As global markets navigate a mixed landscape of fluctuating consumer confidence and economic indicators, investors are increasingly seeking stability amid the uncertainty. In this environment, dividend stocks stand out as a potential source of reliable income, offering consistent returns even when broader market conditions remain volatile.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.12% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.41% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.71% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.45% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.79% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.37% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.13% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.15% | ★★★★★★ |

Click here to see the full list of 1963 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

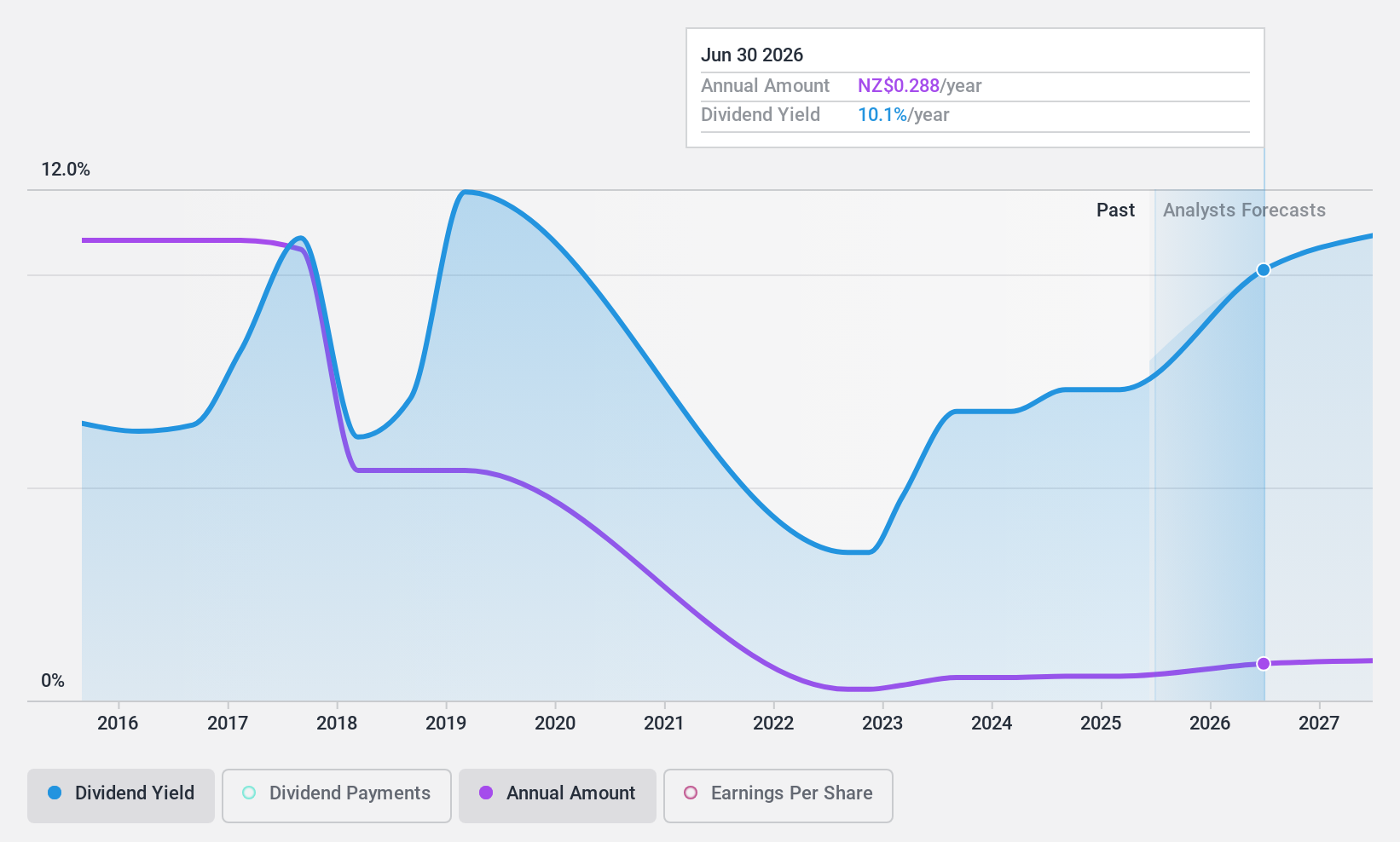

SKY Network Television (NZSE:SKT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SKY Network Television Limited is an entertainment company offering sports and entertainment media services, as well as telecommunications services, in New Zealand and internationally, with a market cap of NZ$357.96 million.

Operations: SKY Network Television Limited generates revenue through several segments, including Sky Box Subscriptions (NZ$498.67 million), Streaming Subscriptions (NZ$110.39 million), Commercial Revenue (NZ$54.55 million), Advertising (NZ$53.60 million), and Broadband Subscriptions (NZ$27.51 million).

Dividend Yield: 6.9%

SKY Network Television offers a high dividend yield, ranking in the top 25% of New Zealand's market. Despite this, its dividend history is marked by volatility and unreliability over the past decade. The company's dividends are well-covered by earnings and cash flows, with payout ratios of 55.2% and 51.9%, respectively. However, earnings are projected to decline annually by 9.7% over the next three years, potentially impacting future payouts despite recent strategic partnerships enhancing content offerings.

- Dive into the specifics of SKY Network Television here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that SKY Network Television is trading behind its estimated value.

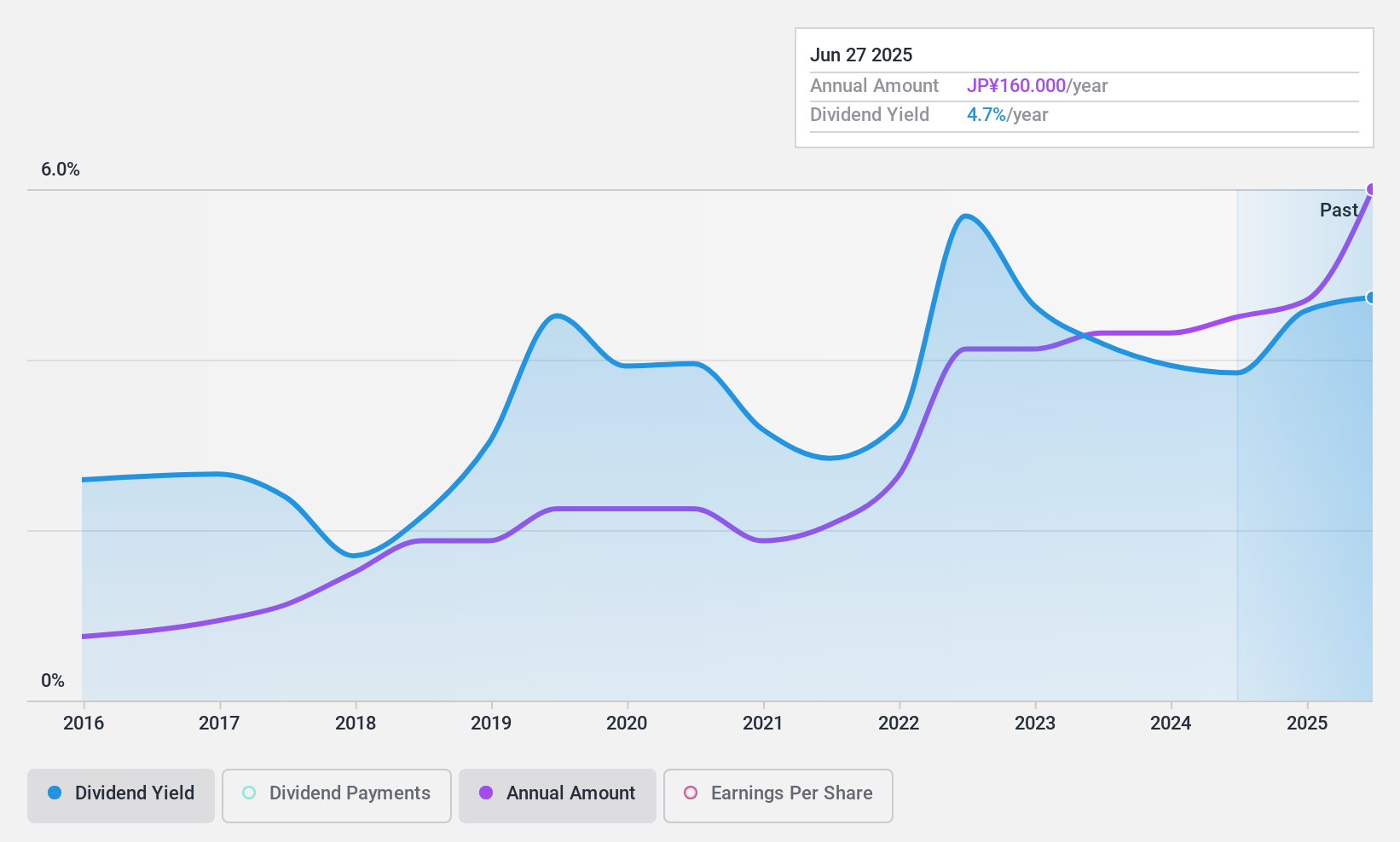

Daitron (TSE:7609)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Daitron Co., Ltd. is an electronic engineering trading company that focuses on importing, exporting, and selling electronic components and assembly goods both in Japan and internationally, with a market cap of ¥30.49 billion.

Operations: Daitron Co., Ltd.'s revenue is primarily derived from its Domestic Sales Business, which accounts for ¥68.24 billion, followed by the Overseas Segment at ¥21.18 billion and the Domestic Manufacturing Business contributing ¥11.09 billion.

Dividend Yield: 4.6%

Daitron's dividend yield is among the top 25% in Japan, with a payout ratio of 41.1%, indicating strong earnings coverage. The cash payout ratio of 20.7% further supports its sustainability from cash flows. However, its dividend history has been volatile over the past decade, raising concerns about reliability despite recent growth in payouts and good relative value compared to peers and industry benchmarks.

- Delve into the full analysis dividend report here for a deeper understanding of Daitron.

- Insights from our recent valuation report point to the potential undervaluation of Daitron shares in the market.

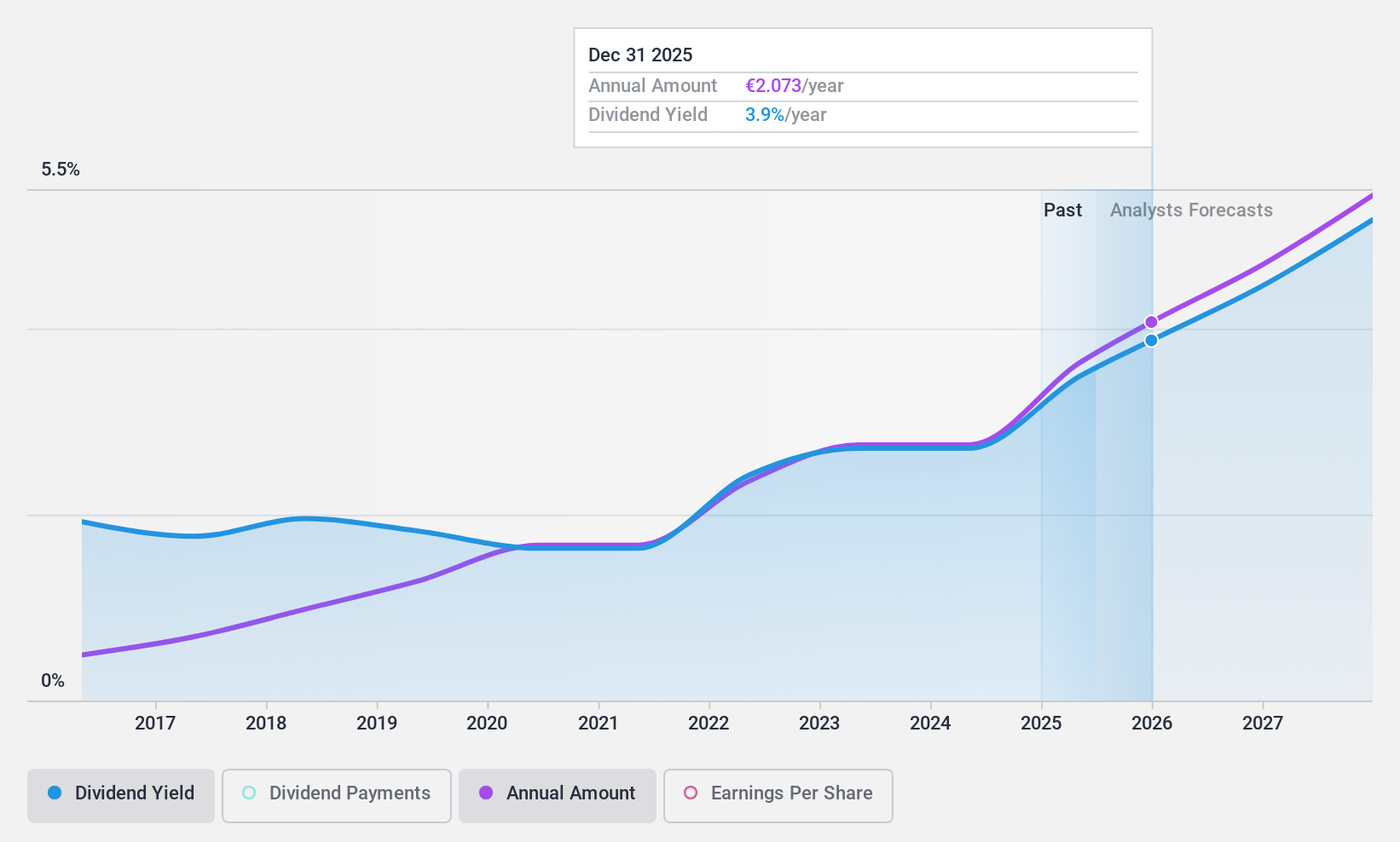

Mensch und Maschine Software (XTRA:MUM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mensch und Maschine Software SE offers CAD/CAM/CAE, product data management, and building information modeling/management solutions in Germany and internationally, with a market cap of €907.42 million.

Operations: Mensch und Maschine Software SE's revenue segments include M+M Software, generating €107.95 million, and M+M Digitization, contributing €242.22 million.

Dividend Yield: 3.1%

Mensch und Maschine Software offers a reliable dividend yield of 3.09%, though it is below the top tier in Germany. The company has maintained stable and growing dividends over the past decade, supported by earnings coverage with a payout ratio of 87.2% and cash flow coverage at 60.8%. Recent earnings growth, with sales reaching €270.08 million for nine months ending September 2024, underscores its financial stability to sustain dividends moving forward.

- Navigate through the intricacies of Mensch und Maschine Software with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Mensch und Maschine Software is priced higher than what may be justified by its financials.

Seize The Opportunity

- Navigate through the entire inventory of 1963 Top Dividend Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:MUM

Mensch und Maschine Software

Provides computer aided design, manufacturing, and engineering (CAD/CAM/CAE), product data management, and building information modeling/management solutions in Germany, Austria, Switzerland, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives