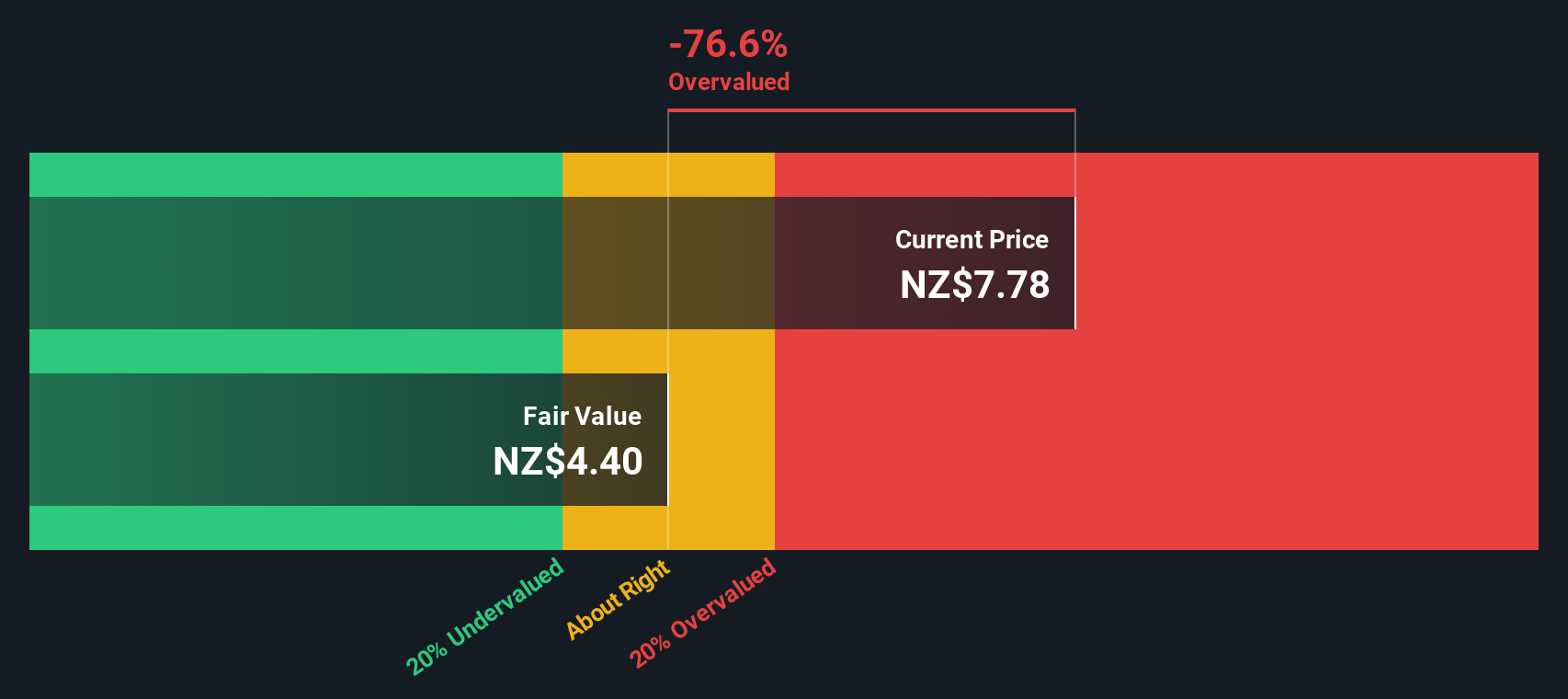

Another View: Discounted Cash Flow Model

Switching perspectives, the SWS DCF model values Port of Tauranga at NZ$4.41 per share, which is well below its current price of NZ$7.85. This could indicate the stock is overvalued if future cash flows slow down, or it may reflect market expectations of additional upside. Does this second perspective challenge the positive narrative?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Port of Tauranga for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Port of Tauranga Narrative

If you see things differently or want to dig into the numbers your way, it only takes a few minutes to build your own perspective, so why not Do it your way

A great starting point for your Port of Tauranga research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why limit yourself to one stock when there are so many compelling opportunities taking shape right now? Make your investments work harder by exploring these handpicked ideas tailored for forward-thinking investors:

- Boost your portfolio’s income by targeting high-yield opportunities through these 19 dividend stocks with yields > 3% and see which companies are rewarding shareholders right now.

- Get ahead of the next tech surge and position yourself for growth with these 25 AI penny stocks as these companies drive artificial intelligence breakthroughs.

- Seize the chance to find value before the crowd does by using these 894 undervalued stocks based on cash flows to track down companies trading below their true potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:POT

Port of Tauranga

A port company, provides and manages port services and cargo handling facilities through the Port of Tauranga, MetroPort, and Timaru Container Terminal in New Zealand.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives