- New Zealand

- /

- Real Estate

- /

- NZSE:WIN

3 Penny Stocks With Market Caps Up To US$400M To Consider

Reviewed by Simply Wall St

Global markets have experienced a mixed week, with U.S. stocks mostly lower due to AI competition fears and political tariff risks, while European indices reached record highs following strong earnings and interest rate cuts by the ECB. In such volatile conditions, the appeal of penny stocks—typically representing smaller or newer companies—remains significant for investors seeking growth opportunities at lower price points. Although often considered niche, these stocks can offer substantial upside potential when supported by strong financial health and fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.85 | HK$44.23B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.64B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.86 | £471.38M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR292.11M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.70 | MYR414.16M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.65 | £174.08M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.39 | MYR1.09B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.78 | A$141.28M | ★★★★☆☆ |

| Lever Style (SEHK:1346) | HK$1.12 | HK$710.96M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.22 | £154.81M | ★★★★★☆ |

Click here to see the full list of 5,712 stocks from our Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Dubai Islamic Insurance & Reinsurance (Aman) (P.J.S.C) (DFM:AMAN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Dubai Islamic Insurance & Reinsurance (Aman) (P.J.S.C) operates in the insurance and reinsurance sector, providing Sharia-compliant products, with a market cap of AED86.91 million.

Operations: The company does not have any reported revenue segments in the provided data.

Market Cap: AED86.91M

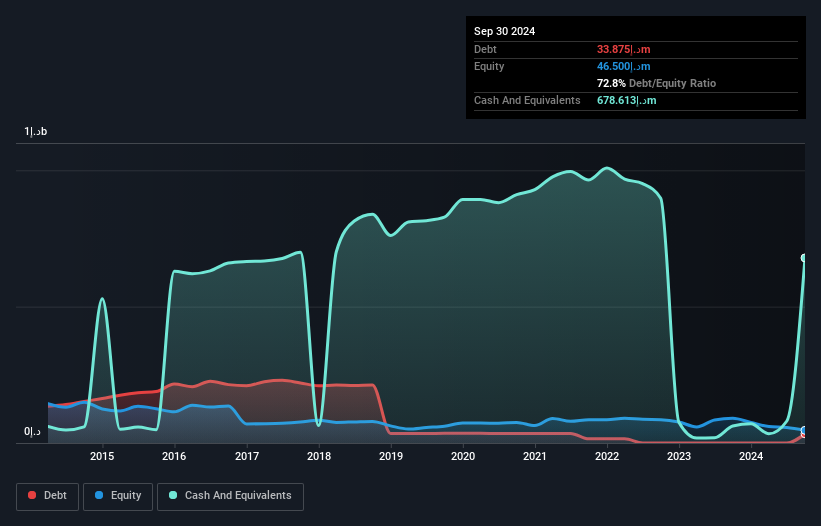

Dubai Islamic Insurance & Reinsurance (Aman) (P.J.S.C) faces challenges typical of penny stocks, with earnings declining by 38.8% annually over the last five years and a negative return on equity of -117.19%. The company is pre-revenue, generating less than US$1 million in revenue, and reported a net loss of AED 13.04 million for the first nine months of 2024. Despite these hurdles, Aman has more cash than total debt and sufficient short-term assets to cover liabilities. Its board members have an average tenure of 5.3 years, indicating experienced oversight amidst financial volatility.

- Jump into the full analysis health report here for a deeper understanding of Dubai Islamic Insurance & Reinsurance (Aman) (P.J.S.C).

- Examine Dubai Islamic Insurance & Reinsurance (Aman) (P.J.S.C)'s past performance report to understand how it has performed in prior years.

Rakon (NZSE:RAK)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Rakon Limited, with a market cap of NZ$129.80 million, designs, manufactures, and sells frequency control and timing solutions for various applications across Asia, North America, Europe, and internationally.

Operations: The company's revenue segments include NZ$25.93 million from France Hirel, NZ$27.70 million from France/India, and NZ$58.83 million from New Zealand (NZ).

Market Cap: NZ$129.8M

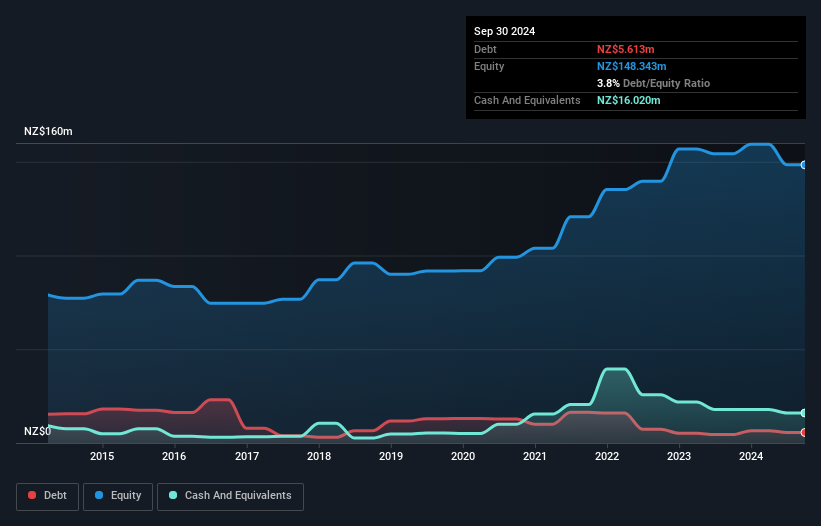

Rakon Limited, with a market cap of NZ$129.80 million, has shown volatility typical for penny stocks. Despite a stable weekly volatility over the past year, its share price has been highly volatile recently. The company's financials reveal challenges; it reported a net loss of NZ$10.37 million for the half-year ended September 2024 and was delisted from OTC Equity in January 2025 due to inactivity. Positively, Rakon's short-term assets cover both short and long-term liabilities, and its debt is well-covered by operating cash flow. Additionally, Rakon secured significant contracts for its space subsystems earlier in 2024.

- Click to explore a detailed breakdown of our findings in Rakon's financial health report.

- Learn about Rakon's future growth trajectory here.

Winton Land (NZSE:WIN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Winton Land Limited is a land developer focusing on creating integrated and fully master-planned neighborhoods in New Zealand and Australia, with a market cap of NZ$539.84 million.

Operations: Winton Land generates its revenue from three segments: Residential (NZ$162.53 million), Commercial (NZ$11.02 million), and Retirement (NZ$0.06 million).

Market Cap: NZ$539.84M

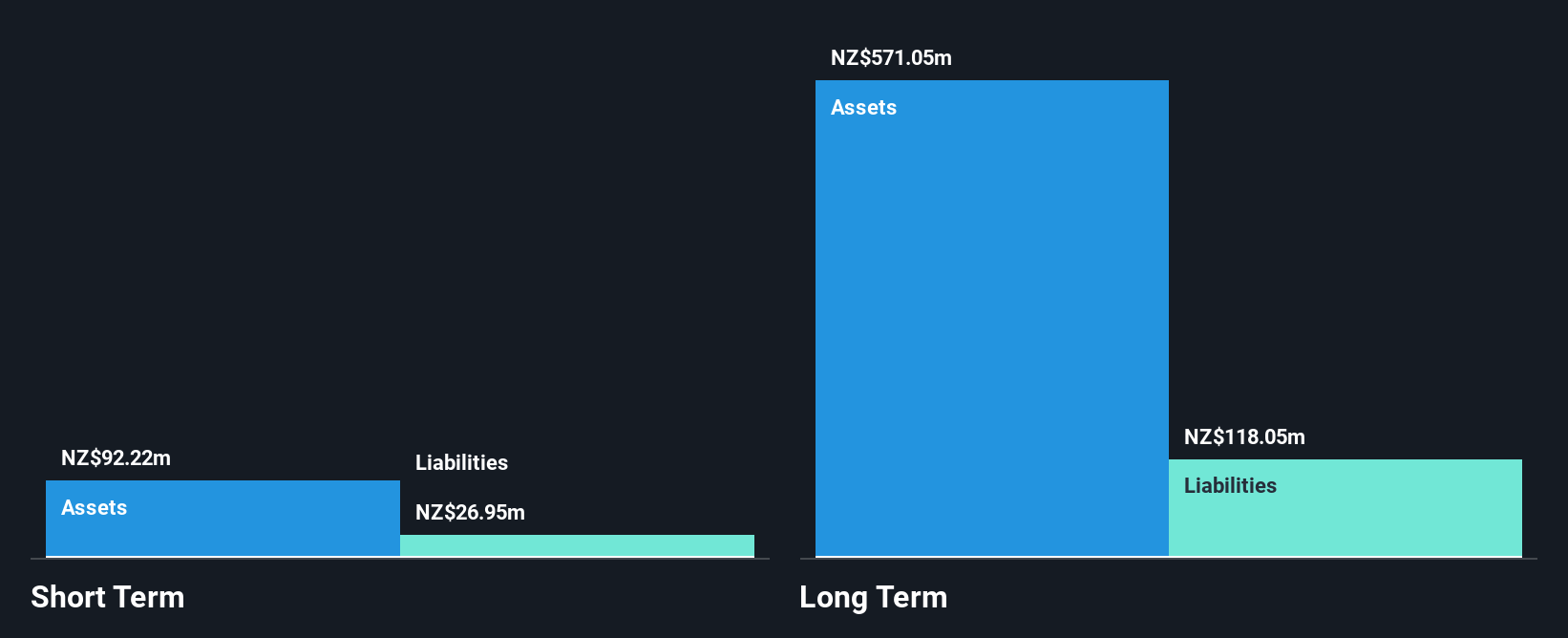

Winton Land, with a market cap of NZ$539.84 million, demonstrates mixed financial health typical for certain penny stocks. While its net debt to equity ratio is satisfactory at 4.3%, and short-term assets exceed liabilities, the company faces challenges with declining profit margins from 29.2% to 9.1% and negative earnings growth over the past year (-75.6%). Despite these setbacks, Winton's earnings have grown by 14.3% annually over five years and are forecasted to grow significantly moving forward, supported by high-quality earnings and experienced management and board teams.

- Dive into the specifics of Winton Land here with our thorough balance sheet health report.

- Explore Winton Land's analyst forecasts in our growth report.

Where To Now?

- Get an in-depth perspective on all 5,712 Penny Stocks by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Winton Land might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:WIN

Winton Land

Engages in the real estate business in New Zealand and Australia.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives