- New Zealand

- /

- Software

- /

- NZSE:VGL

Glycorex Transplantation And 2 Other Promising Penny Stocks To Watch

Reviewed by Simply Wall St

As global markets navigate a mixed start to the year, with U.S. stocks finishing strong despite recent volatility and European indices showing varied performance, investors continue to seek opportunities in diverse sectors. Penny stocks, often smaller or newer companies, remain a relevant investment area that can offer significant growth potential when backed by solid financials. In this article, we explore three penny stocks that stand out for their financial strength and potential for long-term success.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.54 | MYR2.69B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.415 | MYR1.15B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.79 | £434.2M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.045 | £770.58M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.85 | HK$539.57M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.40 | £178.29M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.54 | £67.51M | ★★★★☆☆ |

Click here to see the full list of 5,807 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Glycorex Transplantation (NGM:GTAB B)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Glycorex Transplantation AB is a medical technology company focused on developing, producing, and selling products for organ transplantation, with a market cap of SEK174.30 million.

Operations: The company's revenue is derived entirely from its organ transplantation segment, totaling SEK32.32 million.

Market Cap: SEK174.3M

Glycorex Transplantation AB, with a market cap of SEK174.30 million, has shown potential in the organ transplantation sector through its innovative Glycosorb® ABO product, which recently enabled successful blood group-incompatible heart transplants in Europe and is expanding globally. Despite this progress, the company remains unprofitable with a negative return on equity and high volatility compared to most Swedish stocks. While short-term assets cover liabilities and cash exceeds debt, revenue growth is limited at SEK32 million annually. The board's relatively new tenure may impact strategic direction as it navigates these challenges and opportunities within the medical technology field.

- Jump into the full analysis health report here for a deeper understanding of Glycorex Transplantation.

- Learn about Glycorex Transplantation's historical performance here.

Vista Group International (NZSE:VGL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Vista Group International Limited offers software and data analytics solutions to the global film industry, with a market cap of NZ$748.68 million.

Operations: The company's revenue is primarily derived from the United States (NZ$51.7 million), the United Kingdom (NZ$38.4 million), New Zealand (NZ$25.6 million), and Mexico (NZ$11.7 million).

Market Cap: NZ$748.68M

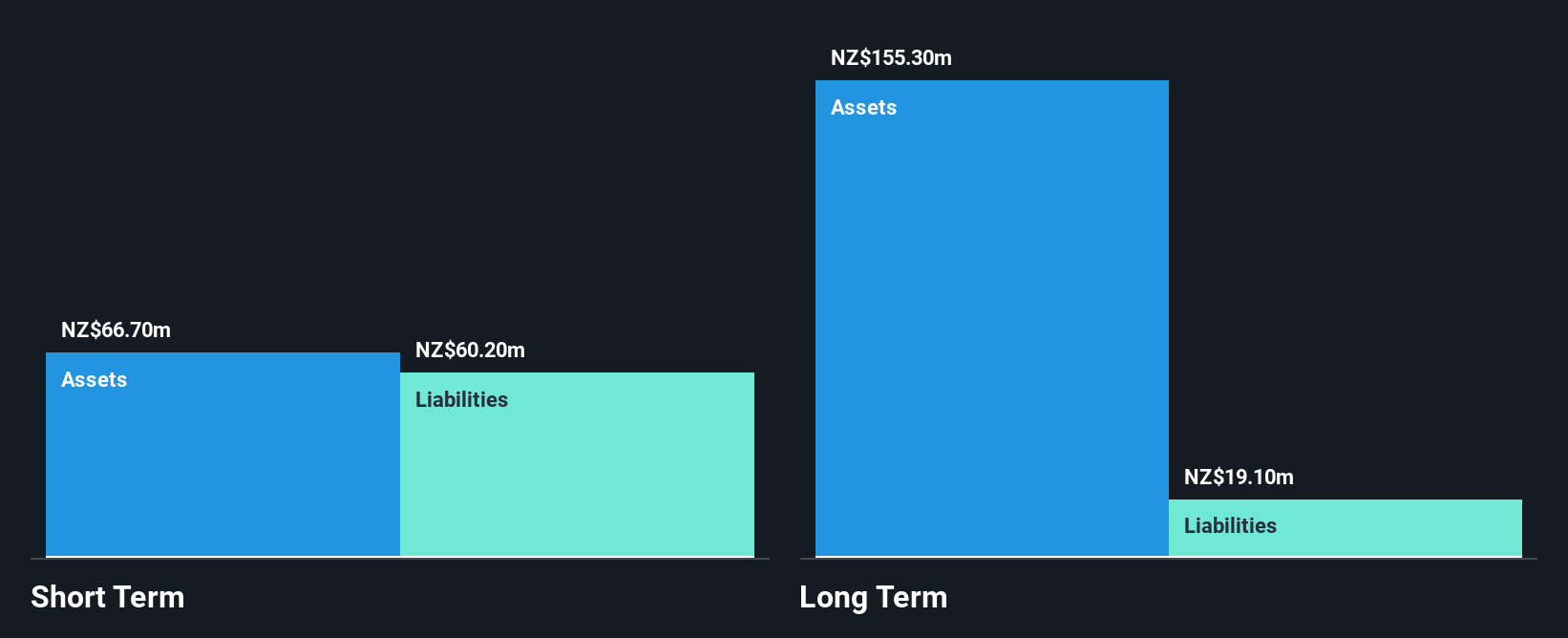

Vista Group International, with a market cap of NZ$748.68 million, offers software and data analytics solutions to the film industry but remains unprofitable as losses have increased by 5.2% annually over five years. Despite this, its short-term assets (NZ$57.4M) exceed both its short-term (NZ$48M) and long-term liabilities (NZ$24.2M). The company's debt is well-covered by operating cash flow at 28.9%, though its return on equity is negative at -5.66%. Recent investor activism led to the withdrawal of a special meeting requisition, highlighting ongoing governance challenges amid strategic shifts in leadership.

- Unlock comprehensive insights into our analysis of Vista Group International stock in this financial health report.

- Gain insights into Vista Group International's outlook and expected performance with our report on the company's earnings estimates.

SinoMedia Holding (SEHK:623)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SinoMedia Holding Limited is an investment holding company offering TV advertisement, creative content production, and digital marketing services across Hong Kong, Singapore, and the People's Republic of China with a market cap of HK$710.92 million.

Operations: The company generates CN¥719.86 million from its advertising segment.

Market Cap: HK$710.92M

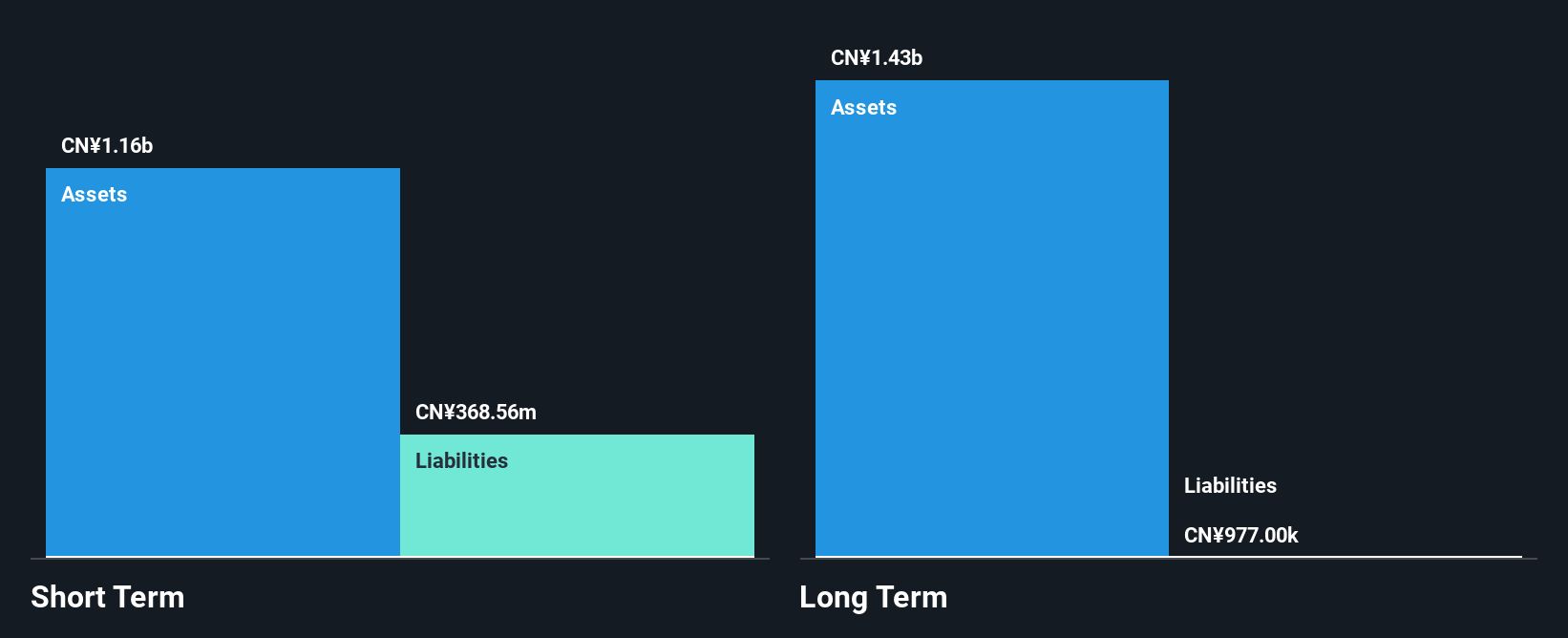

SinoMedia Holding, with a market cap of HK$710.92 million, presents an intriguing profile in the penny stock landscape. Despite negative earnings growth of -20.8% over the past year and a decline in net profit margins from 14.4% to 11.7%, it remains debt-free with substantial short-term assets (CN¥1.2 billion) covering both short-term (CN¥353.4 million) and long-term liabilities (CN¥1.8 million). The company has achieved profitability over the past five years, growing earnings by 13.9% annually, though its return on equity is low at 5.1%. Management's seasoned tenure enhances operational stability amidst these financial dynamics.

- Get an in-depth perspective on SinoMedia Holding's performance by reading our balance sheet health report here.

- Examine SinoMedia Holding's past performance report to understand how it has performed in prior years.

Next Steps

- Get an in-depth perspective on all 5,807 Penny Stocks by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:VGL

Vista Group International

Provides software and data analytics solutions to the film industry worldwide.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives