- New Zealand

- /

- Personal Products

- /

- NZSE:CVT

Comvita Limited's (NZSE:CVT) 26% Dip In Price Shows Sentiment Is Matching Earnings

To the annoyance of some shareholders, Comvita Limited (NZSE:CVT) shares are down a considerable 26% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 46% share price drop.

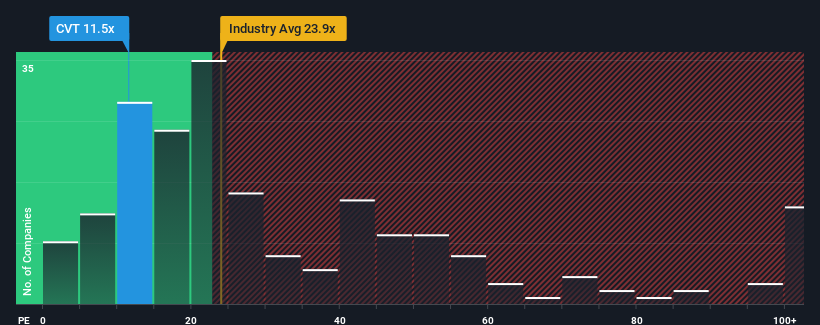

Even after such a large drop in price, Comvita's price-to-earnings (or "P/E") ratio of 11.5x might still make it look like a buy right now compared to the market in New Zealand, where around half of the companies have P/E ratios above 16x and even P/E's above 32x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

The recently shrinking earnings for Comvita have been in line with the market. One possibility is that the P/E is low because investors think the company's earnings may begin to slide even faster. You'd much rather the company wasn't bleeding earnings if you still believe in the business. In saying that, existing shareholders may feel hopeful about the share price if the company's earnings continue tracking the market.

Check out our latest analysis for Comvita

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Comvita would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 13%. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, EPS is anticipated to climb by 17% per annum during the coming three years according to the dual analysts following the company. Meanwhile, the rest of the market is forecast to expand by 20% per annum, which is noticeably more attractive.

In light of this, it's understandable that Comvita's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Comvita's P/E?

The softening of Comvita's shares means its P/E is now sitting at a pretty low level. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Comvita maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider before investing and we've discovered 3 warning signs for Comvita that you should be aware of.

If you're unsure about the strength of Comvita's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:CVT

Comvita

Engages in research, manufacturing, marketing, and distribution nature health products in Australia, New Zealand, Greater China, rest of Asia, North America, Europe, the Middle East, Africa, and internationally.

Good value with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.