- New Zealand

- /

- Media

- /

- NZSE:SKT

3 Reliable Dividend Stocks With Up To 7.1% Yield

Reviewed by Simply Wall St

Amidst a backdrop of record highs in major U.S. indices and geopolitical developments influencing market sentiment, investors are increasingly seeking stability through reliable dividend stocks. With the S&P 500 marking its longest winning streak in over two months, finding stocks that offer consistent income can be an effective strategy to navigate current economic uncertainties and capitalize on robust market performance.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.27% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.22% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.68% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.63% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.94% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.25% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.08% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.85% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.47% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.90% | ★★★★★★ |

Click here to see the full list of 1976 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

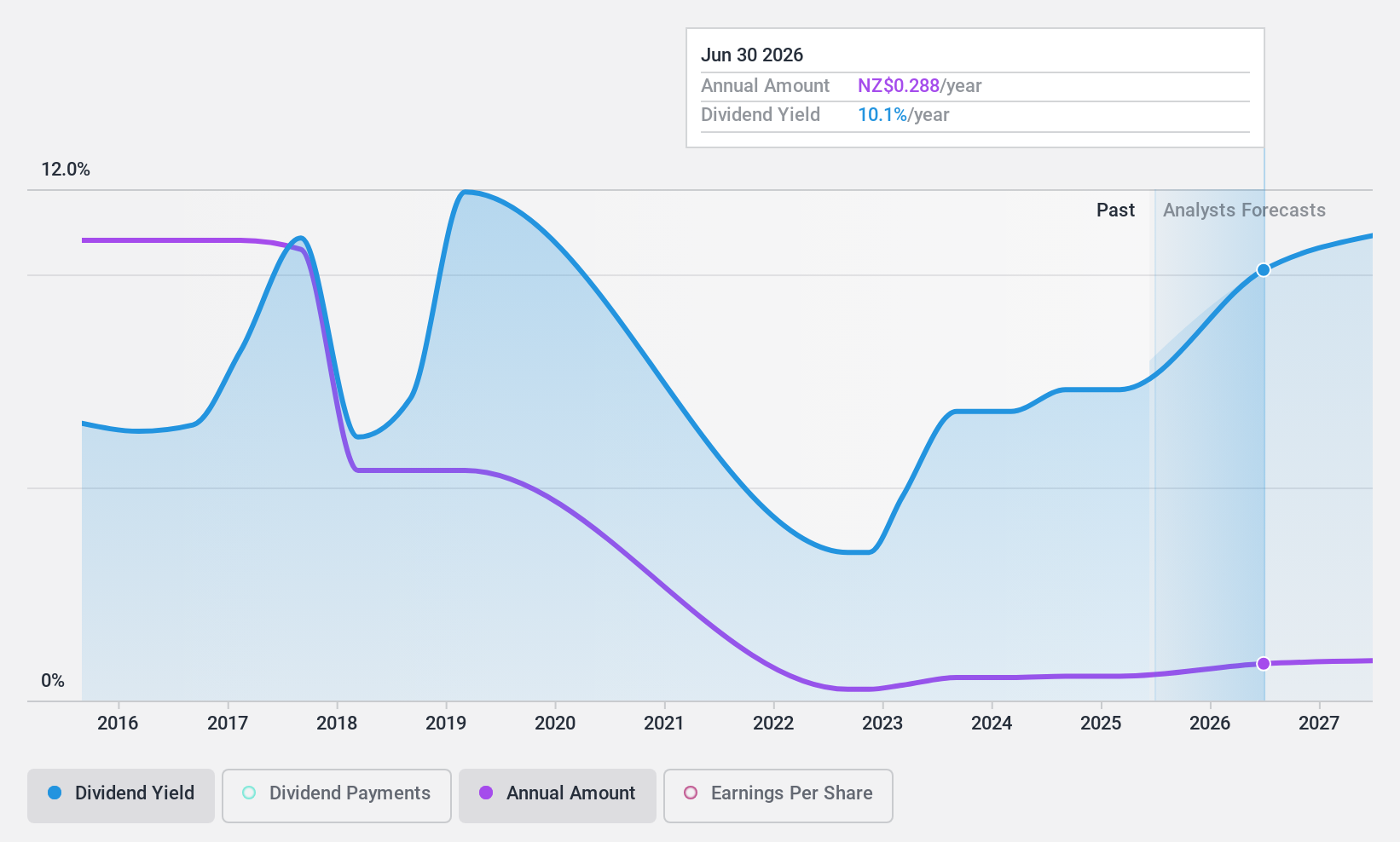

SKY Network Television (NZSE:SKT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SKY Network Television Limited is an entertainment company offering sports and entertainment media services, along with telecommunications services in New Zealand and internationally, with a market cap of NZ$340.06 million.

Operations: SKY Network Television Limited generates revenue from various segments, including NZ$53.60 million from advertising, NZ$54.55 million from commercial activities, NZ$498.67 million through Sky Box subscriptions, NZ$27.51 million via broadband subscriptions, and NZ$110.39 million from streaming subscriptions.

Dividend Yield: 7.2%

SKY Network Television's dividend payments are supported by both earnings and cash flows, with payout ratios of 55.2% and 51.9%, respectively. Despite a top-tier dividend yield of 7.2% in New Zealand, the dividends have been volatile and unreliable over the past decade, reflecting an unstable track record. The stock trades at a significant discount to its estimated fair value, potentially offering good relative value compared to peers amidst recent strategic content partnerships enhancing its market position.

- Take a closer look at SKY Network Television's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of SKY Network Television shares in the market.

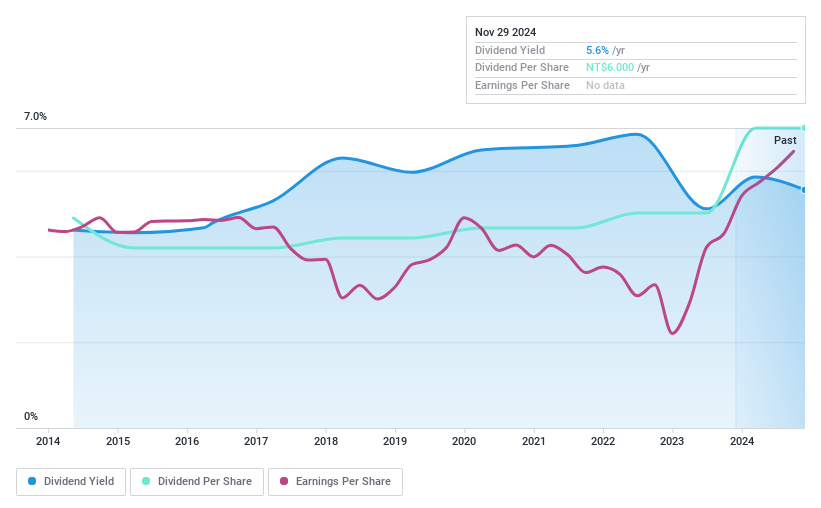

Formosa Optical TechnologyLtd (TPEX:5312)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Formosa Optical Technology Co., Ltd. operates in Taiwan, offering eyecare products, with a market capitalization of NT$6.55 billion.

Operations: Formosa Optical Technology Co., Ltd. generates revenue from its Bio Division, contributing NT$930.46 million, and Bio Technology segment, adding NT$2.91 billion.

Dividend Yield: 5.3%

Formosa Optical Technology's dividends are supported by earnings and cash flows, with payout ratios of 72.3% and 88.8%, respectively. The company offers a high dividend yield of 5.29%, ranking in the top 25% in Taiwan, and has consistently grown its dividends over the past decade without volatility. Its price-to-earnings ratio of 13.7x suggests good value compared to the broader market, while recent earnings growth further strengthens its dividend sustainability.

- Navigate through the intricacies of Formosa Optical TechnologyLtd with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Formosa Optical TechnologyLtd is trading beyond its estimated value.

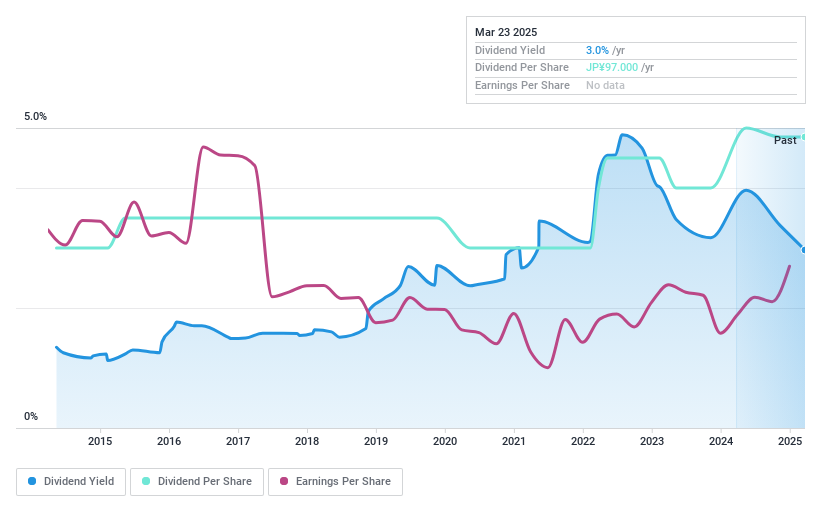

Bank of Iwate (TSE:8345)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Bank of Iwate, Ltd. provides a range of financial products and services in Japan with a market cap of ¥45.47 billion.

Operations: The Bank of Iwate, Ltd.'s revenue is primarily derived from the Banking Industry at ¥41.42 billion, with additional contributions from Leasing at ¥4.47 billion and the Credit Card Business and Credit Guarantee Business at ¥1.20 billion.

Dividend Yield: 4.3%

Bank of Iwate's dividend yield of 4.33% ranks in the top 25% in Japan, although its dividend history has been volatile with significant annual drops. Despite this, the low payout ratio of 14.6% indicates dividends are well-covered by earnings, suggesting some stability in payments. The stock trades at a notable discount to its estimated fair value, potentially offering good value for investors seeking income opportunities despite concerns over high bad loans at 2.6%.

- Unlock comprehensive insights into our analysis of Bank of Iwate stock in this dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Bank of Iwate shares in the market.

Taking Advantage

- Click here to access our complete index of 1976 Top Dividend Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:SKT

SKY Network Television

An entertainment company, provides sport and entertainment media services, and telecommunications services in New Zealand and internationally.

Excellent balance sheet and fair value.