- New Zealand

- /

- Software

- /

- NZSE:ENS

There Could Be A Chance Enprise Group Limited's (NZSE:ENS) CEO Will Have Their Compensation Increased

The decent performance at Enprise Group Limited (NZSE:ENS) recently will please most shareholders as they go into the AGM coming up on 23 November 2022. The focus will probably be on the future strategic initiatives that the board and management will put in place to improve the business rather than executive remuneration when they cast their votes on company resolutions. In our analysis below, we discuss why we think the CEO compensation looks acceptable and the case for a raise.

Check out our latest analysis for Enprise Group

How Does Total Compensation For George Cooper Compare With Other Companies In The Industry?

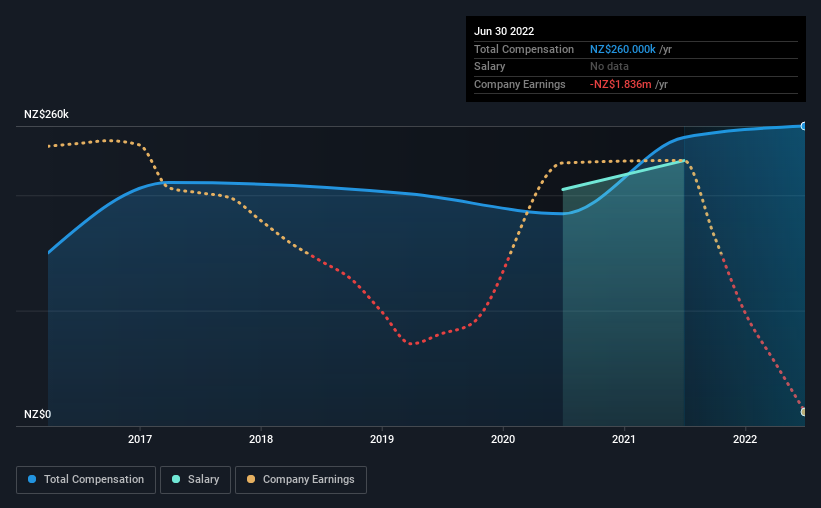

According to our data, Enprise Group Limited has a market capitalization of NZ$15m, and paid its CEO total annual compensation worth NZ$260k over the year to June 2022. That's just a smallish increase of 4.0% on last year. We note that the salary portion, which stands at NZ$230.0k constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the industry with market capitalizations below NZ$325m, we found that the median total CEO compensation was NZ$393k. This suggests that George Cooper is paid below the industry median. Moreover, George Cooper also holds NZ$231k worth of Enprise Group stock directly under their own name.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | NZ$230k | NZ$205k | 88% |

| Other | NZ$30k | NZ$45k | 12% |

| Total Compensation | NZ$260k | NZ$250k | 100% |

Talking in terms of the industry, salary represented approximately 76% of total compensation out of all the companies we analyzed, while other remuneration made up 24% of the pie. According to our research, Enprise Group has allocated a higher percentage of pay to salary in comparison to the wider industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Enprise Group Limited's Growth

Over the last three years, Enprise Group Limited has shrunk its earnings per share by 1.5% per year. Its revenue is up 16% over the last year.

Investors would be a bit wary of companies that have lower EPS On the other hand, the strong revenue growth suggests the business is growing. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Enprise Group Limited Been A Good Investment?

With a total shareholder return of 12% over three years, Enprise Group Limited shareholders would, in general, be reasonably content. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

In Summary...

The company's overall performance, while not bad, could be better. Assuming the business continues to grow at a good clip, few shareholders would raise any objections to the CEO's remuneration. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We did our research and identified 3 warning signs (and 2 which are a bit concerning) in Enprise Group we think you should know about.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Valuation is complex, but we're here to simplify it.

Discover if Enprise Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:ENS

Enprise Group

Operates as a high-tech software and services investment company worldwide.

Adequate balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026