- New Zealand

- /

- Media

- /

- NZSE:SKT

3 Dividend Stocks To Consider With Yields Up To 9.4%

Reviewed by Simply Wall St

As global markets continue to navigate a landscape of accelerating U.S. inflation and volatile Treasury yields, major stock indexes like the S&P 500 and Nasdaq Composite are nearing record highs, reflecting investor optimism amid economic uncertainties. In this environment, dividend stocks can offer a measure of stability and income potential for investors seeking to balance growth with reliable returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.24% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.33% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.05% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.88% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.40% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.04% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.43% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.88% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.54% | ★★★★★★ |

Click here to see the full list of 1983 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

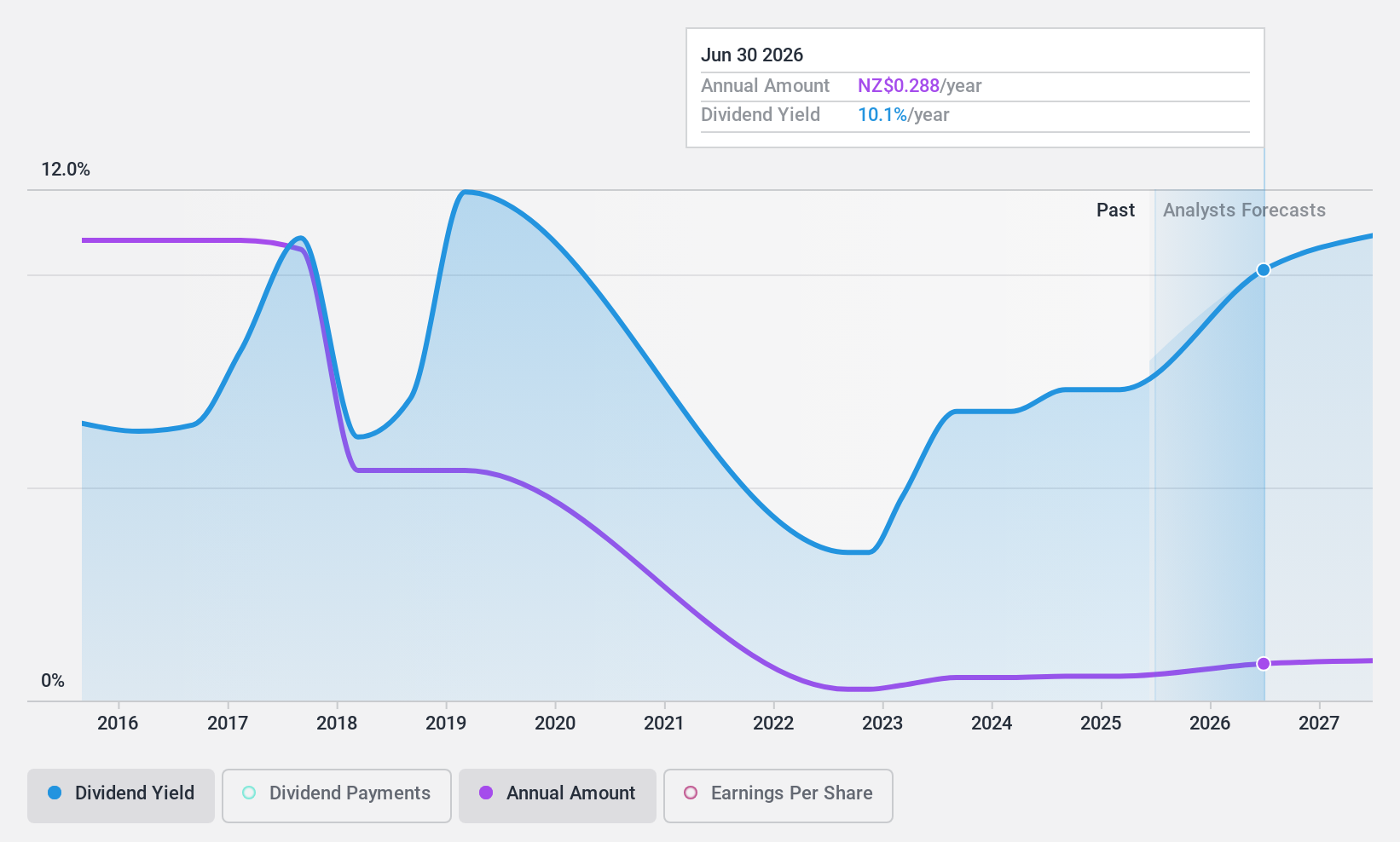

SKY Network Television (NZSE:SKT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SKY Network Television Limited is an entertainment company offering sport and entertainment media services, as well as telecommunications services, in New Zealand and internationally, with a market cap of NZ$357.96 million.

Operations: SKY Network Television Limited generates revenue through several segments, including Sky Box Subscriptions (NZ$498.67 million), Streaming Subscriptions (NZ$110.39 million), Commercial Revenue (NZ$54.55 million), Advertising (NZ$53.60 million), and Broadband Subscriptions (NZ$27.51 million).

Dividend Yield: 7.2%

SKY Network Television's dividend payments are covered by both earnings (payout ratio: 55.2%) and cash flows (cash payout ratio: 51.9%), indicating sustainability in the short term. However, dividends have been volatile and declining over the past decade, raising concerns about reliability. Despite these challenges, SKT offers a high dividend yield of 7.17%, placing it among the top 25% of New Zealand market payers, while trading below estimated fair value suggests potential for capital appreciation.

- Get an in-depth perspective on SKY Network Television's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of SKY Network Television shares in the market.

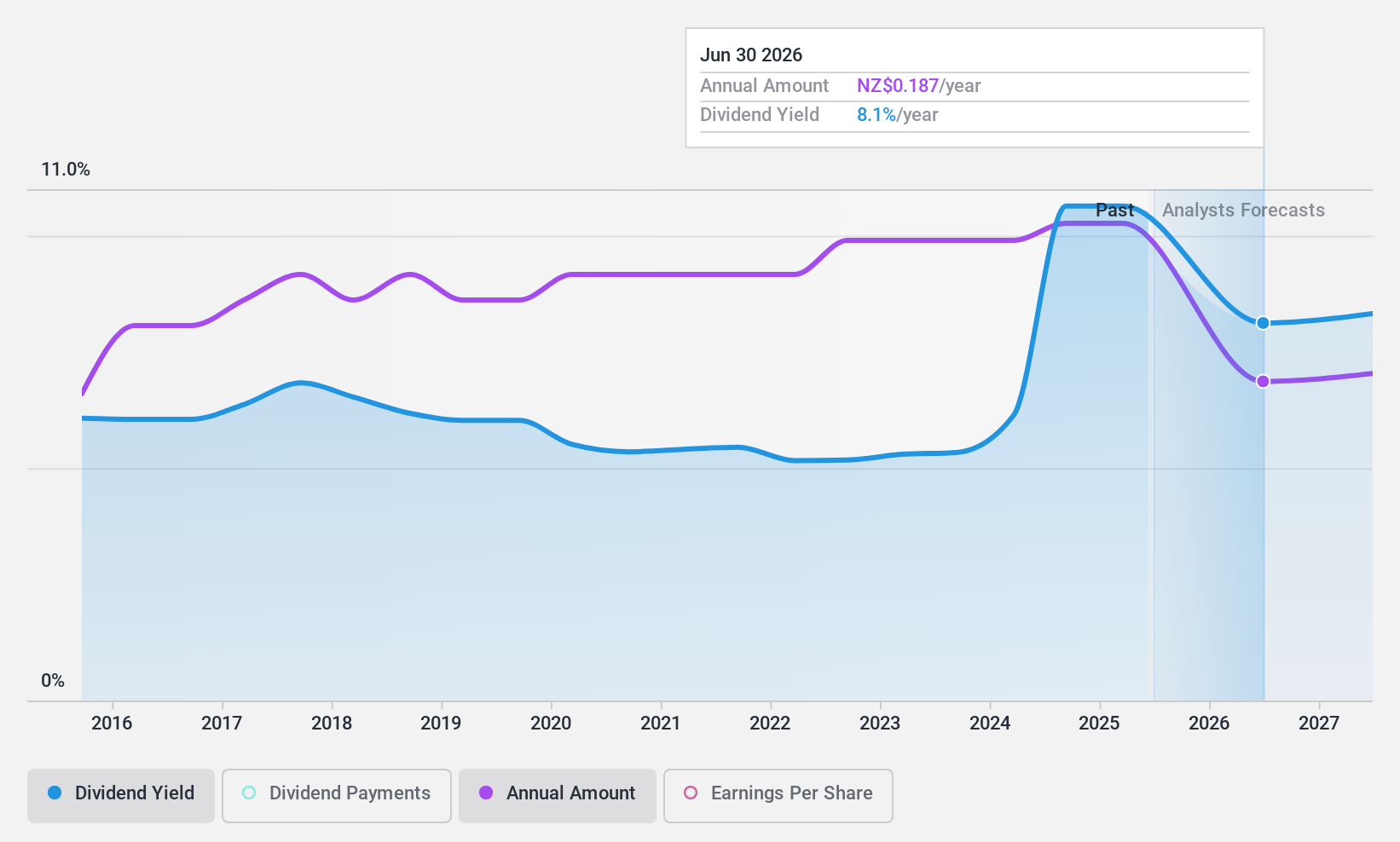

Spark New Zealand (NZSE:SPK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Spark New Zealand Limited, along with its subsidiaries, offers telecommunications and digital services in New Zealand and has a market cap of NZ$5.40 billion.

Operations: Spark New Zealand Limited generates revenue from several key segments, including Voice (NZ$180 million), Mobile (NZ$1.47 billion), Broadband (NZ$613 million), IT Products (NZ$527 million), IT Services (NZ$165 million), Data Centres (NZ$37 million), and Procurement and Partners (NZ$548 million).

Dividend Yield: 9.5%

Spark New Zealand's dividend yield of 9.49% ranks it in the top 25% of New Zealand market payers, although its dividends are not well covered by earnings or free cash flows, with a payout ratio of 158.8% and a cash payout ratio of 314.8%. Despite stable and growing dividends over the past decade, high debt levels and recent exclusion from the S&P/ASX 200 Index may concern investors seeking dividend reliability.

- Dive into the specifics of Spark New Zealand here with our thorough dividend report.

- Our expertly prepared valuation report Spark New Zealand implies its share price may be lower than expected.

