The Warehouse Group (NZSE:WHS): Deep Value and Turnaround Hopes Confront Slowing Revenue Growth

Reviewed by Simply Wall St

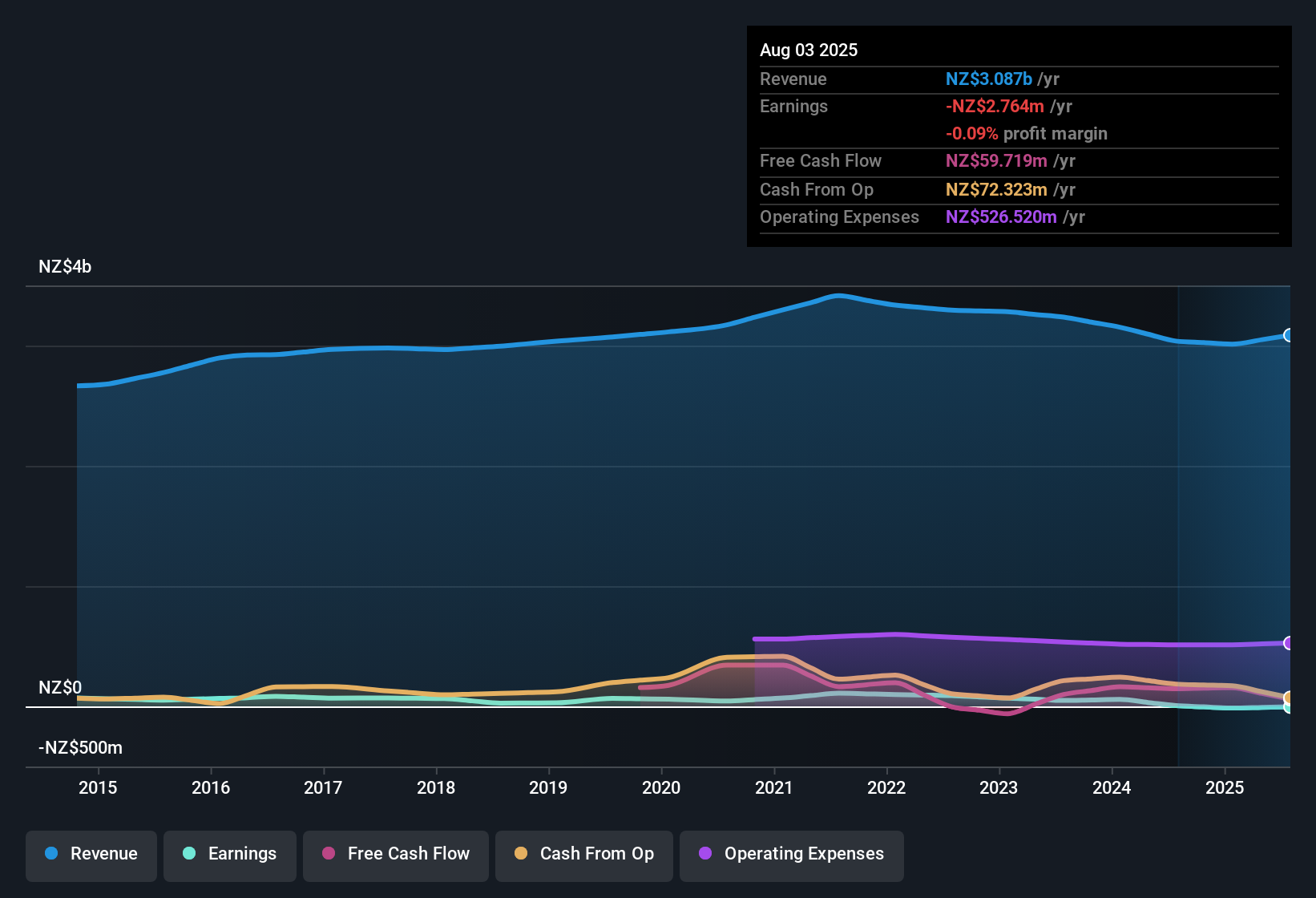

Warehouse Group (NZSE:WHS) is forecast to grow earnings by 36.23% per year, with the company expected to reach profitability within the next three years. While revenue is projected to rise at 2.2% per year, lagging behind the New Zealand market average of 4%, investors will be keeping an eye on improving profit expectations. This comes after a recent five-year stretch where losses increased by 34.3% annually and net profit margin showed no signs of improvement. These results set the stage for the market to focus on the company’s anticipated turnaround in profitability and its relative value versus peers.

See our full analysis for Warehouse Group.Next, we will compare these headline numbers with the most widely-followed narratives and expectations to see which themes remain on track and which might be due for a rethink.

See what the community is saying about Warehouse Group

Profit Margins Expected to Climb

- Analysts anticipate profit margins rising from 0.2% today to 1.3% within three years, reflecting optimism that operational changes and cost control will flow through to the bottom line.

- According to the analysts' consensus view, streamlining efforts such as divesting underperforming businesses and focusing capital on core brands are positioned to drive margin expansion.

- Initiatives include reduced costs via tighter spending controls and a modernization push to make logistics and systems more efficient.

- Improving net margins could help narrow the gap with industry peers, provided restructuring costs do not offset these savings.

Valuation at a Deep Discount

- Warehouse Group trades at a Price-To-Sales Ratio of only 0.1x, lower than both the global industry average of 1x and peer average of 0.8x. The current NZ$0.79 share price sits well below the DCF fair value estimate of NZ$0.88.

- The consensus narrative highlights that this valuation gap heavily supports the investment case, as analysts see room for the share price to rise closer to a fair value of NZ$0.88 and their consensus price target of NZ$0.91.

- The group’s focus on higher-margin segments like home and apparel is expected to further improve valuation metrics if profitable growth materializes.

- Compared to the peer group, Warehouse Group’s discount signals potential upside if future profitability targets are met.

Revenue Growth Trails Market

- Revenue is projected to grow at 2.2% per year for Warehouse Group, which not only lags the New Zealand market average of 4% but also reflects external headwinds and the drag from recently divested units.

- Analysts' consensus narrative points out that, while cost-cutting and product focus initiatives are underway, economic challenges and restructuring costs continue to weigh on revenue gains.

- Recent declines in market share in key categories and operating losses have directly limited sales momentum.

- The impact from selling businesses like Torpedo7 and TheMarket.com, combined with competitive pressure, could further temper top-line improvement in the near term.

Still weighing whether Warehouse Group's turnaround matches expert expectations? See how the narrative plays out and where consensus draws the line for fair value. 📊 Read the full Warehouse Group Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Warehouse Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? Share your viewpoint and craft your own narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Warehouse Group.

See What Else Is Out There

Warehouse Group’s revenue growth has consistently lagged the market, and recent restructuring efforts have not yet delivered reliable, sustained top-line expansion.

If you want to prioritize consistent performers with a proven history of steady results, focus on stable growth stocks screener so you can easily identify companies delivering dependable growth each year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Warehouse Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:WHS

Warehouse Group

Engages in the operation of retail stores in New Zealand.

Good value with moderate growth potential.

Market Insights

Community Narratives