- New Zealand

- /

- Specialty Stores

- /

- NZSE:CMO

Colonial Motor's (NZSE:CMO) Dividend Will Be Increased To NZ$0.47

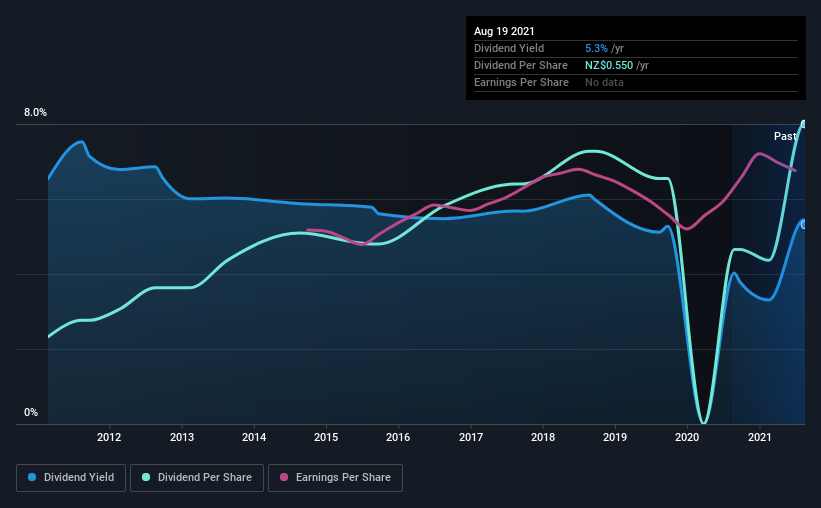

The Colonial Motor Company Limited (NZSE:CMO) will increase its dividend on the 4th of October to NZ$0.47, which is 25% higher than last year. This will take the annual payment from 5.3% to 6.3% of the stock price, which is above what most companies in the industry pay.

Check out our latest analysis for Colonial Motor

Colonial Motor's Earnings Easily Cover the Distributions

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Prior to this announcement, Colonial Motor's dividend made up quite a large proportion of earnings but only 62% of free cash flows. Since the dividend is just paying out cash to shareholders, we care more about the cash payout ratio from which we can see plenty is being left over for reinvestment in the business.

EPS is set to grow by 3.0% over the next year if recent trends continue. If recent patterns in the dividend continue, the payout ratio in 12 months could be 85% which is a bit high but can definitely be sustainable.

Dividend Volatility

The company's dividend history has been marked by instability, with at least 1 cut in the last 10 years. Since 2011, the first annual payment was NZ$0.16, compared to the most recent full-year payment of NZ$0.55. This implies that the company grew its distributions at a yearly rate of about 13% over that duration. Despite the rapid growth in the dividend over the past number of years, we have seen the payments go down the past as well, so that makes us cautious.

Colonial Motor May Find It Hard To Grow The Dividend

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. However, Colonial Motor has only grown its earnings per share at 3.0% per annum over the past five years. Slow growth and a high payout ratio could mean that Colonial Motor has maxed out the amount that it has been able to pay to shareholders. When a company prefers to pay out cash to its shareholders instead of reinvesting it, this can often say a lot about that company's dividend prospects.

In Summary

In summary, it's great to see that the company can raise the dividend and keep it in a sustainable range. The dividend has been at reasonable levels historically, but that hasn't translated into a consistent payment. The payment isn't stellar, but it could make a decent addition to a dividend portfolio.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've picked out 1 warning sign for Colonial Motor that investors should know about before committing capital to this stock. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NZSE:CMO

Colonial Motor

Owns and operates franchised motor vehicle dealerships in New Zealand.

Slight with imperfect balance sheet.

Market Insights

Community Narratives