The board of CDL Investments New Zealand Limited (NZSE:CDI) has announced that it will pay a dividend on the 17th of May, with investors receiving NZ$0.0412 per share. Based on this payment, the dividend yield will be 4.5%, which is fairly typical for the industry.

View our latest analysis for CDL Investments New Zealand

CDL Investments New Zealand Is Paying Out More Than It Is Earning

Solid dividend yields are great, but they only really help us if the payment is sustainable. Before making this announcement, CDL Investments New Zealand was paying out a fairly large proportion of earnings, and it wasn't generating positive free cash flows either. We think that this practice can make the dividend quite risky in the future.

If the company can't turn things around, EPS could fall by 17.5% over the next year. If the dividend continues along the path it has been on recently, the payout ratio in 12 months could be 115%, which is definitely a bit high to be sustainable going forward.

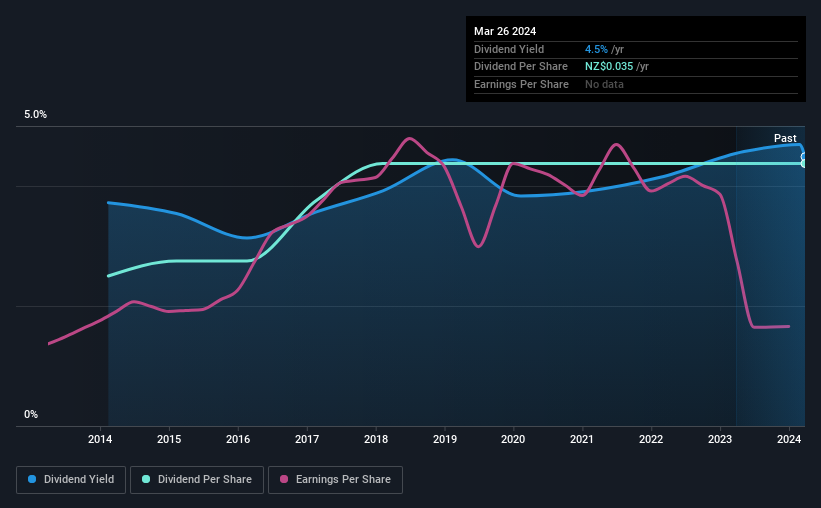

CDL Investments New Zealand Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. The dividend has gone from an annual total of NZ$0.02 in 2014 to the most recent total annual payment of NZ$0.035. This works out to be a compound annual growth rate (CAGR) of approximately 5.8% a year over that time. The dividend has been growing very nicely for a number of years, and has given its shareholders some nice income in their portfolios.

The Dividend Has Limited Growth Potential

The company's investors will be pleased to have been receiving dividend income for some time. However, initial appearances might be deceiving. Over the past five years, it looks as though CDL Investments New Zealand's EPS has declined at around 17% a year. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in.

CDL Investments New Zealand's Dividend Doesn't Look Sustainable

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. In the past the payments have been stable, but we think the company is paying out too much for this to continue for the long term. We don't think CDL Investments New Zealand is a great stock to add to your portfolio if income is your focus.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. Case in point: We've spotted 2 warning signs for CDL Investments New Zealand (of which 1 shouldn't be ignored!) you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

If you're looking to trade CDL Investments New Zealand, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:CDI

CDL Investments New Zealand

Together with its subsidiary, CDL Land New Zealand Limited engages in the investment, development, management, and sale of residential land properties in New Zealand.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives