- New Zealand

- /

- Software

- /

- NZSE:GTK

Here's Why We're Not At All Concerned With Gentrack Group's (NZSE:GTK) Cash Burn Situation

Just because a business does not make any money, does not mean that the stock will go down. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

So should Gentrack Group (NZSE:GTK) shareholders be worried about its cash burn? In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

Check out the opportunities and risks within the NZ Software industry.

How Long Is Gentrack Group's Cash Runway?

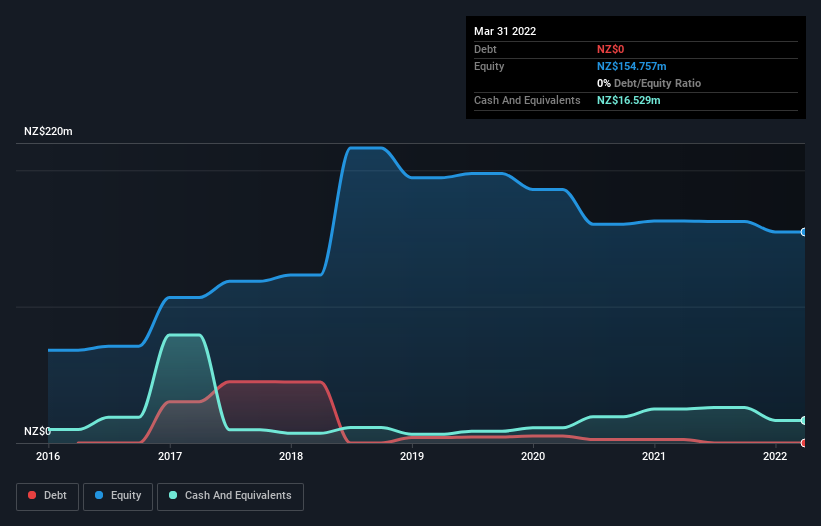

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. As at March 2022, Gentrack Group had cash of NZ$17m and no debt. In the last year, its cash burn was NZ$2.1m. Therefore, from March 2022 it had 7.7 years of cash runway. Notably, however, analysts think that Gentrack Group will break even (at a free cash flow level) before then. In that case, it may never reach the end of its cash runway. The image below shows how its cash balance has been changing over the last few years.

Is Gentrack Group's Revenue Growing?

We're hesitant to extrapolate on the recent trend to assess its cash burn, because Gentrack Group actually had positive free cash flow last year, so operating revenue growth is probably our best bet to measure, right now. Although it's hardly brilliant growth, it's good to see the company grew revenue by 11% in the last year. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Hard Would It Be For Gentrack Group To Raise More Cash For Growth?

While Gentrack Group is showing solid revenue growth, it's still worth considering how easily it could raise more cash, even just to fuel faster growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Commonly, a business will sell new shares in itself to raise cash and drive growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Gentrack Group's cash burn of NZ$2.1m is about 1.2% of its NZ$171m market capitalisation. So it could almost certainly just borrow a little to fund another year's growth, or else easily raise the cash by issuing a few shares.

So, Should We Worry About Gentrack Group's Cash Burn?

As you can probably tell by now, we're not too worried about Gentrack Group's cash burn. For example, we think its cash runway suggests that the company is on a good path. On this analysis its revenue growth was its weakest feature, but we are not concerned about it. It's clearly very positive to see that analysts are forecasting the company will break even fairly soon. Taking all the factors in this report into account, we're not at all worried about its cash burn, as the business appears well capitalized to spend as needs be. Readers need to have a sound understanding of business risks before investing in a stock, and we've spotted 1 warning sign for Gentrack Group that potential shareholders should take into account before putting money into a stock.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:GTK

Gentrack Group

Engages in the development, integration, and support of enterprise billing and customer management software solutions for the energy and water utility, and airport industries.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion