Here's Why I Think Warehouse Group (NZSE:WHS) Is An Interesting Stock

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Warehouse Group (NZSE:WHS). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for Warehouse Group

How Fast Is Warehouse Group Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. It's no surprise, then, that I like to invest in companies with EPS growth. Who among us would not applaud Warehouse Group's stratospheric annual EPS growth of 55%, compound, over the last three years? While that sort of growth rate isn't sustainable for long, it certainly catches my attention; like a crow with a sparkly stone.

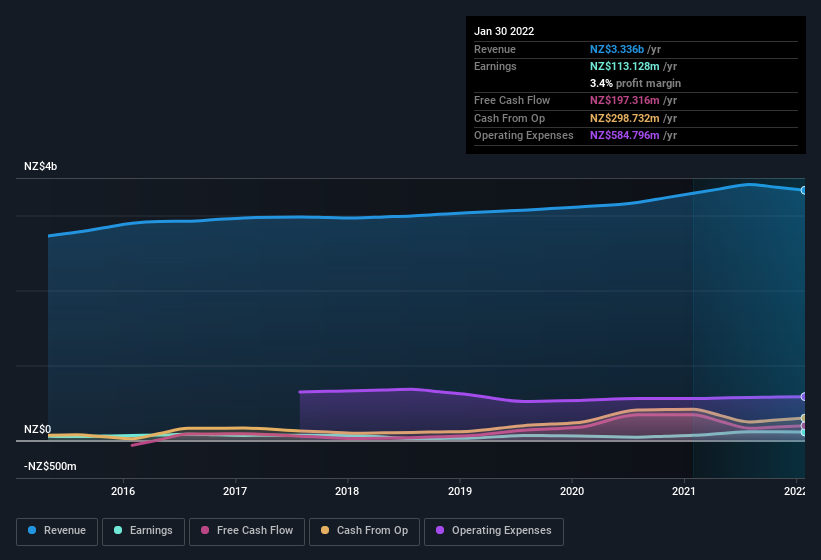

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Warehouse Group reported flat revenue and EBIT margins over the last year. That's not a major concern but nor does it point to the long term growth we like to see.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Warehouse Group's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Warehouse Group Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Any way you look at it Warehouse Group shareholders can gain quiet confidence from the fact that insiders shelled out NZ$409k to buy stock, over the last year. And when you consider that there was no insider selling, you can understand why shareholders might believe that lady luck will grace this business. Zooming in, we can see that the biggest insider purchase was by Group Chief Executive Officer Nick Grayston for NZ$203k worth of shares, at about NZ$4.10 per share.

Along with the insider buying, another encouraging sign for Warehouse Group is that insiders, as a group, have a considerable shareholding. Indeed, they have a glittering mountain of wealth invested in it, currently valued at NZ$310m. That equates to 29% of the company, making insiders powerful and aligned with other shareholders. So it might be my imagination, but I do sense the glimmer of an opportunity.

Is Warehouse Group Worth Keeping An Eye On?

Warehouse Group's earnings have taken off like any random crypto-currency did, back in 2017. Just as heartening; insiders both own and are buying more stock. Because of the potential that it has reached an inflection point, I'd suggest Warehouse Group belongs on the top of your watchlist. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for Warehouse Group that you should be aware of.

The good news is that Warehouse Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Warehouse Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:WHS

Warehouse Group

Engages in the operation of retail stores in New Zealand.

Adequate balance sheet and fair value.

Market Insights

Community Narratives