- New Zealand

- /

- Insurance

- /

- NZSE:TWR

Tower (NZSE:TWR) Profit Margin Rises to 13.6%, Challenging Bearish Profitability Narratives

Reviewed by Simply Wall St

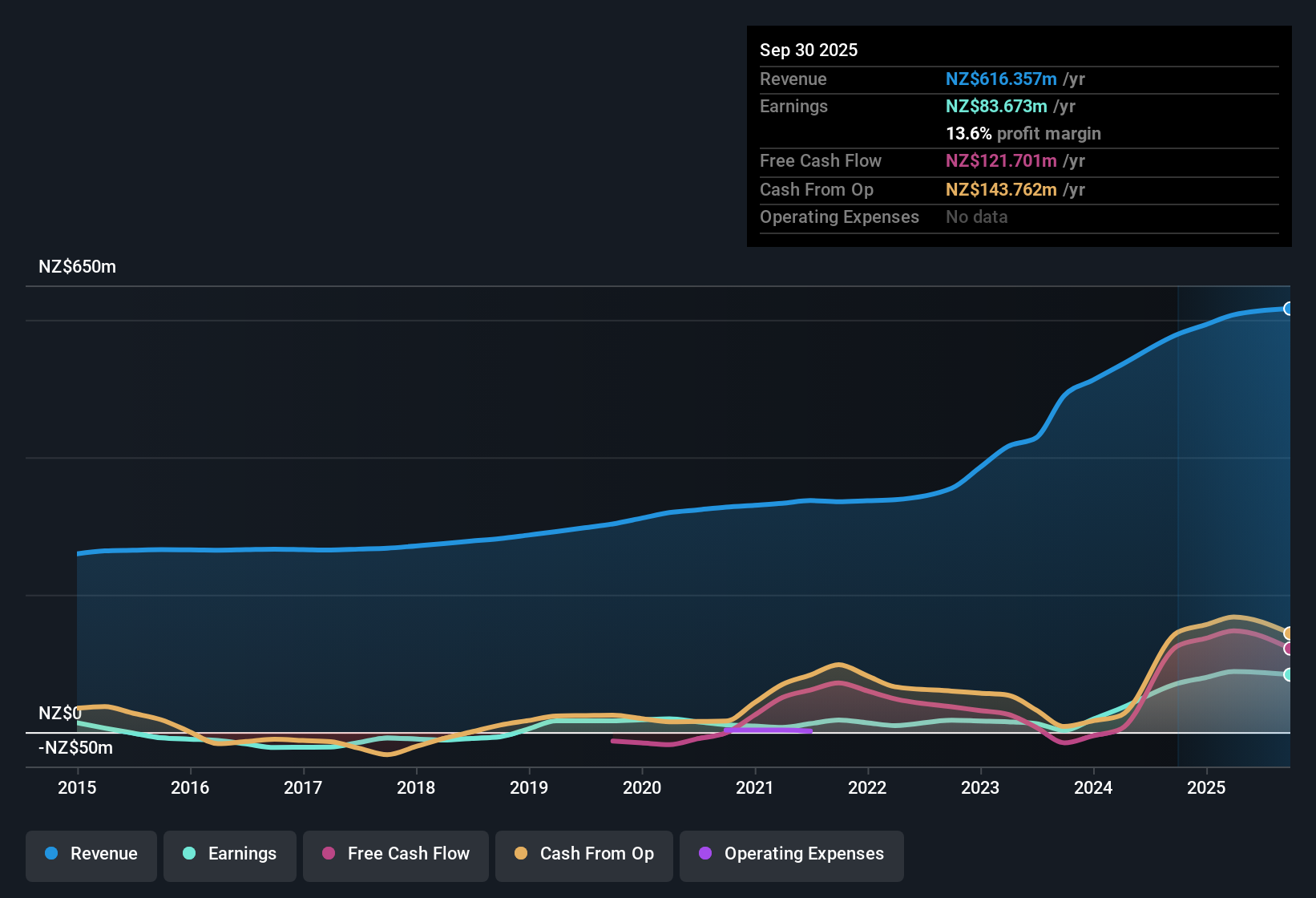

Tower (NZSE:TWR) has just reported its FY 2025 first half results, booking $306.9 million in revenue and basic EPS of $0.15 NZD. The company has seen revenue rise over recent periods, moving from $234.3 million in the first half of FY 2023 to $278.5 million in FY 2024, before reaching this half's $306.9 million result. Margins have expanded as net profit climbed, keeping investors focused on the earnings trends heading into the rest of the year.

See our full analysis for Tower.Let’s put the latest numbers head to head with the leading narratives. It is time to see which market stories carry weight, and which are up for debate.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Up, But Growth Slows

- Tower's net profit margin rose to 13.6% over the last year, up from 12.2% previously. However, annual earnings growth slowed to 18% compared to a five-year average of 52.6% per year.

- Recent analysis suggests Tower is balancing resilient profit margins and a history of strong earnings expansion. With earnings growth now trailing long-term trends,

- the company projects a challenging path forward as income is forecast to decline by 17% annually over the next three years,

- which raises questions about the durability of the historical earnings momentum investors have come to expect.

Discounted Valuation Versus DCF Fair Value

- Tower trades at just 8x earnings, which is lower than both the New Zealand market average of 17.7x and the global insurance industry average of 11.7x.

- Although this low Price-to-Earnings ratio appears attractive, the current share price of NZ$1.95 is well above the DCF fair value estimate of NZ$0.56,

- which highlights a potential disconnect between the market’s valuation and discounted cash flow fundamentals,

- and gives investors reason to scrutinize whether the share price fully reflects future downside risks signaled by profit forecasts.

Dividend Reliability and Forward Risks

- Despite strong historical growth and margin recovery, Tower’s dividend record has shown instability, compounding concerns around an average 17% forecasted annual earnings drop ahead.

- The prevailing market opinion points to Tower as a defensive pick in insurance, valued for its steady presence and broad product range.

- Caution remains, however, as natural disaster exposure and intensified competition mean historical stability may not guarantee predictable income or dividend performance,

- bringing extra attention to the sustainability of returns in a sector where single-event volatility can change the outlook rapidly.

Consensus calls for balance as Tower’s established profitability clashes with warnings of forward earnings pressure. See the latest detailed narrative for the full story. 📊 Read the full Tower Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Tower's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Tower’s discounted valuation hides concerns that future earnings and dividends may be at risk as profitability comes under pressure and payout consistency wavers.

If stable returns and consistent payouts matter to you, consider screening for these 1937 dividend stocks with yields > 3% to discover companies delivering stronger, more reliable yields even in volatile markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tower might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:TWR

Tower

Provides general insurance products in New Zealand and the Pacific Islands.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026