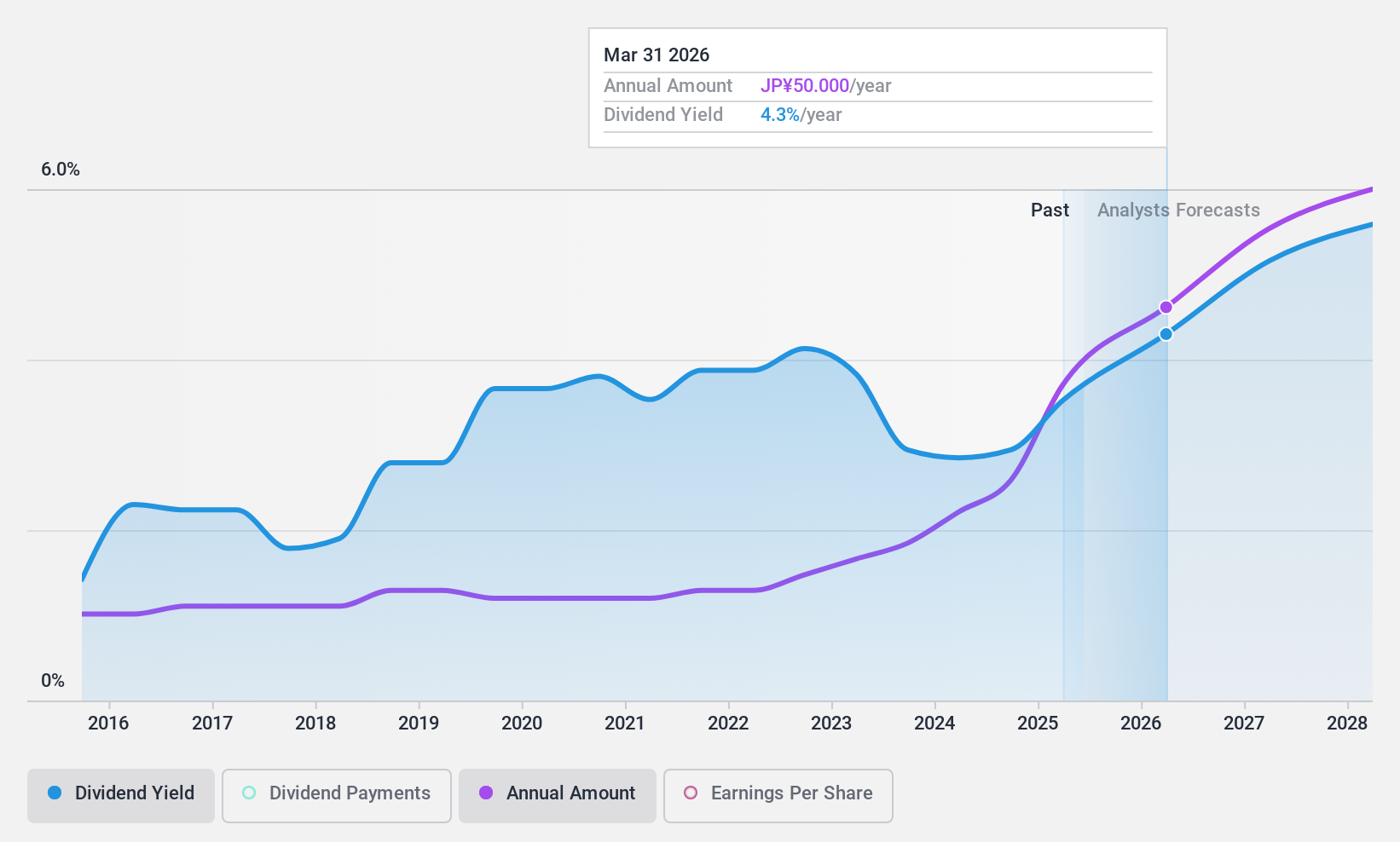

Gunma Bank (TSE:8334)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Gunma Bank, Ltd. offers a range of banking and financial products and services in Japan, with a market cap of approximately ¥413.75 billion.

Operations: Gunma Bank's revenue is primarily derived from its Banking segment, which contributes ¥175.93 billion, complemented by its Lease segment at ¥30.56 billion.

Dividend Yield: 3.7%

Gunma Bank offers a stable dividend history with payments growing steadily over the past decade, supported by a low payout ratio of 32.4%, indicating strong coverage by earnings. While its dividend yield of 3.7% is slightly below Japan's top quartile, it remains attractive for those valuing reliability. However, the bank's allowance for bad loans is low at ¥38%, and there is insufficient data to assess long-term sustainability or future coverage by earnings.

- Click here and access our complete dividend analysis report to understand the dynamics of Gunma Bank.

- The valuation report we've compiled suggests that Gunma Bank's current price could be quite moderate.

Taking Advantage

- Delve into our full catalog of 1983 Top Dividend Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:SKT

SKY Network Television

An entertainment company, provides sport and entertainment media services, and telecommunications services in New Zealand.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives