Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in AFT Pharmaceuticals (NZSE:AFT). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out the opportunities and risks within the NZ Pharmaceuticals industry.

How Fast Is AFT Pharmaceuticals Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. AFT Pharmaceuticals' shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 41%. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

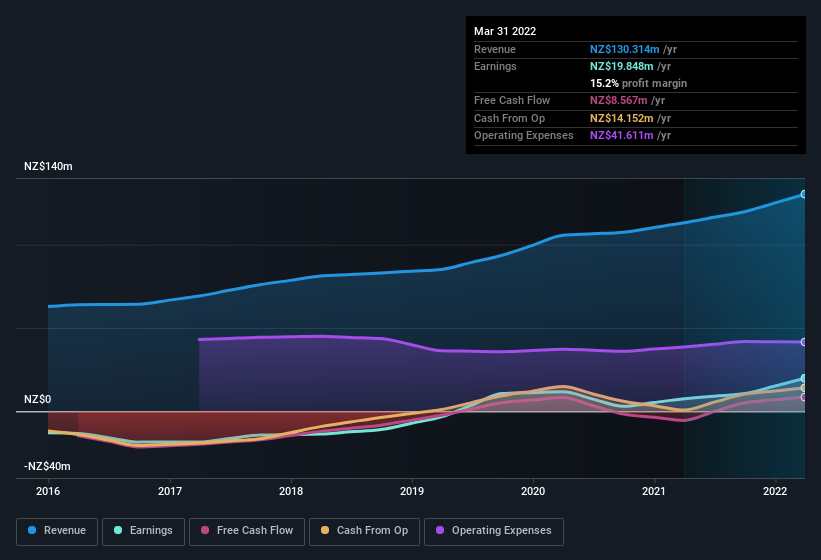

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The good news is that AFT Pharmaceuticals is growing revenues, and EBIT margins improved by 6.2 percentage points to 16%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for AFT Pharmaceuticals.

Are AFT Pharmaceuticals Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

AFT Pharmaceuticals top brass are certainly in sync, not having sold any shares, over the last year. But the bigger deal is that the Independent Director, Jon Lamb, paid NZ$237k to buy shares at an average price of NZ$4.26. Purchases like this clue us in to the to the faith management has in the business' future.

And the insider buying isn't the only sign of alignment between shareholders and the board, since AFT Pharmaceuticals insiders own more than a third of the company. To be exact, company insiders hold 70% of the company, so their decisions have a significant impact on their investments. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. To give you an idea, the value of insiders' holdings in the business are valued at NZ$268m at the current share price. That's nothing to sneeze at!

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because AFT Pharmaceuticals' CEO, Hartley Atkinson, is paid at a relatively modest level when compared to other CEOs for companies of this size. For companies with market capitalisations between NZ$179m and NZ$718m, like AFT Pharmaceuticals, the median CEO pay is around NZ$1.3m.

The AFT Pharmaceuticals CEO received NZ$840k in compensation for the year ending March 2022. That comes in below the average for similar sized companies and seems pretty reasonable. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Is AFT Pharmaceuticals Worth Keeping An Eye On?

AFT Pharmaceuticals' earnings have taken off in quite an impressive fashion. The icing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest AFT Pharmaceuticals belongs near the top of your watchlist. Before you take the next step you should know about the 1 warning sign for AFT Pharmaceuticals that we have uncovered.

The good news is that AFT Pharmaceuticals is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:AFT

AFT Pharmaceuticals

Engages in the development, marketing, and distribution of pharmaceutical products in New Zealand, Australia, Asia, and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives